Summary: Dynamic Securities Analytics, Inc. identified key trends in foreign corruption and kleptocracy Suspicious Activity Reports filed between January 2019 and March 2022.

FinCEN Advisory on Kleptocracy Suspicious Activity Reports

FinCEN released an advisory regarding Kleptocracy Suspicious Activity Reports (SARs) on April 14, 2022. The Advisory urges financial institutions to focus efforts on detecting proceeds of foreign public corruption. Additionally, the advisory provides typologies and potential indicators of kleptocracy and other forms of foreign public corruption such as bribery, embezzlement, extortion, and the misappropriation of public assets.

FinCEN provided a new key term “CORRUPTION FIN-2022-A001” for SARs filed in response to the advisory.

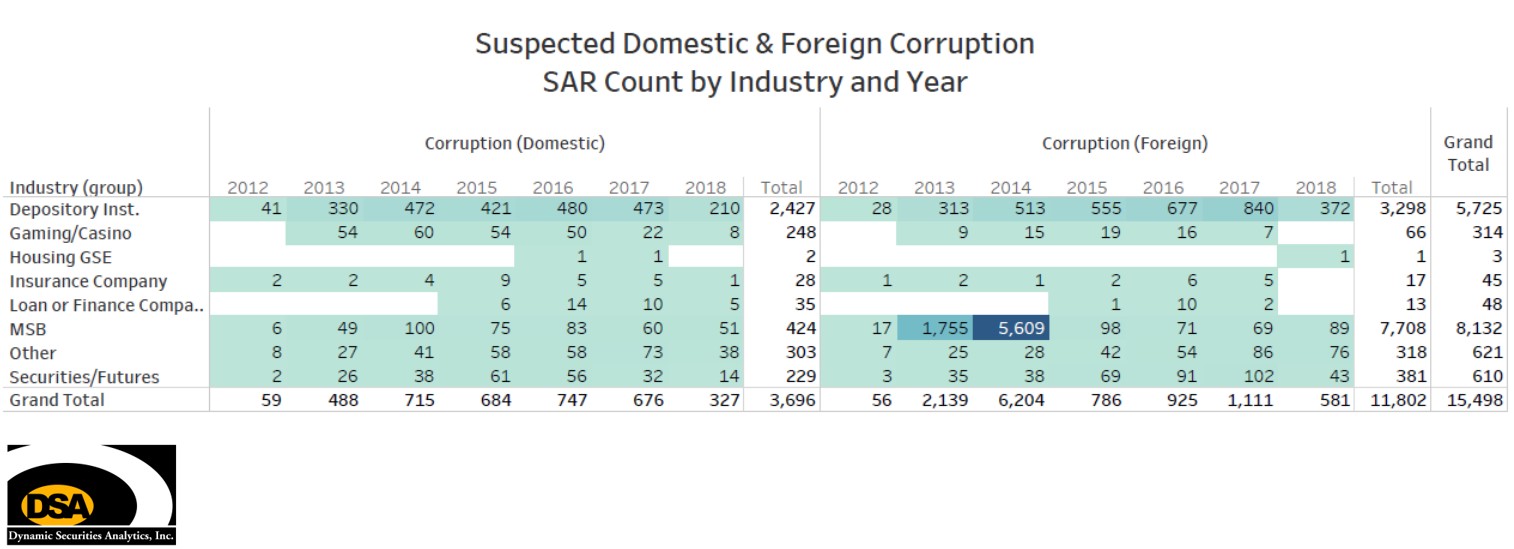

However, foreign public corruption (which includes kleptocracy) has long been reportable on Suspicious Activity Reports. You can read DSA’s 2018 and 2016 analysis of foreign corruption SARs here and here.

