American Banker recently published an article by Claire Williams title “Crypto suspicious activity reports are climbing. Here’s why.” The article largely focused on DSA’s analysis of SARs filed by cryptocurrency exchanges about unregistered cryptocurrency exchanges.

Detection of Unregistered Crypto Exchanges

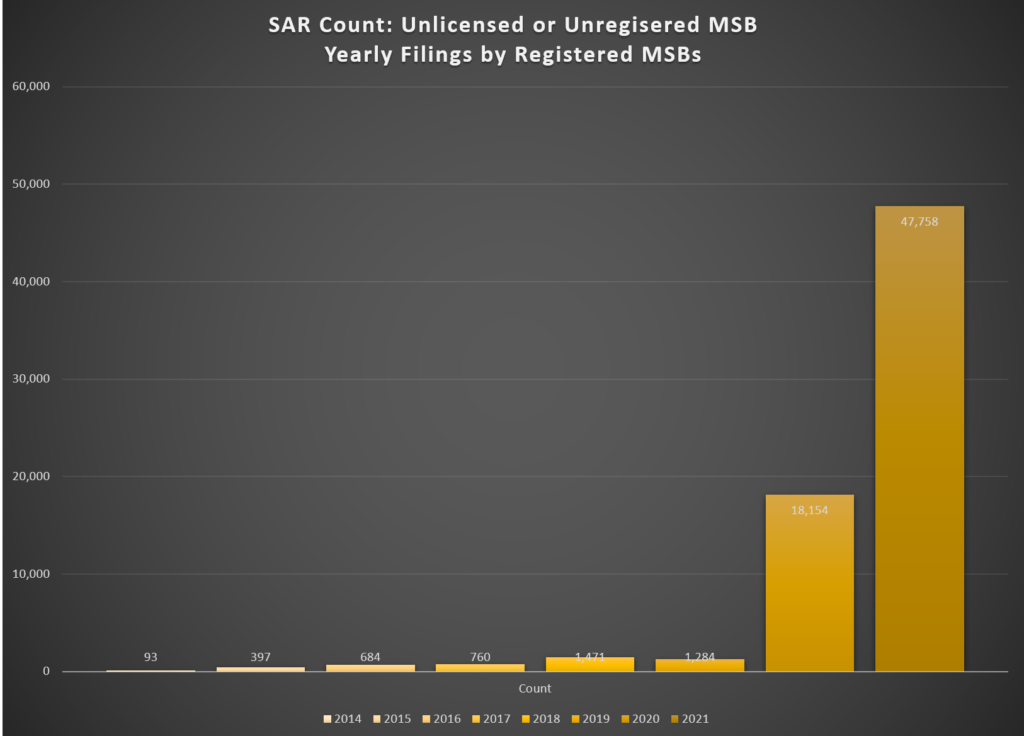

Breaking down the MSB category into types of suspicious activity being reported reveals more clues about where that cryptocurrency jump might be coming from. There’s been a huge leap in SARs filed by registered MSBs about unregistered MSBs, according to Fincen data. Jimenez wrote about her the analysis of registered MSB suspicious activity reports regarding their unregistered counterparts using Fincen data as of October 2021.

Crypto suspicious activity reports are climbing. American Banker.

Skyrocketing Rise in Unregistered MSB SARs

DSA found than 65,397 Unlicensed or Unregistered MSB suspicious activity reports were filed by San Francisco-based MSBs in all of 2021. The graph below depicts filings though October for 2021.

Crypto Exchanges Operating Outside of Regulatory Regime

“There’s this huge world of unregistered unlicensed exchanges or ATMs and other types of entities that are operating outside of the regulatory regime, and that’s something that the licensed exchanges are identifying,” Jimenez said. As a point of comparison, Jimenez said, “if you had a bank saying I noticed all these unregistered banks, that’s a concerning thing.”

Want more insights into cryptocurrency or crypto exchange SARs?

See DSA’s other analysis:

Watch: 2021 SAR Insights – Cryptocurrency Exchange SARs

3 Common Misconceptions about Cryptocurrency Crime Estimates.

Cryptocurrency SARs: What do we know?