UPDATED: 12/29/2022 with Deleted FinCEN Alert on Human Smuggling

Summary: After years of neglect, it appears that Human Smuggling financing is a priority to government agencies. Human Smuggling Suspicious Activity Reports (SARs) filed by MSBs have skyrocketed since mid-2021 while banks filings remain flat. FinCEN issued, then deleted a Human Smuggling Alert on 12/16/2022.

DSA’s Analysis of Human Smuggling SARs

In 2014, FinCEN added Human Smuggling as a “keyword” to the SAR narrative section. In mid 2018, Human Smuggling received a suspicious activity checkbox. With the addition of the checkbox, I was able to begin analyzing Human Smuggling SAR data published on FinCEN’s website. FinCEN itself, has not to date, publicly published any Human Smuggling SAR data analysis.

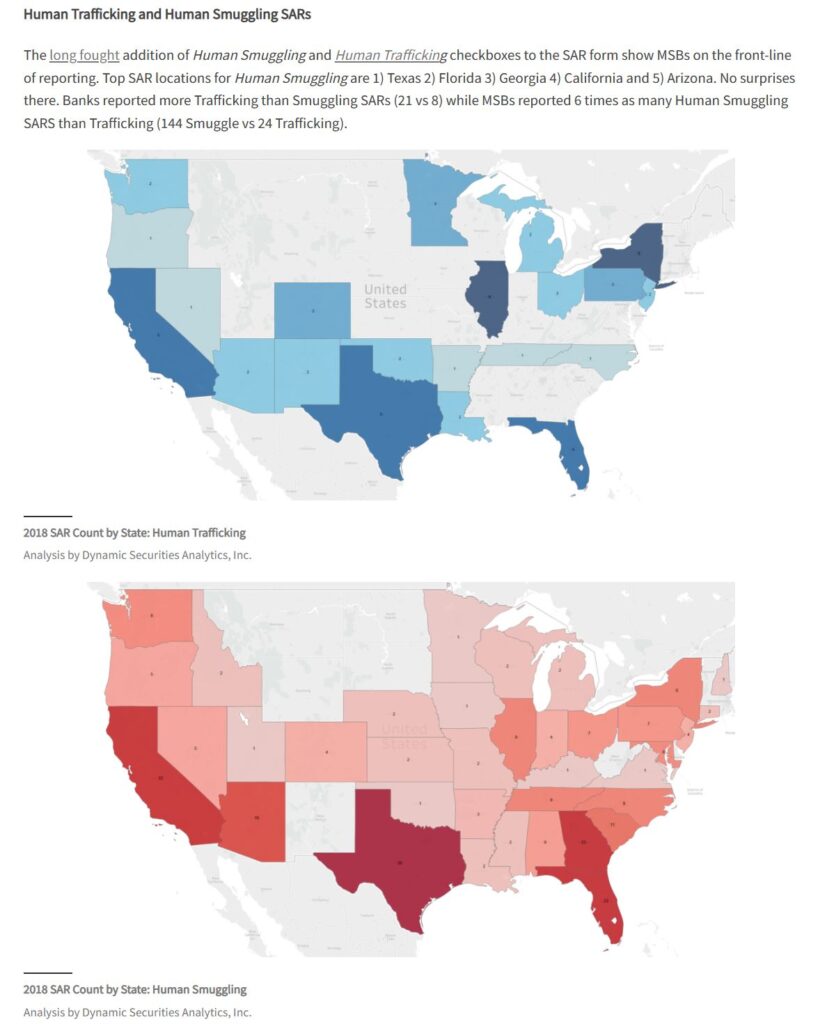

In early 2019, I analyzed Human Smuggling vs. Human Trafficking SARs filed in 2018:

