DSA analyzed CFPB consumer cryptocurrency complaints over a three-year period to identify trends on a product level and also at specific crypto companies. DSA then compared the CFPB data against cryptocurrency complaints filed with the FTC and FBI, and Suspicious Activity Reports filed with FinCEN.

Learn more about the CFPB’s Complaint Database in the footnotes.[i] Links to download the specific CFPB complaints used in this analysis are provided within the post below.

Cryptocurrency Complaints by Product

The CFPB complaint database is searchable by financial product. There are over 50 products ranging from Checking accounts to Credit repair services to Virtual currency. Notably, Virtual Currency is a product option while cryptocurrency is not.

Virtual Currency or Cryptocurrency Complaints?

The CFPB defines Virtual currency in multiple ways on its website:

Virtual currency is “used to track, store, and send value over the internet”.

Other descriptions suggest that the CFPB is referring to cryptocurrency when it uses the term Virtual currency:

Virtual currencies are designed to be an alternative to current payment systems. Better-known virtual currencies include Bitcoin, XRP, and Dogecoin.

A third CFPB definition is even broader and could encompass NFTs:

Virtual currency is a digital representation of value that’s not issued by a government or a public authority but may be accepted as a means of payment. It can be transferred, stored, or traded electronically.

Not surprisingly, the public has filed complaints involving Virtual currency unrelated to cryptocurrency. These complaints often reflect mobile payments or peer-to-peer payments such as Venmo, Zelle, or PayPal.

Who are Cryptocurrency Complaints filed Against?

There are several interesting phenomena found when analyzing the companies named in consumer cryptocurrency complaints (excluding the mobile payments and P2P payments noted above). CFPB Virtual Currency Complaints download.

Cryptocurrency Complaints Against Traditional Financial Institutions

First, many traditional financial institutions and FinTechs are named in complaints because:

- An alleged cryptocurrency fraud or scam was funded from these institutions

- The bank/payment account was hacked, and the stolen funds were used to purchase cryptocurrency

- Fund transfers between crypto firms and the Trad-Fi went awry

- Trad-Fi prohibited transactions involving cryptocurrency or did not permit customers to “link” their bank accounts to specific apps.

Cryptocurrency Complaints Against Crypto-Focused Companies

Next, familiar crypto companies often do not show during a company name search. This is because many of crypto firms use DBA’s. For instance, searches for Binance and Crypto.com yield these results:

The table below provides crypto Trade Name / DBA versus the company name listed in the CFPB database. As an aside, FinCEN lists “Gemini Trust” as a registered MSB, not “Winklevoss Exchange.”

| # | Trade Name / DBA | CFPB / Legal Name |

| 1 | Binance.US | BAM Management US Holdings Inc. |

| 2 | Bitcoin of America | SandPSolutions |

| 3 | Coinlist | Amalgamated Token Services, Inc. |

| 4 | Crypto.com | Forix DAX, Inc. |

| 5 | FTX.us | West Realm Shires Services Inc. |

| 6 | Gemini | Winklevoss Exchange LLC. |

| 7 | Kraken | Payward Ventures Inc. |

| 8 | LibertyX | Moon Inc. |

Crypto FDIC Insurance Confusion

The FDIC issued Cease & Desist letters demanding five companies and their officer, directors, and employees stop making false and misleading statements about FDIC deposit insurance.

Correspondingly, CFPB complaints show that some crypto investors are under the belief that either their crypto or the exchange they use is FDIC insured. Several complaints allege that the exchanges advertised that they were FDIC insured.

What Issues are the Cryptocurrency Product Complaints About?

The CFPB provides broad categories that consumers can classify their Virtual currency complaints:

- Money was not available when promised

- Wrong amount charged or received (transfer amounts, fees, exchange rate, taxes)

- Confusing or missing disclosures (showing the fine print about usage, explaining your rights)

- Other transaction problem (unauthorized transaction, cancellation, refund)

- Other service problem (advertising or marketing, pricing, privacy)

