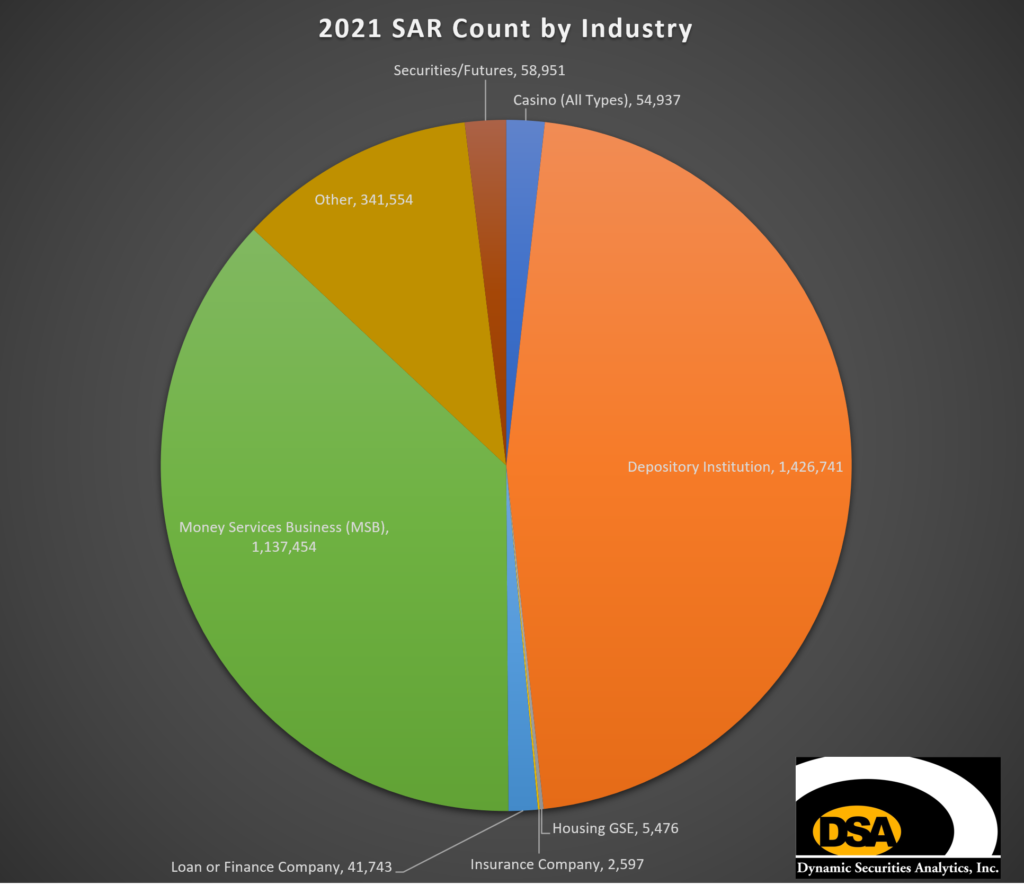

The Wall Street Journal‘s Morning Risk Report features DSA‘s finding that in 2021, San Francisco-based crypto exchanges filed more Suspicious Activity Reports (‘SARs’) than all securities firms, insurance companies, and casinos nationwide combined.

The article by Mengqi Sun also noted DSA president, Alison Jimenez‘, concern that the current SAR form may not be adequate:

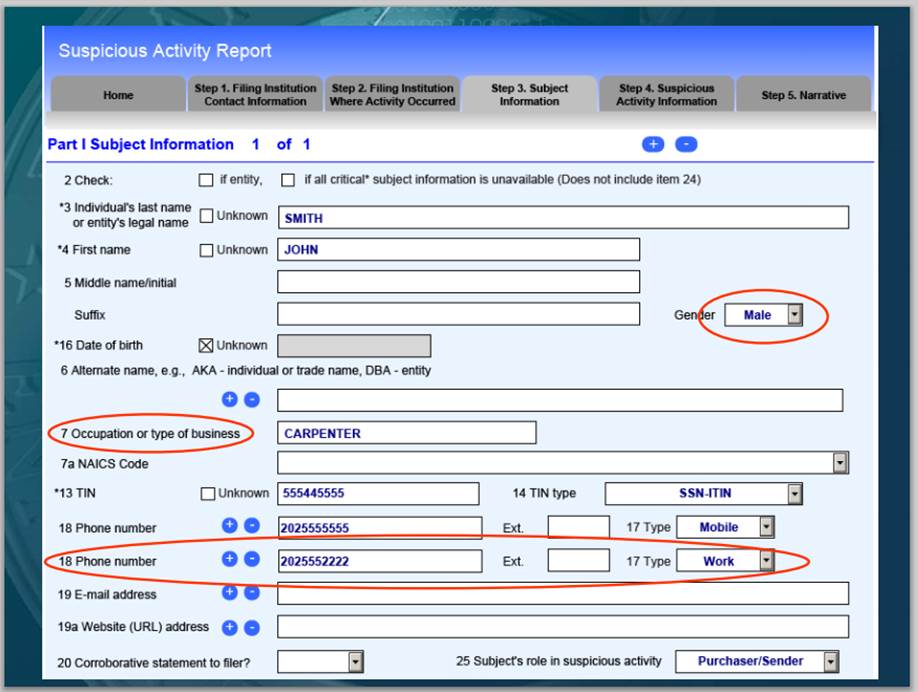

The surge of SAR filings by crypto exchanges suggests more exchanges are setting up compliance processes and reporting possible illicit transactions, she said. But to learn more and to better understand the extent of suspicious transactions involving cryptocurrency and the quality of the filings, the SAR filing forms might need to be updated to add a separate category for crypto, she said.

Alison Jimenez quoted in “Surge in Suspicious Activity Reports Likely Linked to Crypto Exchanges, Report Says”, WSJ, Feb 9, 2022.

Cryptocurrency Exchange Suspicious Activity Reports

Read DSA’s full report at: 2021 Cryptocurrency Exchange Suspicious Activity Reports.

The full report covers additional topics including: the top three suspicious activity categories, categories with few SARs, and the usefulness or unusefulness of the current Suspicious Activity Reporting form methodology to law enforcement.

Want more insights into cryptocurrency or crypto exchange SARs?

See DSA’s other analysis:

Watch: 2021 SAR Insights – Cryptocurrency Exchange SARs

3 Common Misconceptions about Cryptocurrency Crime Estimates.