By Alison Jimenez, Dynamic Securities Analytics, Inc. and Steven Kemmerling, MRB Monitor

Securities Brokers Engaging with Marijuana Businesses

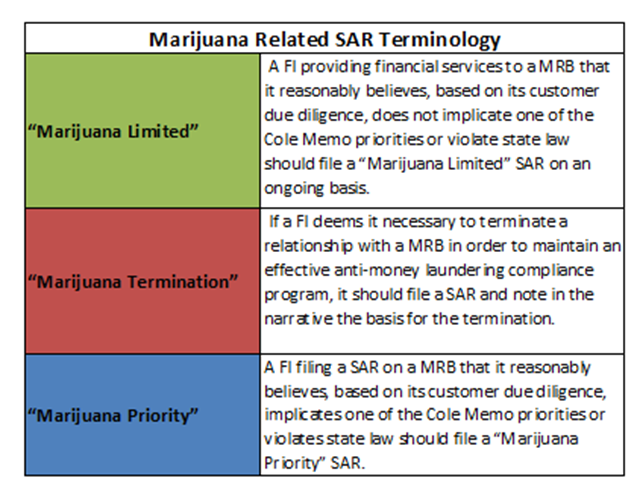

Forty-one securities brokers filed Suspicious Activity Reports (“SARs”) regarding Marijuana Related Businesses from February 2014 through July 1, 2015. The count includes securities firms that terminated marijuana accounts. Securities brokers accounted for 8% of the financial institutions filing marijuana SARs. The marijuana-related SAR data was provided to Dynamic Securities Analytics (“DSA”) by FinCEN per a FIOA request.

SEC Regulated Financial Institutions

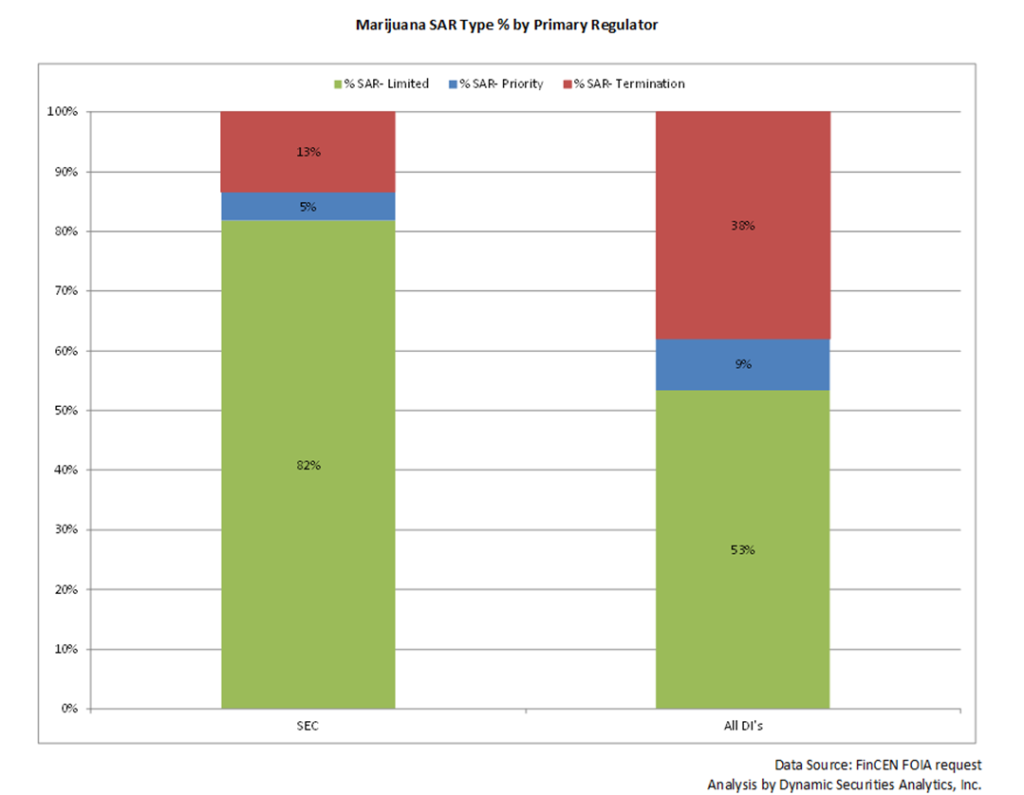

We analyzed marijuana SAR filings by financial institutions (“FIs”) whose primary regulator is the SEC (i.e., broker/dealers, investment advisors, stock exchanges, and mutual funds). Our analysis found that SEC-regulated financial institutions:

- On average filed 5.5 marijuana related SARs versus 11 on average filed by Depository Institutions (among FIs filing marijuana SARs)

- Had a significantly greater percentage of Limited (82%) filings compared to Depository Institutions (53%). Read more about Depository Institutions in the related blog post New Marijuana Banking SAR Data has International Implications.

- Had the lowest percentage of Priority and Terminations SARs (18% combined) filings compared to the other financial institution types (47%)

- The most stark contrast was with OCC-supervised national banks, which filed 74% Termination SARs and only 20% Limited SARs

In summary, these numbers seem to indicate a greater willingness by SEC-regulated FIs to work with and service marijuana-related businesses compared to FIs supervised by other federal regulators.

Marijuana Related Securities

The Wall Street Journal reported that the SEC allowed share registration for a company “whose business model includes the cultivation and sale of marijuana.” Furthermore, the Marijuana Index, which tracks listed companies in the marijuana sector, includes 150 companies in its Global Composite Constituents Index with a combined market value of $5.6 billion. The SEC also released an Investor Alert regarding Marijuana Related Investments.