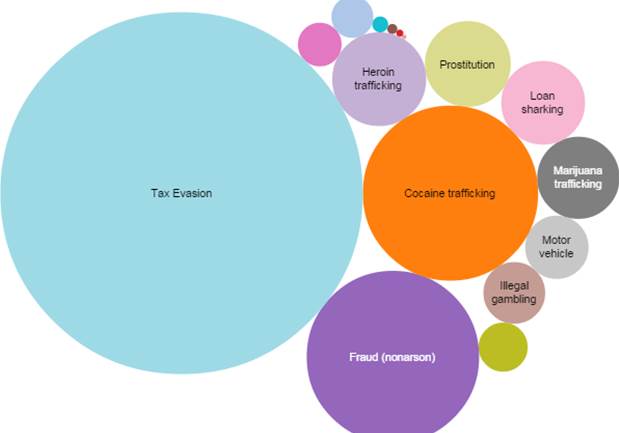

Like any small business, Ponzi schemes can be a flash in the pan or a long term endeavor, all depending on management. It is suspected that Madoff’s scheme went on for decades before it crumbled.

The math behind running a long-term Ponzi scheme is fairly straightforward. If inflows and outflows are managed properly, the scheme can last almost indefinitely. Try out DSA’s Ponzi Scheme calculator to see for yourself.

Ponzi Scheme Longevity Rules:

- Encourage “reinvestment” of income. The less income the schemer pays out, the longer the scheme will last.

- Moderate the amount stolen each year. If he steals a smaller amount each year, the scheme will last longer and he will likely be able to steal more money overall.

- Discourage redemptions. Paying out principal to investors at a high rate will crash the scheme quickly. Therefore institute a large penalty for early redemptions or promise an even higher Rate of Return if the principal is reinvested instead of withdrawn.

- The Rate of Return promised should be higher than alternatives but not so high that paying out income will quickly bankrupt the scheme.

- Recruit new money. New money is key to maintaining a scheme for an extended period.

Why Longevity Matters

There are two conflicting desires working against each other for Ponzi schemers: 1) maximizing the amount stolen 2) evading detection. A schemer may not start off aiming for longevity but longevity postpones a crash and a crash is when schemes are often detected. If the schemer consumes too much of the “investments” upfront for personal use, he is unable to meet income and redemption requests and the scheme quickly collapses.

Longevity engenders trust, which leads to repeat investment and new investors and a larger pot to steal. Longevity adds to a schemers credibility. Consider the shocked Madoff investors who thought it was impossible that it was a Ponzi scheme since they had been investing for decades with Madoff. In fact, it was just a really well-managed scheme that followed the Longevity Rules. To quote Kevin Spacey’s character in the Usual Suspects:

Ponzi Scheme Red Flags

The Longevity Rules assumes that the scheme’s red flags are missed by financial institutions and regulators. If you are interested in learning about Ponzi scheme red flags, I will be presenting a webinar for ACAMS on November 25, 2014 titled Dissecting the Inner Workings of Recent Ponzi Schemes.

Check out the PonziTracker.com database and analytics (prepared by DSA) to learn more about uncovered Ponzi schemes.