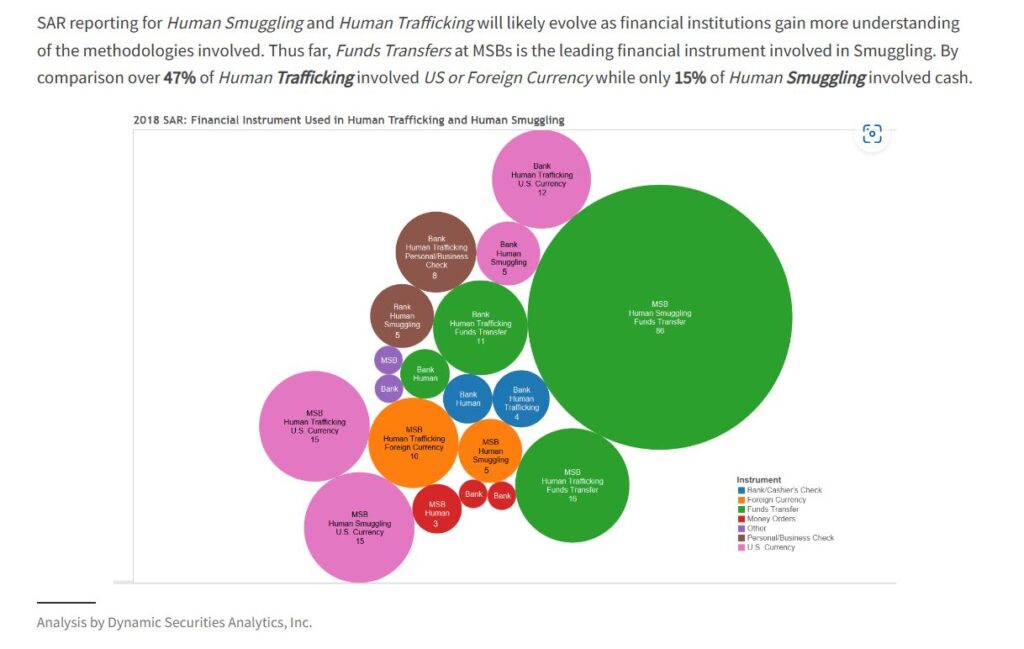

I also identified the types of financial institutions filing Human Smuggling SARs and the which financial products were used:

In 2019, I studied the first year of Human Smuggling Suspicious Activity Reports in a stand-alone blog post.

I found several areas for improvement in complying with anti-money laundering reporting for Human Smuggling:

The 2015 National Money Laundering Risk Assessment reported that migrant smugglers responded to increased MSB scrutiny by changing tactics to utilizing funnel accounts at banks. ICE HSI defined funnel accounts as involving an account at a bank with branches nationwide to make structured deposits in one or more geographic locations and then structured withdrawals in the state where the account was open. ICE reported this method was first associated with human smuggling but has been readily adopted by drug traffickers as well.

The relatively low number of Human Smuggling SARs reported by banks that involved deposit accounts could either imply that Depository Institutions have not yet mastered identifying human smuggling funnel account transactions or Smugglers have moved on to new methods.

The geographic concentration of Smuggling SARs may point to a gap in financial institutions’ understanding of the complex nature of migrant smuggling. A recent study on corruption in the US Border Patrol found that 30% of the incidents took place at either the US/Canadian border or at US airports. Financial institutions need to keep in mind that US migrant smuggling also occurs via air or sea, and not necessarily at the southwest border.

ThomsonReuters published my article “Migrant Smuggling: What Financial Institutions Need to Know” in 2019. I touched on new financing methods used by Human Smuggling Organizations (HSO):

“Pre-paid cards, digital payment methods, and virtual currencies offer new ways for smugglers to conduct their business. Financial institutions need to incorporate these new payment systems into their Migrant Smuggling detection scenarios.

Similarly, banks should consider including social media monitoring into detection scenarios as well because smugglers have adapted well to this technology.”

A VICE news article by Emily Green on migrants kidnapped for ransom published on April 20, 2021 included my thoughts on how Human Smuggling finance is overlooked by government agencies:

“Until financial institutions are told they need to be actively monitoring their transactions for kidnapping ransom payments, they are not going to do it,” said Alison Jimenez, president of Dynamic Securities Analytics, a U.S.-based anti–money laundering company. “The priorities are what the government tells them are the priorities, and right now no one is being told human smuggling is a priority—period.”