Analysis of Foreign Corruption & Kleptocracy Suspicious Activity Reports

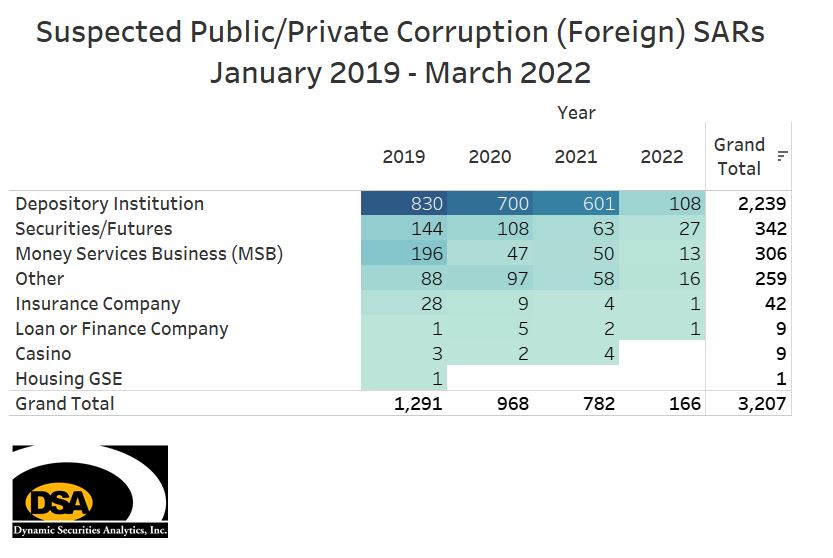

DSA analyzed foreign corruption SARs filed between January 2019 and March 2022 to identify trends that may assist in the anti-kleptocracy initiative.

There were 3,207 Suspected Public/Private Corruption (Foreign) SARs filed between January 2019 and March 2022. Depository Institutions filed 69% of all Foreign Corruption SARs. The annual SAR count has fallen from 1,291 filed in 2019 to 782 filed in 2021.

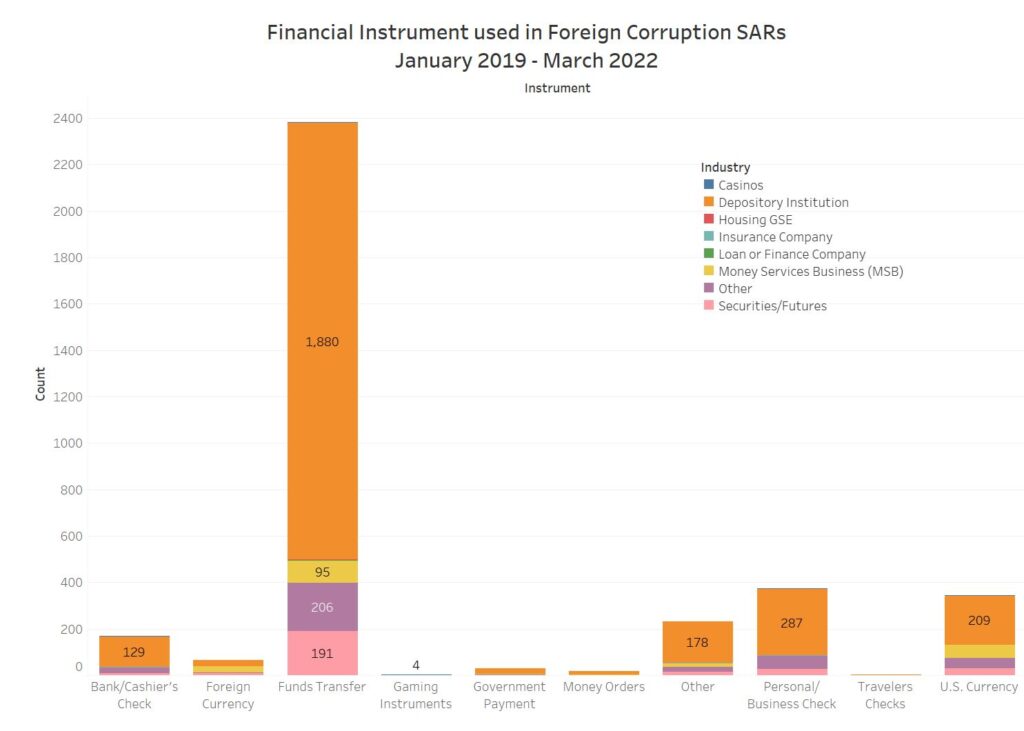

Financial Products Used in Foreign Corruption and Kleptocracy Suspicious Activity Reports

Fund Transfers is by far the leading financial instrument in Foreign Corruption SARs. Multiple financial instruments can be selected for a given SAR. Fund Transfers was selected for 65% of all Foreign Corruption Suspicious Activity Reports. It may come as a surprise that personal and business checks were the second most reported financial instrument.

Contrary to the Hollywood images of suitcases full of cash, US currency was reported in less than 10% Foreign Corruption SARs.

Geographic Foreign Corruption / Kleptocracy Suspicious Activity Report Insights

There are some interesting geographic insights in the Foreign Corruption SAR data.

Florida Man Files SARs

First, Florida and specifically Miami-Dade county filed the second most Foreign Corruption SARs after New York County, NY. Miami-Dade held the #2 position for SARs filed by Depository Institutions and Securities/Futures. Other high ranking Florida counties include Broward at #7 for Depository Institutions and Palm Beach County as the #3 filer for Securities/Futures.

