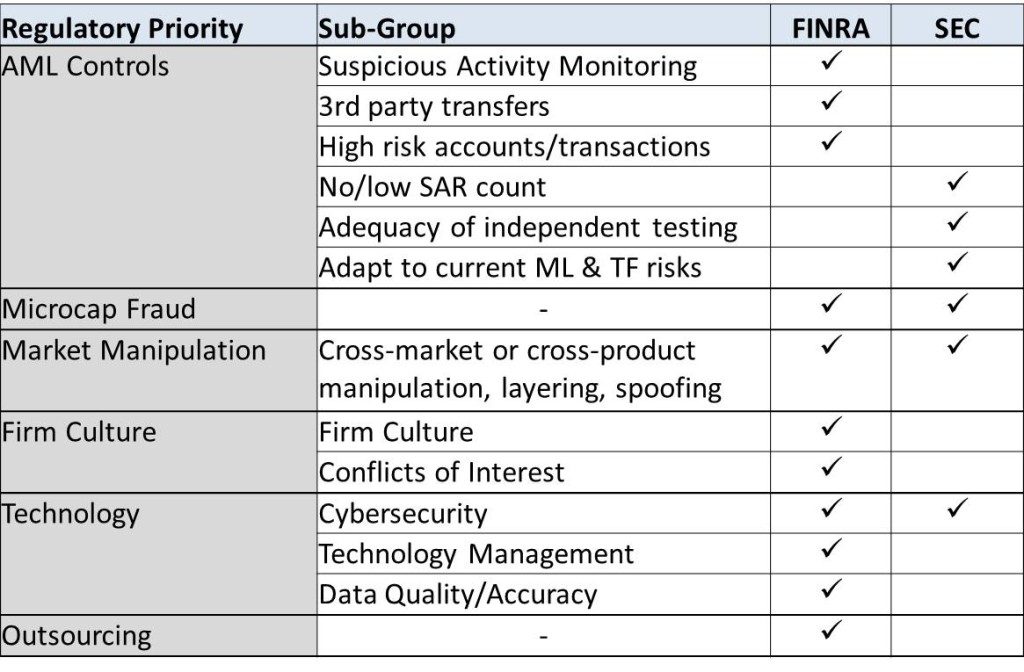

FINRA and the SEC recently released their respective 2016 exam & regulatory priorities. DSA reviewed the priorities for topics that directly or indirectly touch on AML issues. While there is overlap in the areas of cybersecurity, market manipulation and microcap securities, the two regulators diverge on other AML priorities. DSA prepared the comparison below:

No/Low SAR Count

The SEC reiterated its concern about broker/dealers either filing zero or few SARs. DSA analyzed this issue in a prior post :

DSA calculated that firms with less than 10 registered reps filed on average 0.32 SARs in 2014. In other words, only 1 out of 3 of these small firms filed a SAR. In 2014, there was one SAR filed for every 4,855 broker-dealer accounts. The SEC can not simply mandate that certain firms file more SARs. In order for small firms with small customer bases to file more SARs, all BDs must file more SARs due to the account distribution across firms. Otherwise, the SEC would in effect be saying that customers at small firms are by default more suspicious. For instance, if every small firm filed 1 SAR and the largest firms continued to file SARs at the rate of 1 per 4,855 accounts, then small firms would be filing SARs at a rate 3 times that of large firms.

Is the SEC suggesting that customers who choose to invest with regional BDs are three times as suspicious as those who invest at international conglomerates?

If the SEC will only be happy when every BD firm files at least one SAR, then 70,000 SAR-SFs will need to be filed in a year. This would be a three-fold increase over current SAR-SF filing rates.