– “US Companies Are Helping Mexican Cartels Get Rich Kidnapping Migrants”, VICE, April 20, 2021.

Human Smuggling Financing Becomes a Priority… to Homeland Security

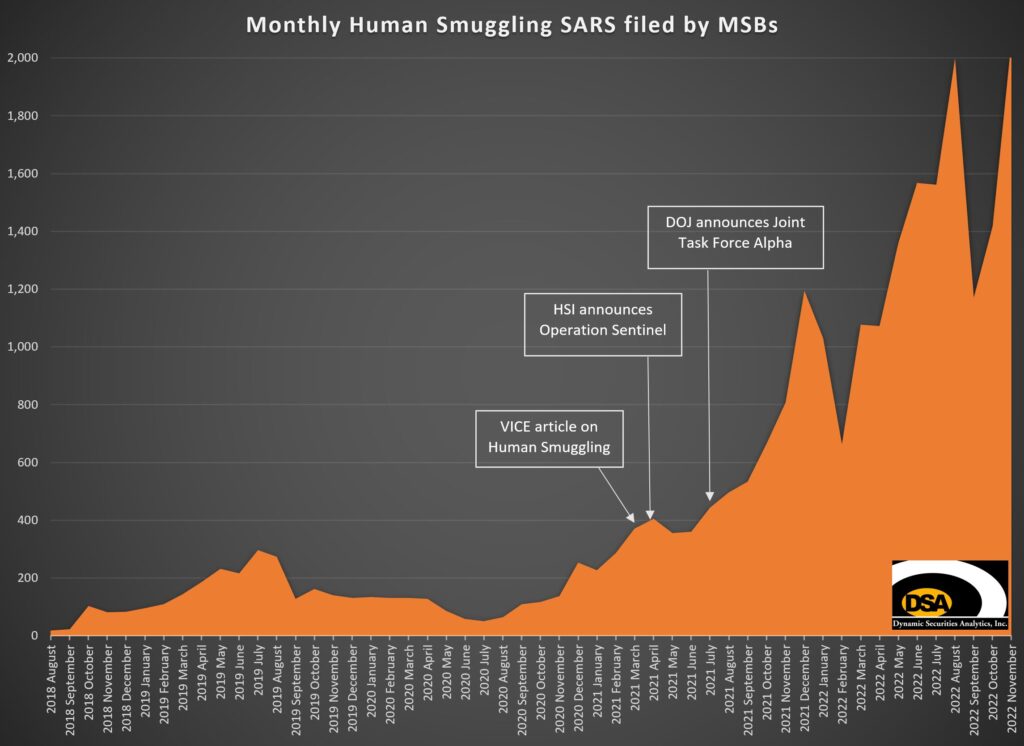

Just a few days after my comment to VICE, Homeland Security decided that countering Human Smuggling finance was a priority.

The Secretary of Homeland Security announced Operation Sentinel with an explicit focus on the financial aspect of human smuggling:

“Transnational criminal organizations put profit over human life, with devastating consequences. With the help of our federal and foreign partners, we aim to cut off access to that profit by denying these criminals the ability to engage in travel, trade, and finance in the United States.”

Homeland Security’s press release did not mention any financial regulator partners in Operation Sentinel.

Despite the apparent lack of involvement of financial regulators in Operation Sentinel, MSBs got the message and dramatically increased Human Smuggling SARs, starting in mid-2021.

