The Tampa Bay Business Journal published an article titled “Financial crimes experts get in the weeds over marijuana banking services” by Margie Manning. DSA president, Alison Jimenez, was quoted several times about the challenges that financial institutions have dealing with state-legalized marijuana businesses.

The financial institutions often find themselves facing a Catch-22 situation, whether or not they provide services to marijuana companies and ancillary businesses, said Alison Jimenez, president and founder of Dynamic Securities Analytics Inc., an anti-money laundering consulting firm in Tampa.

While most banks do not publicly acknowledge they do business with marijuana companies there are about 300 financial institutions nationally that have filed reports with financial regulators indicating they have some type of relationship with those companies. This comment comes from Steven Kemmerling, the founder of MRB Monitor, a consulting firm that advises financial institutions about handling marijuana related businesses. This means that these institutions are acting in a strange duality with the system that is currently in place.

Read more about marijuana banking, anti-money laundering laws and suspicious activity reports below:

American Banker op-ed on Marijuana Banking

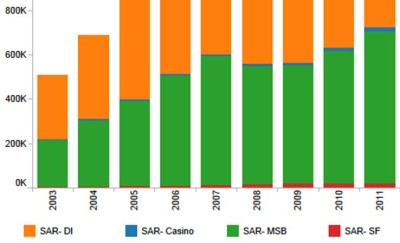

Marijuana SAR Data has International Implications

Securities Brokers have relatively open arms to marijuana businesses