The overwhelming majority of laundered funds originate from income tax evasion, yet there is no corresponding SAR category.

FinCEN

37 posts

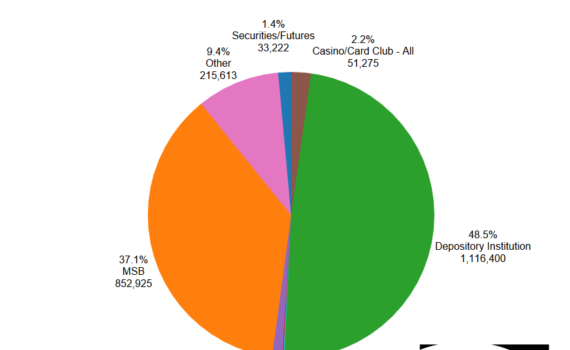

2,301,163 SARs were filed in 2019 which is an increase of 6% from 2018 levels. Depository Institutions filed 48% of all SARs, MSBs accounted for 37% and Securities/Futures filed 9%.

FinCEN recently released stats on the 314(a) information request program. FinCEN stated that over 16,000 […]

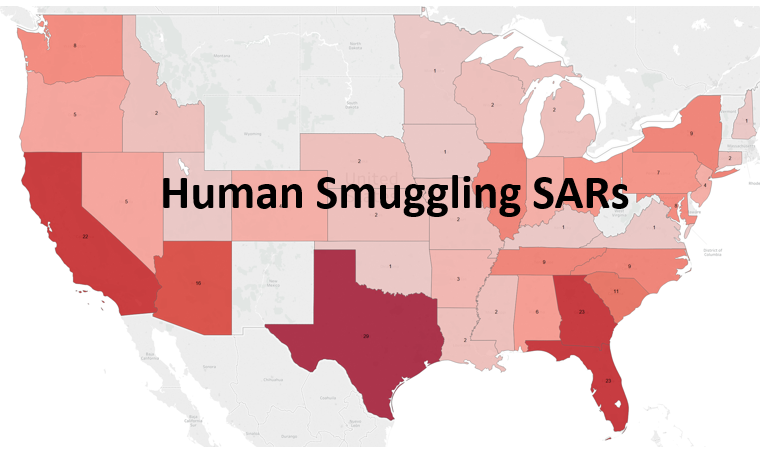

Dynamic Securities Analytics, Inc (‘DSA’) analyzed a FinCEN report which provided data on Suspicious Activity Reports (‘SARs’) […]

Alison Jimenez, president of Dynamic Securities Analytics, was quoted in a recent Association of Certified […]

Dynamic Securities Analytics, Inc. analyzed 2017 SAR-SF filings from FinCEN’s SAR Stats to identify filing […]

Alison Jimenez will be a featured speaker at the Digital Finance Institute’s #FinTech2017 conference in […]