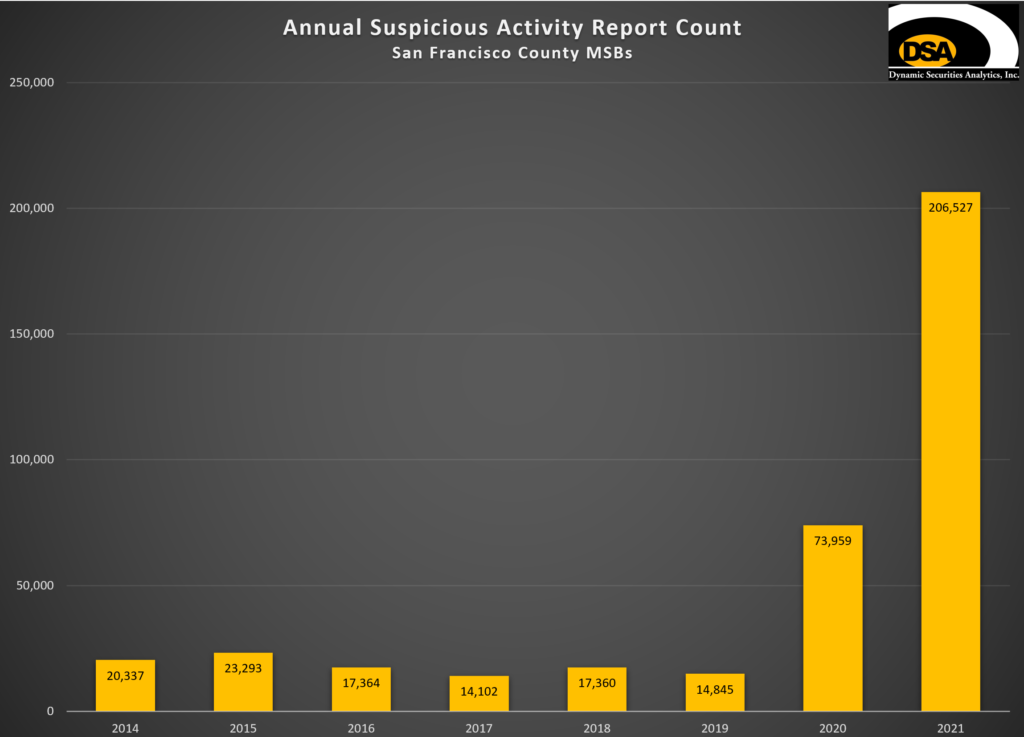

Dynamic Securities Analytics’ report on crypto exchange SARs was featured by the Financial Times. DSA studied suspicious activity reports filed in 2021 by San Francisco-based MSBs. San Francisco is home to several major crypto exchanges.

Surge in SAR filings by crypto exchanges

The article by Gary Silverman discusses DSA’s finding that SF MSB suspicious activity reports surged to 206,527 in 2021, up from 14,845 in 2019.

Read DSA’s full report at: 2021 Cryptocurrency Exchange Suspicious Activity Reports.

The full report covers additional topics including: the top three suspicious activity categories, categories with few SARs, and the usefulness or unusefulness of the current Suspicious Activity Reporting form methodology to law enforcement.

The Financial Times article also discusses DSA’s insight that the spike in Unregistered MSB suspicious activity reports was likely linked to a 2019 FinCEN advisory on illicit activity involving cryptocurrency.

Read DSA’s full report on Unregistered Cryptocurrency Exchange SARs.

Detailed data on crypto & crime needed

DSA president, Alison Jimenez, was quoted in the Financial Times article:

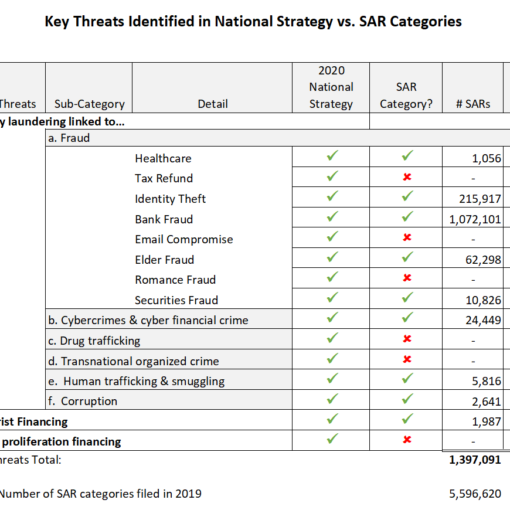

Jimenez said her report pointed to the need for FinCEN to collect more detailed information on the use of cryptocurrencies in financial crime and money laundering.

“There is a lot of discussion about how to best regulate the crypto industry,” she said. “We need more data.”

Alison Jimenez quoted in Financial Times “Crypto Platforms Linked to Surge in Suspicious Activity Reports”, 2/8/2022.

Want more insights into cryptocurrency or crypto exchange SARs?

See DSA’s other analysis:

Watch: 2021 SAR Insights – Cryptocurrency Exchange SARs

3 Common Misconceptions about Cryptocurrency Crime Estimates.