Just like May flowers follow April showers, Ponzi scheme implosions will follow a market crash.

The last example of this phenomenon was the 2008 market crash. In 2008, there were 40 Ponzi schemes discovered in the US valued at over $1,000,000. In 2009, there were over 100.

Rising markets can mask Ponzi schemes– it is easy to raise funds and few investors are asking for redemptions. When the stock market crashes and investors simultaneously try to cash out of a previously unknown fraudulent investments, the schemes quickly collapse. Additionally, fraudsters will have a difficult time raising new money during a market crash, which is how in ‘normal’ times they keep the schemes running.

During the 2008-09 Ponzi scheme surge, it wasn’t just mom & pop investors who were lulled into the schemes, large investment advisers, broker-dealers, and banks were eventually swept up in investor litigation and regulatory enforcement actions. We can expect to see the same situation play out again in the coming months/years.

Ponzi Suspicious Activity Reports (SARs)

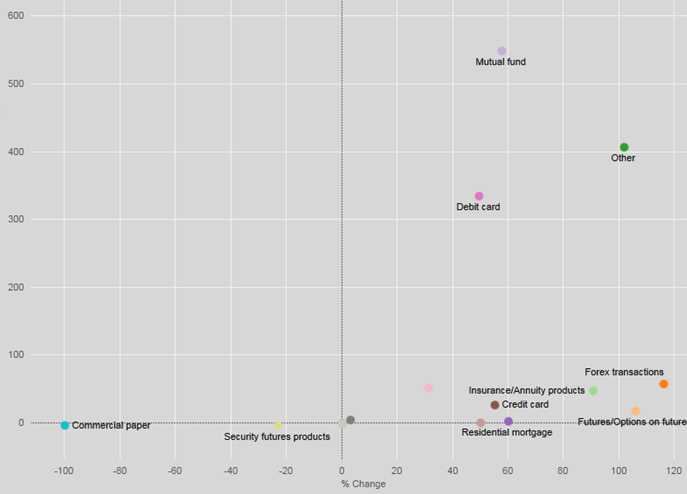

Dynamic Securities Analytics reported that in 2019 there were 660 Suspicious Activity Reports (SARs) filed by financial institutions for Ponzi schemes. We can also expect Ponzi SAR filings to increase over the next months/years.

Ponzi Schemes, Loans and Check-Kiting

Ponzi schemers may also turn to loan fraud keep the scheme going when new investor funds are not available. Depository Institutions have filed Ponzi SARs that indicated the subject was a Borrower. Ponzi schemers turned to Home Equity Loans and Residential Mortgages to prop up the scheme as reported by the SARs Product category.

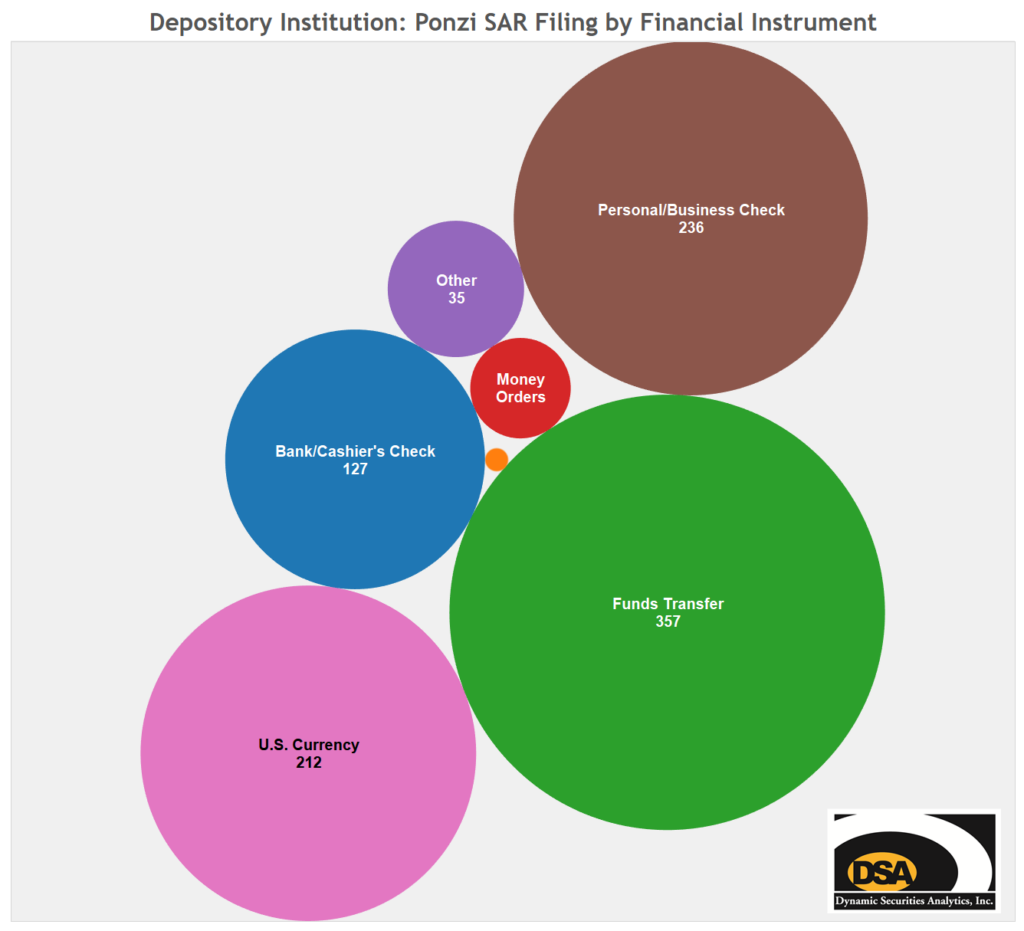

Another way to keep the scheme afloat is to buy more time. How does a Ponzi schemer do that? He engages in check-kiting. Checks have a float time that can be manipulated to inflate a bank balance at one bank and allow a schemer to make fake “interest” payments to investors. Banks reported Bank/Cashier Checks and Personal/Business Checks combined as the leading instrument type involved in suspected Ponzi schemes.

Check-Kiting: Floating worthless checks between accounts established at two or more institutions. The underlying premise of check kiting is the customer’s ability to gain access to deposited funds before they are collected

Here is the playbook of a Ponzi schemer trying to postpone being discovered:

- “Temporarily” freeze redemptions

- Stop paying dividends

- Shuffle money between bank accounts to artificially inflate account values

- Stop answering investors’ calls

To learn more about Ponzi schemes, see DSA‘s prior the posts below:

Updated SAR Form and Ponzi Schemes – Dynamic Securities Analytics, Inc.