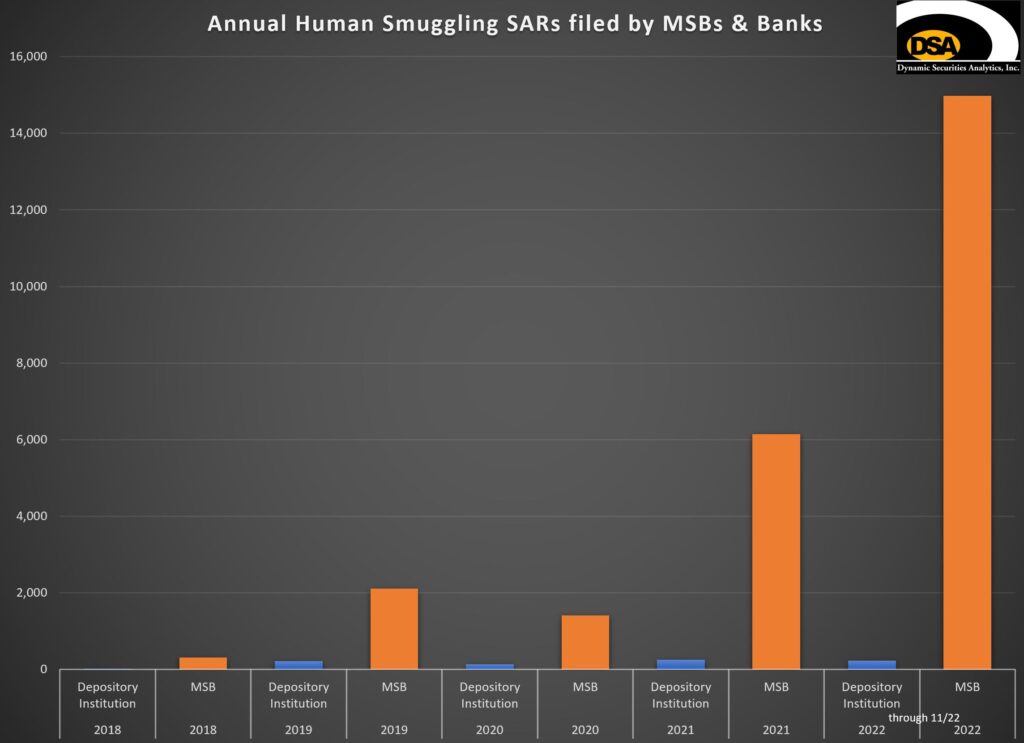

MSBS filed 2,061 Human Smuggling SARs from November 2022. The November 2022 monthly Human Smuggling SAR filings were greater than the yearly filings for 2019 and 2020.

Human Smuggling Becomes a Priority… to the Department of Justice

A few months later, in July 2021, the Attorney General announced “Joint Task Force Alpha”, a law enforcement task force to enhance the US efforts against “the most prolific and dangerous human smuggling and trafficking groups operating in Mexico and the Northern Triangle countries of Guatamala, El Salvador, and Honduras.”

However, Joint Task Force Alpha also did not mention the involvement of any financial regulators in the press release:

The Joint Task Force will consist of federal prosecutors from U.S. Attorney’s Offices along the Southwest Border (District of Arizona, Southern District of California, Southern District of Texas, and Western District of Texas), from the Criminal Division and the Civil Rights Division, along with law enforcement agents and analysts from DHS’s Immigration and Customs Enforcement and Customs and Border Patrol. The FBI and the Drug Enforcement Administration will also be part of the Task Force. And it will work closely with Operation Sentinel, a recently announced DHS operation focused on countering transnational criminal organizations affiliated with migrant smuggling.

Despite Homeland Security’s and the DOJ’s emphasis on countering Human Smuggling Transnational Criminal Organizations, Depository Institutions (banks) Human Smuggling SARs have essentially remained flat. Depository Institutions filed 224 Human Smuggling SARs from January through November 2022 versus 14,981 filed by MSBs during the same period.

