DSA president, Alison Jimenez, was quoted on foreign corruption in a moneylaundering.com article by Valentina Pasquali. The article discusses a recent Finra enforcement action resulting in a $20,000 fine.

The Finra enforcement action against BLV Securities involved allegations that proceeds from foreign corruption were laundered through the firm.

Customer A, a Brazilian citizen, was arrested in Brazil in 2018 based on his

alleged involvement in a wide-ranging public corruption and international money

laundering scheme. After his arrest, which was reported in multiple Brazilian

news sources, BLV Securities nonetheless permitted Customer A to open 13

accounts at the firm, either in his name or the name of an entity he owed.

In 2019, Customer A sought to wire $2.5 million from a personal account at BLV

Securities to a bank account in his name in Panama. When a firm representative

asked for additional details about the purpose of the transfer, Customer A

responded by email, “[Y]ou got to be kidding me. Do I have to explain

transferring money from my account to another same owner’s account?”A day after that transfer, Brazilian authorities approved the equivalent of a plea

agreement with Customer A, in which he admitted to participating in a money

laundering scheme and agreed to pay a multi-million dollar fine.

Alison Jimenez discussed the risk of foreign corruption in the moneylaundering.com article:

This case serves as a reminder that foreign corruption proceeds will seek out the weakest link in the U.S. financial system.

You can read the article here and the Finra enforcement action here.

__________________________

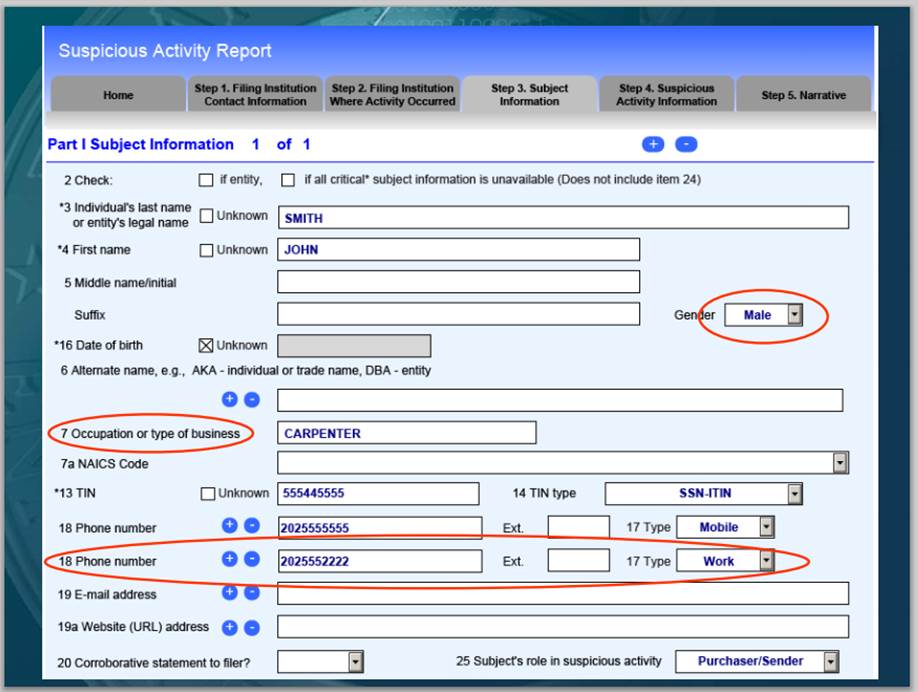

To learn more about Corruption related Suspicious Activity Reports see:

A Closer Look at Corruption SARs – Dynamic Securities Analytics, Inc.

Dynamic Securities Analytics, Inc. provides litigation consulting services to help clients successfully navigate disputes involving securities, cryptocurrency, and money laundering.