FinCEN

76 posts

Dynamic Securities Analytics' 2020 SAR Insights focuses on the interplay between COVID-19 and Suspicious Activity Reports filed by Depository Institutions.

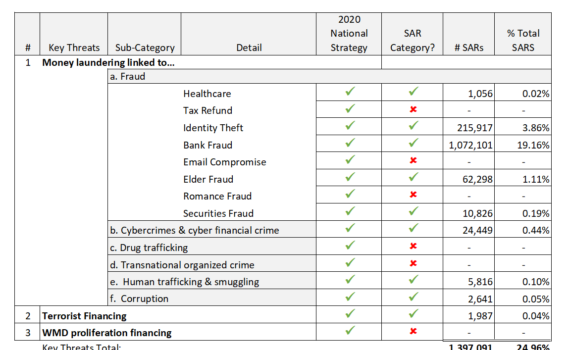

Several key threats including Drug Trafficking, Organized Crime and Tax Evasion do not have SAR category checkboxes. SAR data is only "useful" to government authorities inasmuch as it is discoverable. Structured data is more easily searchable and will lead to improved AML effectiveness.

There is a complete disjoint between what financial institutions are asked to report, what they do report, and national illicit finance priorities.

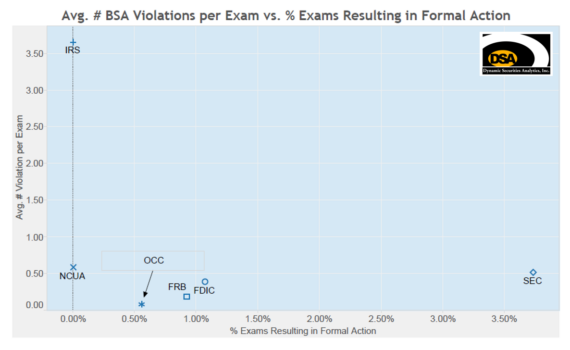

DSA analyzed SAR data and BSA regulator enforcement data to compare the level of regulator scrutiny.