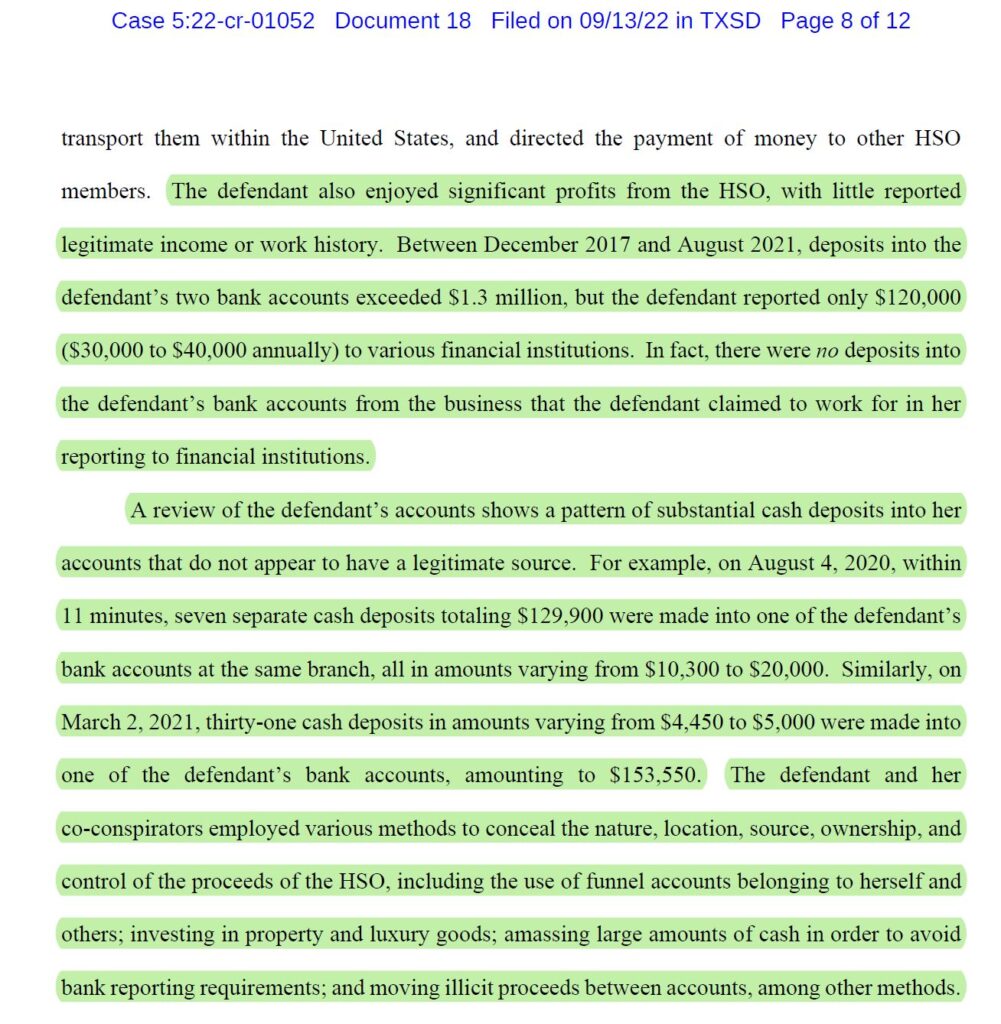

Bank Accounts used by Alleged Human Smuggling Organization

In September 2022, the DOJ announced a Joint Task Force Alpha investigation that led to the arrest and takedown of an alleged prolific human smuggling ring.

According to the government’s Motion for Pre-Trial Detention, this Human Smuggling Organization was “as lucrative as it was prolific, and it generated at least millions of dollars in proceeds.” The indictment also details how the defendant used bank accounts to launder proceeds of the Human Smuggling ring:

As described above, the unusual bank transactions related to Human Smuggling included:

- No deposits into the bank account from the business that the defendant claimed to work for

- Substantial cash deposits without a legitimate source

- Multiple cash deposits within minutes into the same accounts. For example, on 3/2/2021, there were 31 cash deposits in amounts from $4,500 to $5,500 that totaled to $153,550.

- Use of funnel accounts

Human Smuggling becomes a Priority…. to FinCEN, maybe?

FinCEN included Human Smuggling as a National Priority in its June 30, 2021 list of priorities. Human Smuggling was briefly mentioned jointly with Human Trafficking.