- Unexpected or other fees

- Fraud or scam

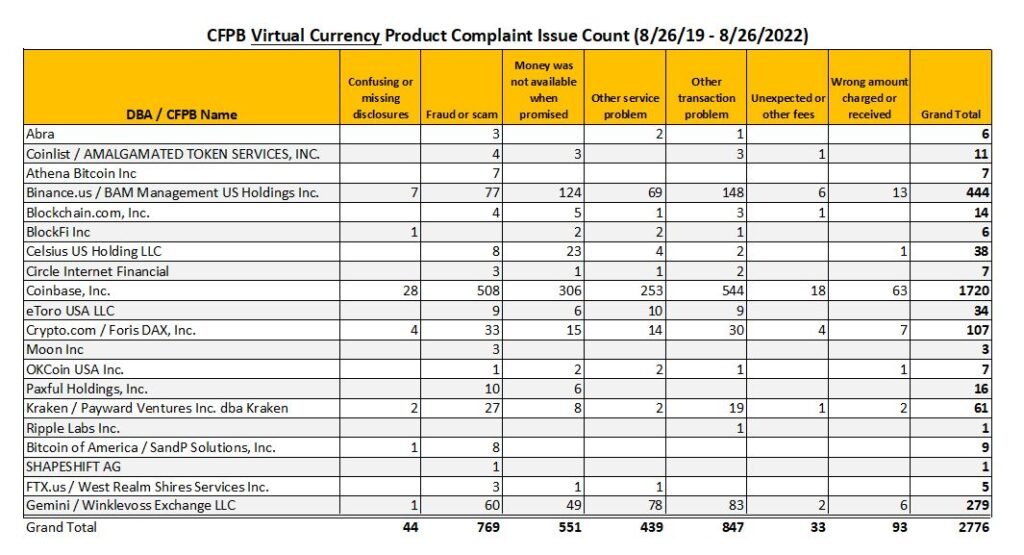

First, I isolated crypto-centric firms (removing banks, payment companies, and broker-dealers) to identify the largest cryptocurrency issues in the consumer complaints.[ii] Other transaction problem accounted for the largest share with 31% of complaints. Fraud or Scam took second place with 28% of complaints and Money was not available when promised was third accounting for 20% of complaints.

The overall numbers are heavily influenced by the Virtual currency complaints of one firm, Coinbase. Coinbase is the firm identified in 61% of the complaints. Keep in mind, the CFPB advises “When looking at complaint volume about a company or product, consider company size and/or market share. For example, companies with more customers may have more complaints than companies with fewer customers.”

The top five firms (Coinbase, Binance.US, Kraken, Crypto.com, and Gemini) account for 94% of all Virtual currency complaints among crypto-focused firms.

Notably, the distribution of Virtual currency complaint categories varied from firm to firm. For example, 17% of Binance.US Virtual currency complaints were in the Fraud or scam category vs. 30% for Coinbase. On the other hand, 28% of Binance.US complaints were for Money was not available when promised versus 18% for Coinbase.

On this note, the Washington Post estimated that Celsius had 500,000 users when withdrawals were frozen, yet only 23 complaints have been filed with the CFPB against Celsius for the issue of Money not available when promised.