Hola Puerto Rico

Puerto Rico is a Foreign Corruption SAR filing industry outlier. Two counties/municipalities filed 102 SARs for the “Other” industry category. Overall, these counties ranked 7th and 17th among all US counties for Foreign Corruption SARs.

Financial Institution Back-Office Foreign Corruption SAR Locations

As DSA has previously identified, SAR geographic data often reflects the back-office locations of major financial institutions. This trend continues with Foreign Corruption SARs filed in Delaware County, OH, Mecklenburg County, NC, and Fairfax County, VA taking top spots.

Few Foreign Corruption SARs Filed by FinTechs or Cryptocurrency Exchanges

It is always interesting to also explore who is not filing SARs for a given category. Notably, only a handful of Foreign Corruption SARs were filed by FinTechs and/or cryptocurrency exchanges located in Silicon Valley or San Francisco proper.

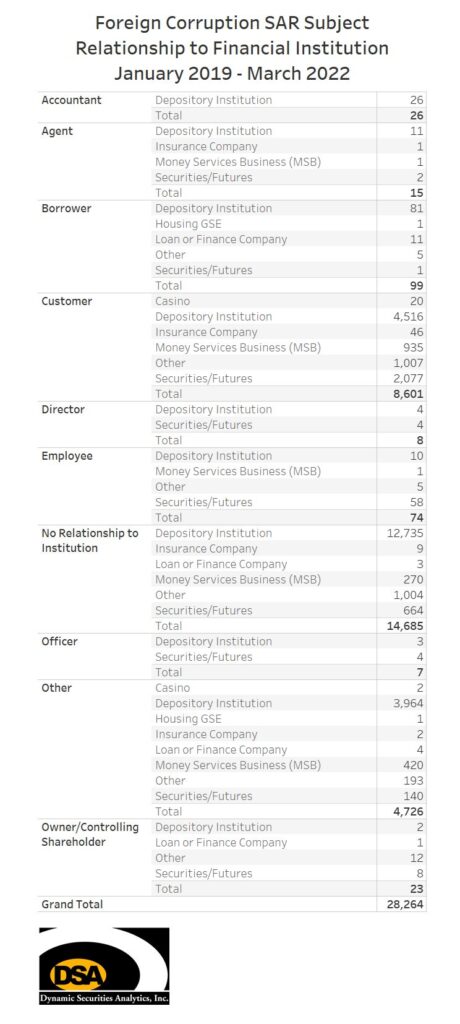

Relationship of SAR Subject to Financial Institution

Financial Institutions reported that the SAR subject had No Relationship to the Institution for half of all Foreign Corruption SAR subjects. Keep in mind that a single SAR can have multiple relationships and subjects. Customer was the second most common relationship with 8,601 customer subjects identified.

Interestingly, Florida Securities/Futures firms reported the most Employee relationships for Foreign Corruption SARs. Puerto Rico reported the most Owner / Controlling Shareholder Foreign Corruption SARs.

Kleptocracy Suspicious Activity Red Flags

The FinCEN Kleptocracy advisory included a list of ten financial red flags to assist financial institutions in detecting, preventing, and reporting suspicious activity associated with kleptocracy and foreign corruption.

Red Flags:

- Transactions involving long-term government contracts consistently awarded, through an opaque selection process, to the same legal entity or entities that share similar beneficial ownership structures.

- Transactions involving services provided to state-owned companies or public institutions by companies registered in high-risk jurisdictions.

- Transactions involving official embassy or foreign government business conducted through personal accounts.

- Transactions involving public officials related to high-value assets, such as real estate or other luxury goods, that are not commensurate with the reported source of wealth for the public official or that fall outside that individual’s normal pattern of activity or lifestyle.

- Transactions involving public officials and funds moving to and from countries with which the public officials do not appear to have ties.

- Use of third parties to shield the identity of foreign public officials seeking to hide the origin or ownership of funds, for example, to hide the purchase or sale of real estate.

- Documents corroborating transactions involving government contracts (e.g., invoices) that include charges at substantially higher prices than market rates or that include overly simple documentation or lack traditional details (e.g., valuations for good and services).

- Transactions involving payments that do not match the total amounts set out in the underlying documentation, or that involve vague payment details or the use of old or fraudulent documentation to justify transfer of funds.

- Transactions involving fictitious email addresses and false invoices to justify payments, particularly for international transactions.

- Assets held in the name of intermediate legal entities whose beneficial owner or owners are tied to a kleptocrat or his or her family member.

Want more Suspicious Activity Report Insights?

Read DSA’s 2021, 2020, 2019, 2018 and 2016 SAR Insights.

Read DSA’s analysis on Unregistered Cryptocurrency Exchange SARs.

Watch “How Covid-19 Impacted SARs“.