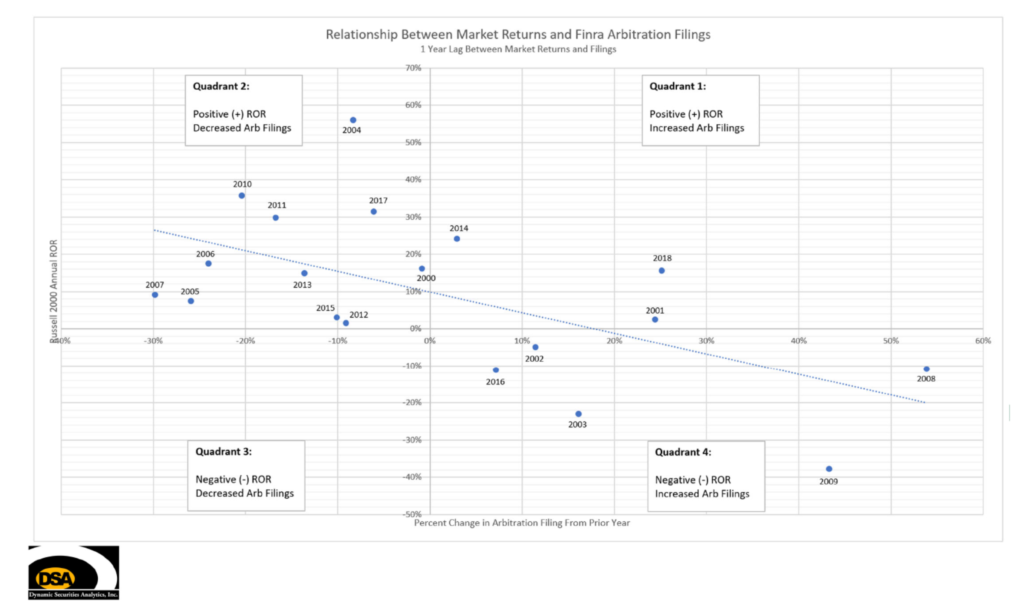

With the recent market turmoil, Dynamic Securities Analytics post from August 2019 on predicting Finra arbitration filings deserves a revisit.

In short, if the market falls 10%, Finra arbitration filings are expected to increase 35%. A market drop of 20% suggests a 50% increase in filings.

Filing Lag Time

First I looked at the lag time between market events and Finra filings. I found that the number of arbitrations filed is most closely inversely related to the market returns with a one-year lag.1 For instance, say the market drops by -10% in 2020, Finra arbitrations will increase in 2020 but not by as much as they will in 2021.

Trend Line

The ‘trend line’ on the graph can give you an idea of what to expect for any given market ROR. For instance, if the market has a ROR of -20% than arbitration filings will increase by 50% one year later. Similarly, if the market drops by -10% then one year later, you can expect a 35% increase in arbitrations filed.

We can expect arbitration filings to number 5,071 in the year 2021 if the market ends 2020 10% down from 2019 levels. As a reference, 2019 saw 3,757 new arbitrations filed. If the market is down 20% at the end of the year, then I expect that 5,635 arbitrations will be filed in 2021. We have not seen annual filing counts over 5,000 per year since 2010.

Ready to Ramp Up?

If your law firm or legal department hasn’t prepared yet for the spike in Finra arbitration filings, it is time to start. Dynamic Securities Analytics, Inc. is ready to help with quantitative expertise in calculating securities damages.

1 Russel 2000 Index 1-year lag correlation was higher than same year and 2-year lag, and higher than S&P 500 correlation for same lag times.