CFPB Complaints by Cryptocurrency Company

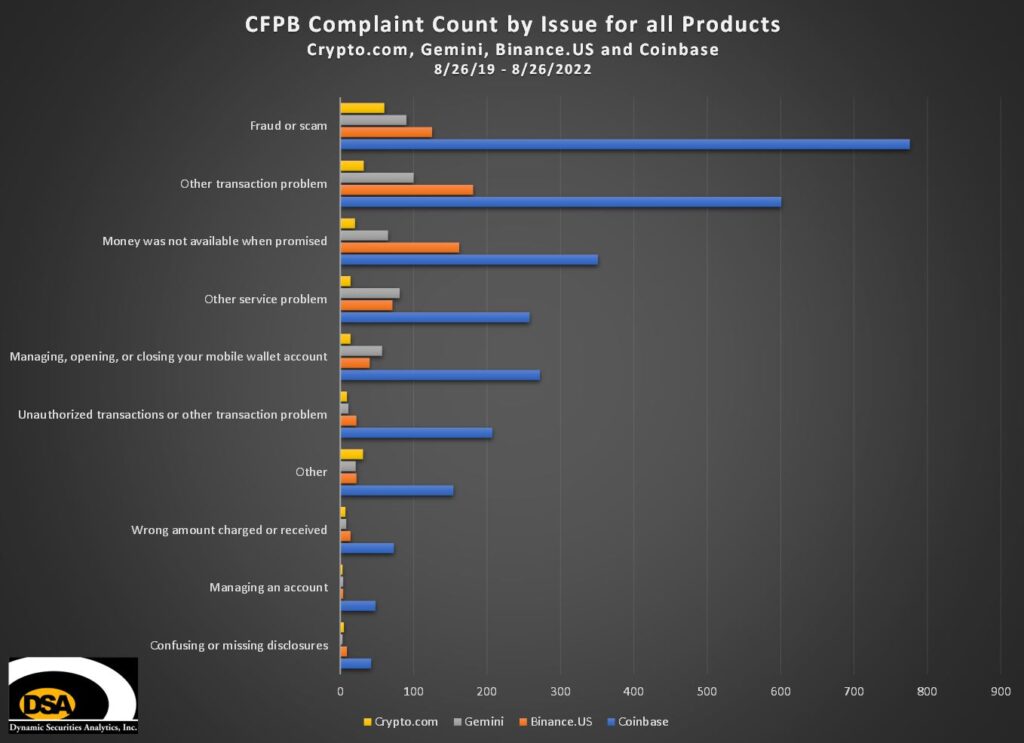

The analysis above looked at complaints that listed Virtual currency as the product involved. I also analyzed complaints against top cryptocurrency companies for all products, not just cryptocurrency.

Cryptocurrency Firms Complaints by Product

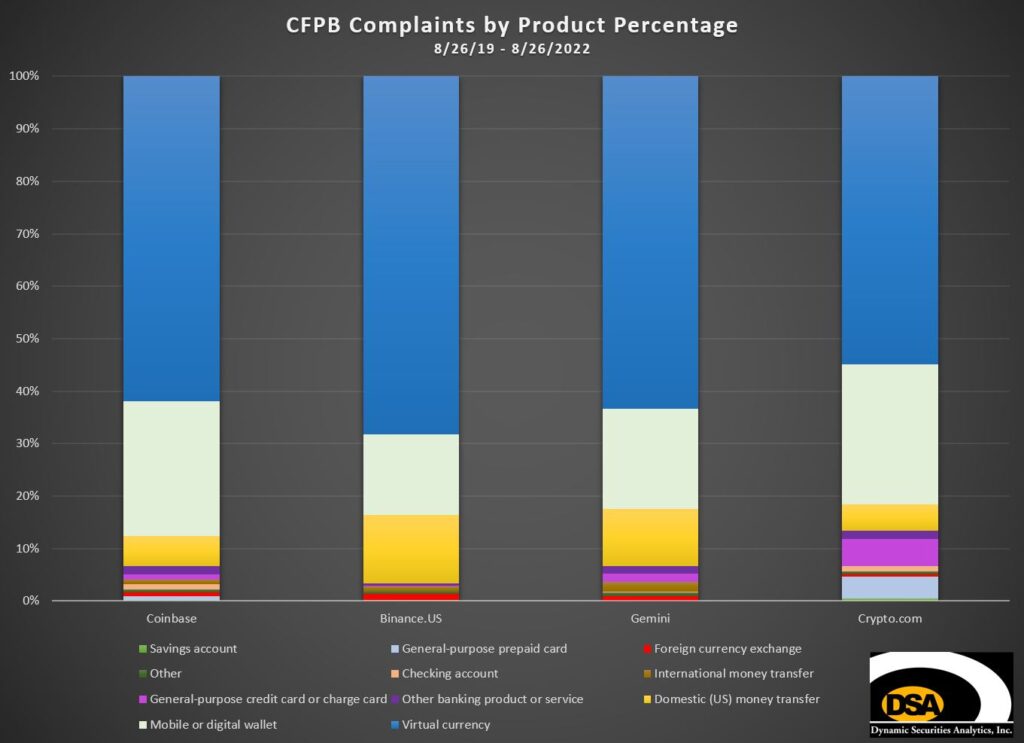

The table below shows the product percentage of complaints at four cryptocurrency firms: Coinbase, Binance.US, Gemini, and Crypto.com.

Of these four firms, Binance.US has the largest share of overall complaints about Virtual currency at 68% while Crypto.com has the lowest at 55%. Mobile Wallets generate a large share of complaints at all four firms, accounting for 26% and 27% of complaints at Coinbase and Crypto.com respectively.

Turning to traditional financial products, Crypto.com had 9% of complaints involving Credit cards or Pre-paid cards while the other three firms had 3% of less for these same products. Binance.US had the largest share of Domestic (US) money transfer product issues with 13% of complaints in this category.

Cryptocurrency Firms Complaints by Issue

I also analyzed the complaint Issues for all products, not just Virtual currency. While Coinbase often led the overall complaint counts, the four firms differed in their leading complaint issues. For example, Crypto.com and Coinbase had Fraud or Scam as their top issue while Binance.US and Gemini both had Other Transaction Problem as their leading issue.

The percentage of complaints involving Money was not available when promised varied widely, from 10% at Crypto.com to 25% at Binance.US. Fraud or Scam complaints ranged from 19% of complaints at Binance.US to 31% at Crypto.com.

