The Marijuana Businesses Access to Banking Act of 2015 bill’s stated purpose is:

to create protections for depository institutions that provide financial services to marijuana-related businesses, and for other purposes.

A press release by one of the co-sponsors, Senator Jeff Merkley (D-OR), points out the following:

“Forcing businessmen and businesswomen who are operating legally under Oregon state law to shuttle around gym bags full of cash is an invitation to crime and malfeasance. That must end,” said Merkley. “The people of Oregon have spoken, and the federal government should make sure that legal marijuana businesses can operate properly within our banking system. It’s time to let banks serve these legal businesses without fearing devastating reprisals from the federal government.”

Key provisions of the proposed bill include:

Preventing federal banking regulators from:

- Prohibiting, penalizing or discouraging a bank from providing financial services to a legitimate state-sanctioned and regulated marijuana business;

- Terminating or limiting a bank’s federal deposit insurance solely because the bank is providing services to a state-sanctioned marijuana business;

- Recommending or incentivizing a bank to halt or downgrade providing any kind of banking services to these businesses; or

- Taking any action on a loan to an owner or operator of a marijuana-related business.

The Marijuana Businesses Access to Banking Act of 2015 bill also creates a safe harbor from criminal prosecution and liability and asset forfeiture for banks and their officers and employees who provide financial services to legitimate, state-sanctioned marijuana businesses, while maintaining banks’ right to choose not to offer those services.

Financial Services Needed to Run a Business

While the bill attempts to fix the cash-intensive nature of legalized marijuana related businesses (“MRB”) by opening access to banking, it does not address other types of financial services commonly used by businesses.

Imagine a local bakery. The bakery will have a checking account, a business credit card, insurance and maybe even an employee retirement plan. The proposed legislation only addresses the checking account issue.

Where does this leave Other Financial Services Providers?

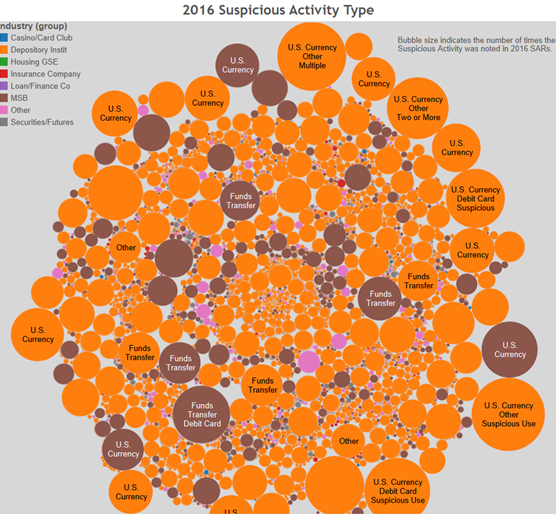

The bill’s safe harbor for banks does not apply to other financial institutions. DSA previously reported that 37 broker/dealers, 10 MSBs, 4 insurance companies and 2 casinos had filed Marijuana-related SARs. Broker/dealers are regulated by the SEC which is a federal regulator (but not named specifically in the House bill) and by Finra, an self-regulatory organization. Broker/dealers would likely still be wary to open a retirement account for a MRB if this bill is passed. Will Money Services Businesses be willing to cash checks from MRBs? Will insurance companies be willing to cover property owned by an MRB? Furthermore, the safe harbor and asset forfeiture protection do not apply to the “legitimate, state-sanctioned marijuana businesses” themselves. Would a bank be willing to lend to an MRB when the MRB’s assets could be seized at any moment?

Unintended Monopoly?

The bill could be interpreted to give Depository Institutions a monopoly on providing financial services to MRBs since the language is narrowly tailored to banks and their regulators. There is significant overlap between financial services offered by depository institutions and non-banks such as check-cashing and mortgage lending, however only depository institutions are addressed in the bill. The uneven playing field would put brokerage firms, insurance companies, and money services businesses at a steep competitive disadvantage to banks in the $2.7billion legalized marijuana marketplace.