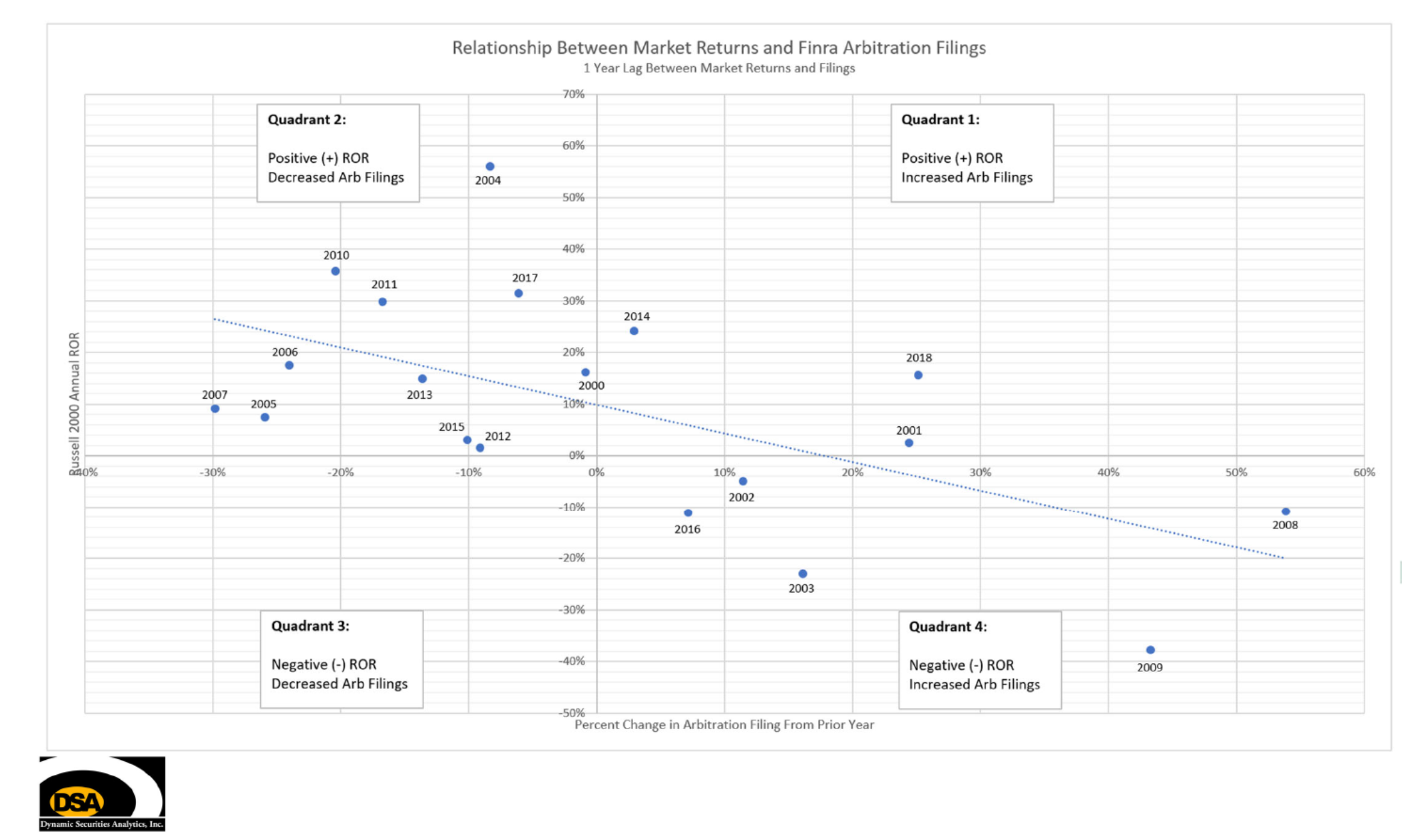

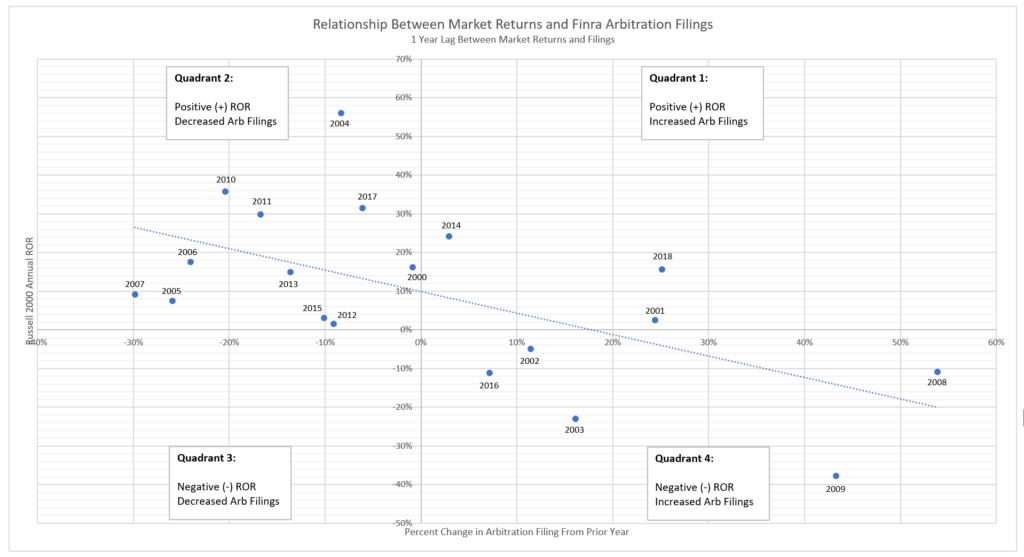

I was recently asked by a securities attorney colleague if I could predict the future number of Finra arbitrations based on current market returns. Below is one method (although many alternatives could be used) to try to gauge future fluctuations in Finra arbitration filings.

Filing Lag Time

First I looked at the lag time between market events and Finra filings. I found that the number of arbitrations filed is most closely inversely related to the market returns with a one-year lag.1 For instance, say the market drops by -10% in 2019, Finra arbitrations will increase in 2019 but not by as much as they will in 2020.

Trend Line

The ‘trend line’ on the graph can give you an idea of what to expect for any given market ROR. For instance, if the market has a ROR of +10% than arbitration filings will hold steady (no change) one year later. On the other hand, if the market drops by -10% then one year later, you can expect a 35% increase in arbitrations filed. If the market has a 0% ROR, you can expect an almost 20% increase in arbitration filings the following year.

Expected & Unexpected Results

As expected, there has not been a negative market and a decrease in arbitration filings. However, there are several years where the market was positive but Finra arbitrations increased. Most recently this occurred in 2018 when there was a spike in both the number of “intra-industry” arbitrations and customer arbitrations involving municipal bonds.

My analysis looks at all Finra arbitrations filed so it is most certainly skewed by “product” cases and the increase in expungement cases. However, the analysis may be useful for planning future workloads.

1 Russel 2000 Index 1-year lag correlation was higher than same year and 2-year lag, and higher than S&P 500 correlation for same lag times.