CFPB Cryptocurrency Complaints v. Other Government Data Sources

Now that we have a handle on CFPB cryptocurrency complaints, we can see how that data stacks up to other US government data sources including the FTC, FBI, and FinCEN.

FTC Cryptocurrency Complaints

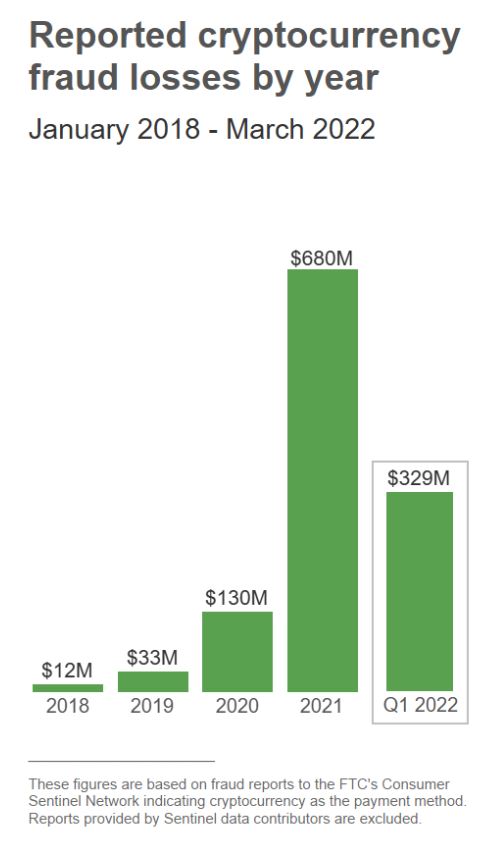

The FTC produced a detailed study on cryptocurrency scam complaints received by the FTC from January 2021 through March 2022. More than 46,000 people reported having lost over $1 billion dollars in crypto scams during the period. The FTC found that the median loss was $2,600 with Bitcoin (70%), Tether (10%), and Ether (9%) being the top cryptocurrencies used in the scams.

Conversely, the CFPB only reports 856 Fraud or scam over the same period relating to Virtual currency (which often includes non-cryptocurrency products). The variation in the number of crypto scam complaints received by the FTC versus the CFPB is striking.

It is helpful to keep in mind that a small fraction of victims report consumer fraud to government entities when looking at the number of complaints, whether CFPB, FTC or FBI.

FBI Cryptocurrency Complaints

The FBI’s Internet Crime Complaint Center’s (“IC3”) mission is to provide the public with a reliable and convenient reporting mechanism to submit information to the FBI concerning internet facilitated crime. IC3 analyzes and disseminates information for public awareness. To that end, the FBI has issued numerous consumer alerts about cryptocurrency scams including:

DeFi Exploits

The FBI warns that cyber criminals are increasingly exploiting vulnerabilities in decentralized finance (DeFi) platforms to steal cryptocurrency, causing investors to lose money. The FBI reports that between January and March 2022, cyber criminals stole $1.3 billion in cryptocurrencies, almost 97% of which was stolen from DeFi platforms.

Fake Apps

The FBI reported that fake crypto apps defrauded investors of more than $42 million between October 2021 and July 2022.

Crypto ATMS and QR Codes

The FBI warned about scams leveraging cryptocurrency ATMS and QR Codes to receive payments from victims in online impersonation scams, romance scams, and lottery scams.

Liquidity Mining Scams

The FBI states that liquidity mining scams has been responsible for over $70 million in losses since January 2019. Liquidity mining examples are found in the CFPB complaints.

Impersonation of Law Enforcement

The FBI warned of scammers impersonating law enforcement or government officials in attempts to extort or steal personally identifiable information. The scammers often demand payment via cryptocurrency ATM.

SIM Swapping

FBI received 1,611 SIM swapping complaints in 2021 with adjusted losses of more than $68 million in both from fiat and virtual currency accounts.

Romance Scams

From January 1, 2021 – July 31, 2021, the FBI received over 1,800 complaints related to online romance scams. FBI estimates that 24,000 Americans have lost more than $1 billion to romance fraud in 2021. The FBI did not break down the portion attributable to crypto vs fiat.

CBS News reports:

“Victims [of cryptocurrency scams] lose anywhere from a few hundred dollars to a few million dollars and if you can imagine, these scams and schemes usually involve a large number of individuals so you may have a group of victims spread out across the country,” said Supervisory Special Agent Eric Yingling with FBI Pittsburgh.