December 2022 was a busy month for FinCEN. On December 7th, FinCEN announced its annual Law Enforcement Awards recognizing law enforcement agencies and officials because of the role BSA data played in the successful pursuit and prosecution of criminal cases. On December 15th, FinCEN issued a Notice of Proposed Rulemaking regarding the Beneficial Ownership database. And on December 22nd, FinCEN published a Financial Trend Analysis regarding BSA data involving Russian Oligarchs.

FinCEN Announces then Deletes Human Smuggling Alert

Notably, on December 16th, 2022, FinCEN issued an “Alert on Human Smuggling Along the Southwest Border of the United States.” The press release and Alert have since been scrubbed from FinCEN’s website.

Notably, on December 16th, 2022, FinCEN issued an “Alert on Human Smuggling Along the Southwest Border of the United States.” The press release and Alert have since been scrubbed from FinCEN’s website.

Luckily, the press release was captured by 3rd party websites including Dev Odedra’s www.thelaundrynews.com.

FinCEN’s Deleted Human Smuggling Press Release

Below is the text of FinCEN’s now-deleted press release from www.publicnow.com:

FINCEN – FINANCIAL CRIMES ENFORCEMENT NETWORK

12/16/2022 | Press release | Distributed by Public on 12/16/2022 08:44

FinCEN Issues Alert On Human Smuggling Along The Southwest Border Of The United States

WASHINGTON-The Financial Crimes Enforcement Network (FinCEN) issued an alert today to better support financial institutions in detecting financial activity related to human smuggling along the southwest border of the United States. The alert provides trends, typologies, and red flag indicators to help financial institutions better identify and report suspicious transactions potentially related to such activity.

“Illicit actors, including transnational criminal organizations, engage in human smuggling activity at the U.S. southwest border to reap illicit financial gains, and they do so without regard for the well-being or physical safety of those involved,” said FinCEN Acting Director Himamauli Das. “Financial institutions need to know that their vigilance and prompt Bank Secrecy Act reporting matters-it aids investigations tied to human smuggling and transnational organized crime, and can ultimately save lives.”

Human smuggling is one of the eight “Anti-Money Laundering and Countering the Financing of Terrorism National Priorities” identified by FinCEN, in coordination with its interagency partners, pursuant to the Anti-Money Laundering Act of 2020. Illicit actors seeking to make a profit by smuggling migrants across the southwest border have exploited the increasing volume of migration activity. Recent events involving the death of migrants attempting to cross into the United States illustrate the dangers associated with human smuggling and how smuggling networks exploit human beings for profit. According to the U.S. Department of Homeland Security’s Homeland Security Operational Analysis Center, human smuggling along the southwest border of the United States generates an estimated $2 billion to $6 billion in yearly revenue for these illicit actors. In support of ongoing initiatives by the U.S. Government to combat human smuggling, today’s alert builds upon FinCEN’s 2020 and 2014 human smuggling and human trafficking advisories, while providing information specifically related to human smuggling occurring along the southwest border of the United States.

Financial institutions with questions about the content of today’s alert should contact the FinCEN Regulatory Support Section at frc@fincen.gov.

A “page not found” message appears on the FinCEN website when the alert link is clicked. Similarly, no search results are found for the December 2022 Human Smuggling Alert on FinCEN’s website. I emailed FinCEN at the address included in the press release to ask what happened to the Alert but haven’t received a response yet.

UPDATE: A few people managed to download the FinCEN Alert on Human Smuggling on 12/16/2022 before it was removed from FinCEN’s website. A PDF version is linked to below:

