DSA president, Alison Jimenez, was quoted in a recent VICE article by Pulitzer Prize winner, Emily Green. The article discusses human smuggling and the kidnapping of migrants for ransom at the southwest border and financial institutions’ anti money laundering obligations to detect such transactions.

“Until financial institutions are told they need to be actively monitoring their transactions for kidnapping ransom payments, they are not going to do it,” said Alison Jimenez, president of Dynamic Securities Analytics, a U.S.-based anti–money laundering company. “The priorities are what the government tells them are the priorities, and right now no one is being told human smuggling is a priority—period.”

“US Companies Are Helping Mexican Cartels Get Rich Kidnapping Migrants”, VICE, April 20, 2021.

Human Smuggling SARs

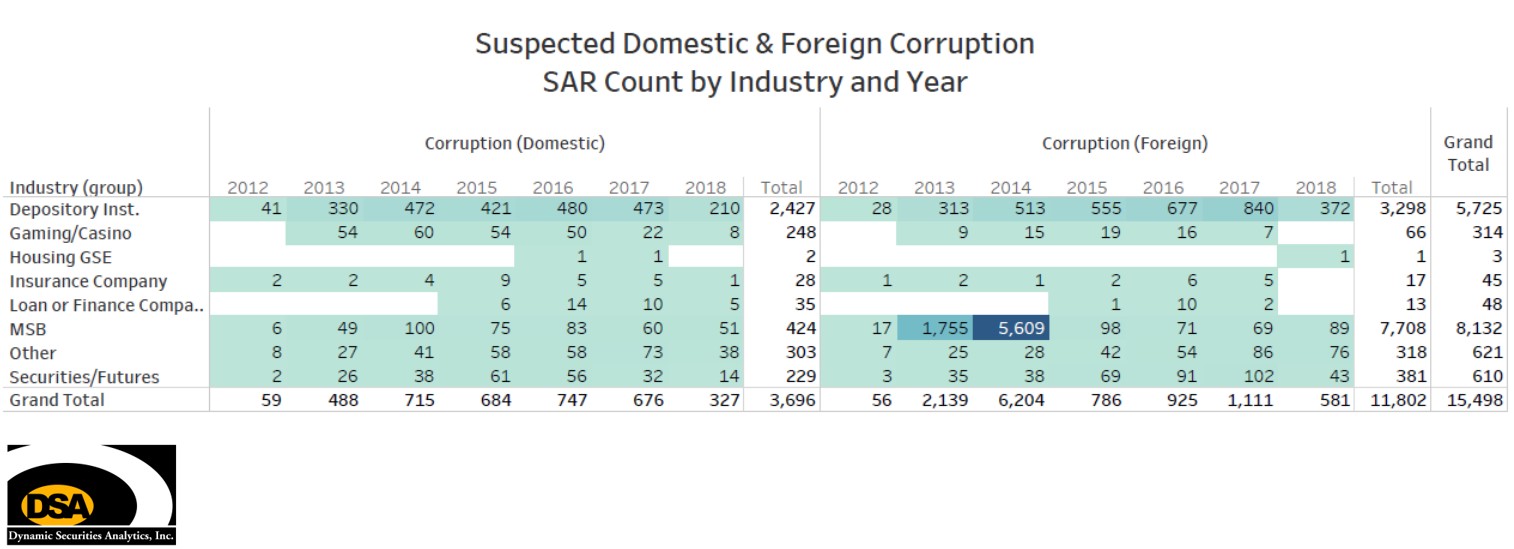

Dynamic Securities Analytics previously prepared analysis of Human Smuggling Suspicious Activity Report (SARs) filed by financial institutions.

Analysis of Human Smuggling SARs – Dynamic Securities Analytics, Inc.

DSA found several areas for improvement in complying with anti money laundering reporting for Human Smuggling.

The 2015 National Money Laundering Risk Assessment reported that migrant smugglers responded to increased MSB scrutiny by changing tactics to utilizing funnel accounts at banks. ICE HSI defined funnel accounts as involving an account at a bank with branches nationwide to make structured deposits in one or more geographic locations and then structured withdrawals in the state where the account was open. ICE reported this method was first associated with human smuggling but has been readily adopted by drug traffickers as well.

The relatively low number of Human Smuggling SARs reported by banks that involved deposit accounts could either imply that Depository Institutions have not yet mastered identifying human smuggling funnel account transactions or Smugglers have moved on to new methods.

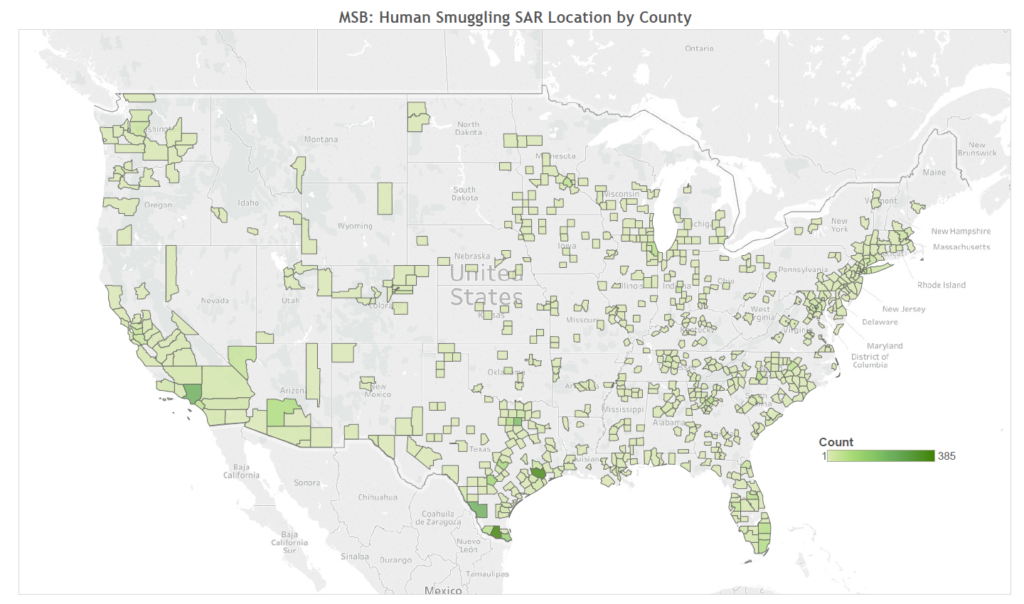

The geographic concentration of Smuggling SARs may point to a gap in financial institutions’ understanding of the complex nature of migrant smuggling. A recent study on corruption in the US Border Patrol found that 30% of the incidents took place at either the US/Canadian border or at US airports. Financial institutions need to keep in mind that US migrant smuggling also occurs via air or sea, and not necessarily at the southwest border.

Human Smuggling Payments & Financial Institutions

Alison Jimenez also wrote an article on human smuggling and anti money laundering obligations for financial institutions published by ThomsonReuters.

Migrant Smuggling: What Financial Institutions Need to Know | Legal Executive Institute

Pre-paid cards, digital payment methods, and virtual currencies offer new ways for smugglers to conduct their business. Financial institutions need to incorporate these new payment systems into their Migrant Smuggling detection scenarios.

Similarly, banks should consider including social media monitoring into detection scenarios as well because smugglers have adapted well to this technology.