ACAMS Today published an article authored by DSA president, Alison Jimenez, titled “Banks, Human Trafficking and P2P Payments” as part of Human Trafficking Awareness Month.

The article discusses:

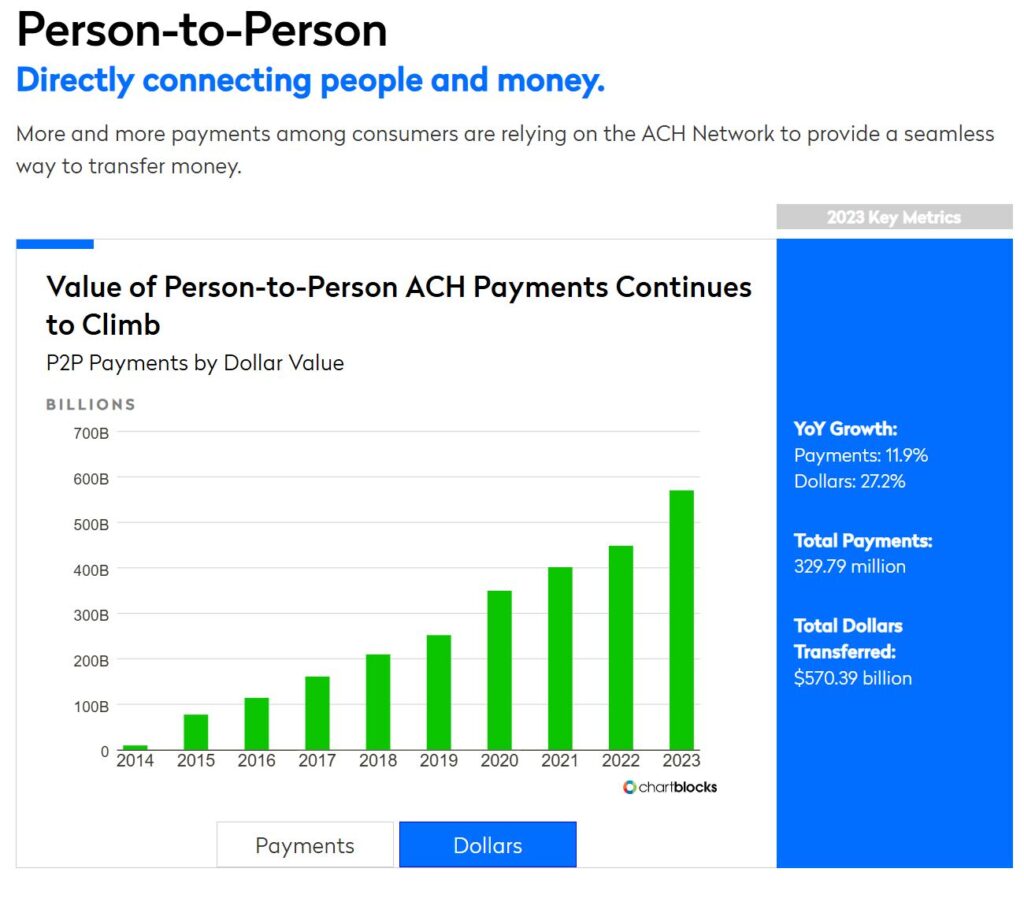

- The interactions between banks and P2P transactions

- Re-evaluating bank product risk assessments in light of P2P transactions flowing through certain rails

- Case study from the recent FinCEN enforcement action against TD Bank highlighting human trafficking & P2P

- Bank-facing P2P human trafficking red flags

- Transaction monitoring of P2P transactions by banks

P2P payment methods have been enthusiastically adopted by consumers—and by perpetrators of Human Trafficking. Financial institutions may face exposure by rotely applying traditional transaction monitoring and risk assessments without accounting for the evolving use of ACH, debit cards and card networks in P2P payments.

By understanding the touch points of P2P payments within a bank, and by specifically and appropriately monitoring for unusual P2P transactions, banks can help turn the tide against Human Trafficking facilitated by emerging payments.