Dynamic Securities Analytics, Inc (‘DSA’) analyzed a FinCEN report which provided data on Suspicious Activity Reports (‘SARs’) referencing 314(b) information sharing among financial institutions.

What is 314(b)?

FinCEN’s 314(b) FactSheet explains that “Section 314(b) of the USA PATRIOT Act provides financial institutions with the ability to share information with one another, under a safe harbor that offers protections from liability, in order to better identify and report potential money laundering or terrorist activities. 314(b) information sharing is a voluntary program, and FinCEN strongly encourages information sharing through Section 314(b).”

Information Sharing Guidelines

The 314(b) information sharing program is voluntary for financial institutions. Financial institutions must register with FinCEN and prior to sharing information with another financial institution, it must ensure that the other institution is also registered in the 314(b) program. Finally, financial institutions must:

establish and maintain procedures to safeguard the security and confidentiality of shared information, and must only use shared information for the purpose of:

• Identifying and, where appropriate, reporting on activities that may involve terrorist financing or money laundering;

• Determining whether to establish or maintain an account, or to engage in a transaction; or

• Assisting in compliance with anti-money laundering requirements.

FinCEN further advised financial institutions to mention 314(b) information sharing in the SAR narrative section:

In cases where a financial institution files a SAR that has benefited from 314(b) information sharing, FinCEN encourages financial institutions to note this in the narrative in order for FinCEN to identify and communicate specific examples of the benefits of the 314(b) program.

FinCEN Findings

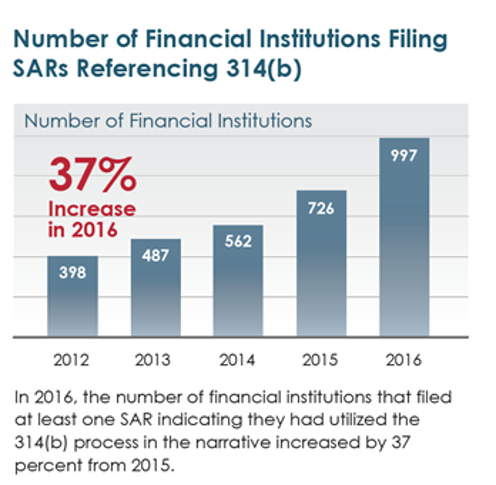

FinCEN found that the number of SARs wherein the utilization of the 314(b) Program was discussed in the narrative have increased steadily over the past five years.

FinCEN Key Findings:

- 44% increase in the number of 314(b) references from 2012 through 2016

- 16,000 314(b) references in 2016, up from around 4,000 in 2012

- 997 financial institutions filed at least 1 SAR with a 314(b) reference in 2016

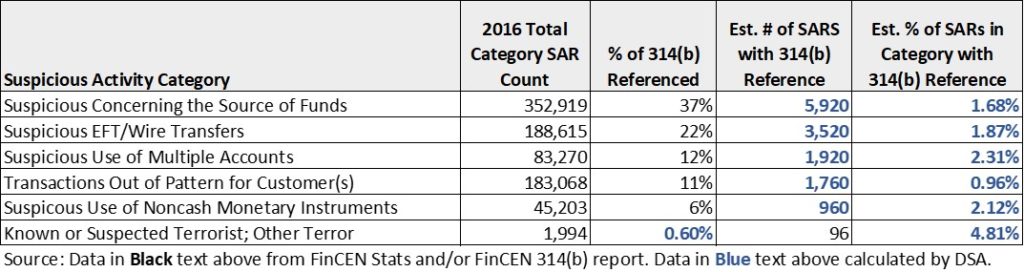

- “Suspicious Concerning the Source of Funds” accounted for 37% of all 314(b) references in 2016

A Closer Look

DSA took a closer look at the figures provided by FinCEN by comparing the 314(b) numbers against overall and category specific SAR filings.

DSA Key Findings:

- 0.33% of all SARs filed in 2016 mentioned 314(b) info sharing

- In other words, only 3.3 out of every 1,000 SARs filed in 2016 mentioned 314(b), but this is up from 1.5 out every 1,000 SARs back in 2013

- 1.68% of “Suspicious Concerning the Source of Funds” 2016 SARs filed would have referenced 314(b)

- 4.81% of all 2016 Terror Finance SARs would have reference 314(b)

Caveats and Conclusions

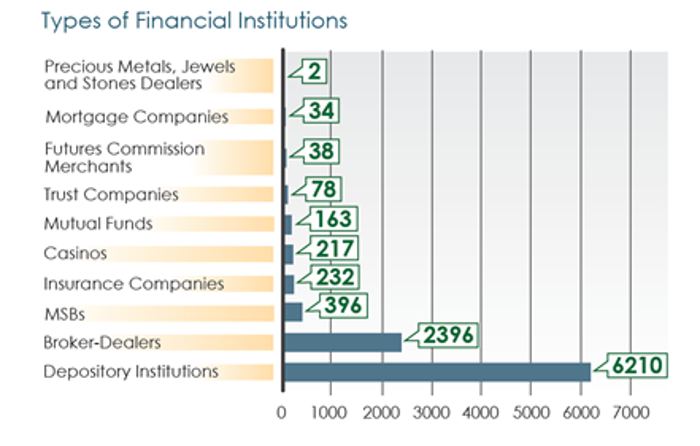

The voluntary nature of some aspects of 314(b) program curtails the number of SARs reporting benefiting from the program. First, not every bank, MSB and broker-dealer is enrolled. For instance, there are about 4,000 broker-dealers registered with the SEC/FINRA but only 2,396 were enrolled in the 314(b) program. FinCEN provided the graphic below showing the number of institution types enrolled.

Secondly, reporting in the SAR form narrative that the SAR benefited from 314(b) sharing is also voluntary. It is likely that many more financial institutions shared information via 314(b) but the data was not included on the SAR form. Or given the additional insight provided by the information shared the FI may have decided NOT to file a SAR. FinCEN notes in the Fact Sheet that a benefit of 314(b) sharing may included: Facilitating efficient SAR reporting decisions – for example, when a financial institution obtains a more complete picture of activity through the voluntary information sharing process and determines that no SAR is required for transactions that may have initially appeared suspicious.

However, there is room for a lot more information sharing especially in regards to certain types of suspicious activity. For example, 98% of the time, banks filed “Suspicious Wire Transfer” SARs without sharing information with the bank counter-party. The financial institution would know which bank was the wire counter-party and could have reached out to them to gain understanding of the transaction. Further increasing 314(b) information sharing could result in more comprehensive and accurate SARs, and fewer false positive SAR filings.