Business Email Compromise and Second Hop Transfer

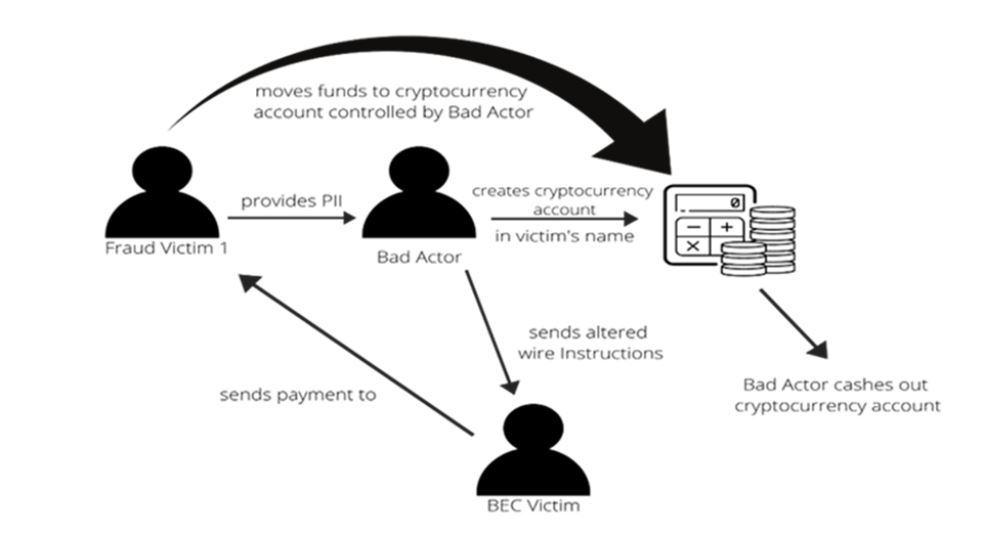

The FBI reports that Business Email Compromise victims have unknowingly had their email hacked and wire instructions were altered by bad actors to instead wire funds to Cryptocurrency Exchanges.

Another disturbing pattern is the “Second Hop Transfer” that the FBI describes as:

Second Hop Transfer uses victims of other cyber-enabled scams such as Extortion, Tech Support, and Romance Scams. Often, these individuals provided copies of identifying documents such as drivers licenses, passports, etc., that are used to open cryptocurrency wallets in their name.

The Advisory provides the illustration below to show the Second Hop Transfer pattern:

Each of the scam typologies identified by the FBI is found in CFPB cryptocurrency complaint narratives. Download the narratives of CFPB virtual currency complaints here.

While CFPB consumer cryptocurrency complaints are not verified by the agency, the complaints do comport with FBI and FTC consumer alerts.

FinCEN Cryptocurrency Suspicious Activity Reports

Financial institutions, including some types of cryptocurrency business are required to file Suspicious Activity Reports with FinCEN. While SARs clearly differ from consumer complaints, they can serve as another resource to gauge financial crimes impacting consumers.

FinCEN reported that over 92,000 crypto-related SARs were filed in 2021. In a prior post, DSA analyzed 2021 SARs to identify those likely filed by San Francisco cryptocurrency exchanges.

DSA found that surprisingly few Cyber Event Against Customer SARs were filed with only 67 reported in 2021. On the other hand, SF MSBs filed over 31,000 fraud-related SARs with the top two categories Credit/Debit Card and ACH fraud having 14,023 and 10,546 SARs respectively.

What did we learn from CFPB Cryptocurrency Complaints?

First, the term Virtual currency is potentially confusing, overly broad, or unclear to consumers who file complaints with the CFPB. Next, traditional financial institutions and payment companies are often named in cryptocurrency-related complaints, even if they don’t offer crypto products. Third, there are differences amongst crypto-focused companies on which products and issues customers complain. Finally, CFPB complaint narratives provide first-hand reports of issues highlighted in FTC and FBI advisories.

________________________________________________

Want more Cryptocurrency Insights?

Read DSA’s 2021 Cryptocurrency Exchange SAR Insights.

Read DSA’s analysis on Unregistered Cryptocurrency Exchange SARs.

Read DSA’s blog “Cryptocurrency SARS: What do we know?”

Dynamic Securities Analytics, Inc. provides litigation consulting to help clients successfully navigate disputes involving securities, cryptocurrency, and money laundering.

[i] See the CFPB’s description about the database here. The CFPB notes that “one consumer’s experience is not necessarily representative of all consumers’ experiences and narratives are not verified before publication.”

[ii] Some of the excluded firms offer crypto services in addition to other financial products or services. I attempted to isolate firms that are exclusively or largely crypto-related.