FinCEN Alert Human Smuggling FINAL 508

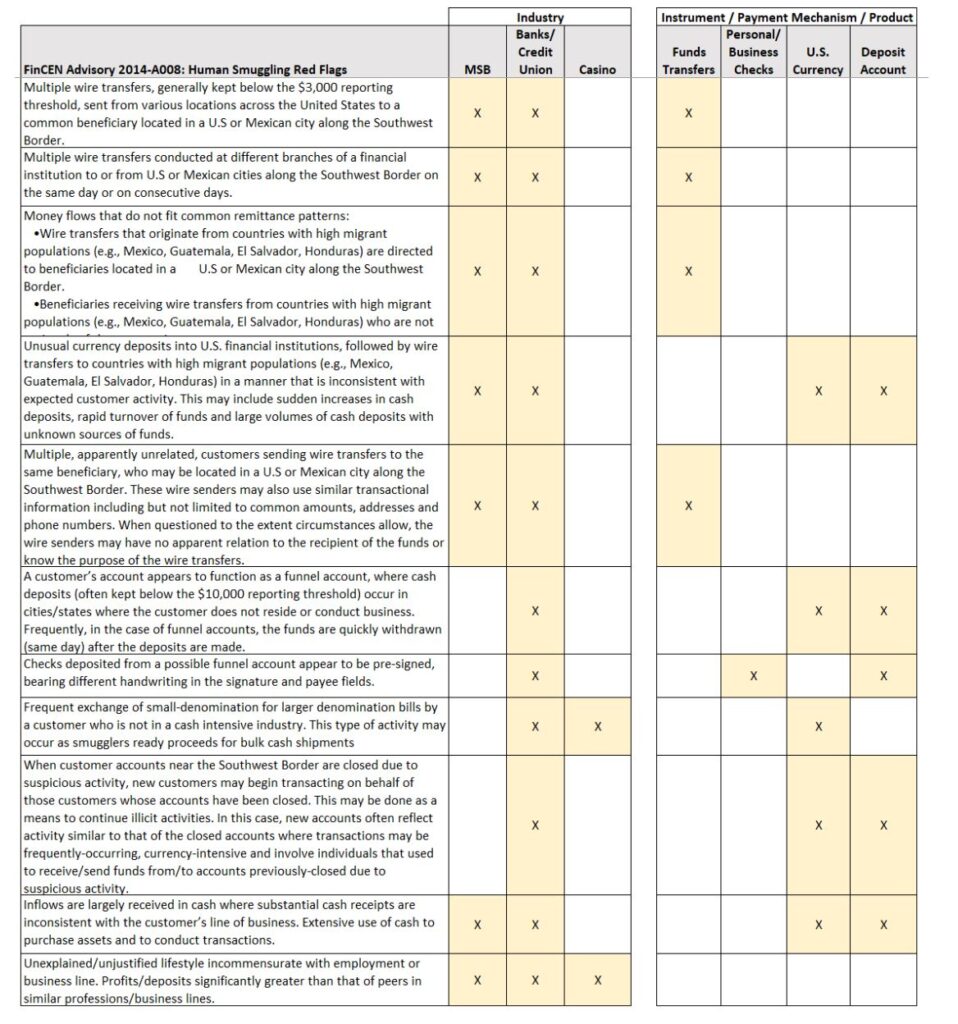

FinCEN’s 2014 Alert on Human Smuggling

FinCEN issued FIN-2014-A008 “Guidance on Recognizing Activity that May be Associated with Human Smuggling and Human Trafficking – Financial Red Flags” on September 11th, 2014. Recall that Human Smuggling did not receive a SAR checkbox until 2018. This 2014 alert created the Human Smuggling SAR keyword.

Below is my summary of FinCEN’s 2014 list of Human Smuggling Red Flags along with the Financial Institution and Financial Product:

FinCEN’s deleted 12/16/2022 press release mentions a 2020 Alert on human smuggling but the 2020 Alert focused on Human Trafficking and merely referenced the 2014 Alert. The 2020 Alert did not provide any new information on Human Smuggling red flags, trends, or typologies.

I look forward to reading FinCEN’s new Alert on Human Smuggling to see what has changed and what remains the same since they last analyzed the topic in 2014.

Want more Suspicious Activity Report or Human Smuggling Insights?

Read DSA’s 2021, 2020, 2019, 2018 and 2016 SAR Insights.

Read DSA’s analysis on Human Smuggling SARs.

Listen to Emily Green‘s Pulitzer Prize winning audio reporting on Human Smuggling and the kidnapping of migrants for ransom from This American Life.