Summary: The portion of law enforcement 314(a) requests involving money laundering has increased in recent years, while the portion involving terrorism has fallen. Federal law enforcement composes the bulk of requesters. FinCEN reports stale law enforcement feedback data. An estimated 50,000 subjects have been named in 314(a) requests since inception.

What is 314(a)?

314(a) is a tool used by law enforcement to locate financial assets and recent transactions by subjects of criminal investigations. Certain financial institutions are required to search their records and identify if they have responsive information with respect to a particular investigative subject.

Per FinCEN:

“Through an expedited communication system, FinCEN’s 314(a) process enables an investigator to canvas the nation’s financial institutions for potential lead information that might otherwise never been uncovered.”

Law Enforcement Assurances

FinCEN acts as the middleman between state, federal, local and European Union law enforcement and financial institutions. FinCEN requires law enforcement to provide assurances that the request has been subject to appropriate scrutiny at the agency level and that the matter under investigation satisfies FinCEN’s standards for processing a request.

Law enforcement must certify that the investigation is based on credible evidence of money laundering or terrorist finance. FinCEN may also, on its own behalf and on behalf of other components of Treasury submit 314(a) requests.

Law enforcement must document the magnitude or impact of the case, the seriousness of the underlying criminal activity, the importance of the case to a major agency program, or other fact demonstrating its importance.

Exhausted Traditional Means?

The 2018 and 2019, FinCEN 314(a) Fact Sheets also includes this paragraph:

“In addition, law enforcement must certify in cases involving money laundering that all traditional means of investigation have been exhausted. The support for the assertion that other investigative alternatives have been exhausted or are unavailable must be provided in the form submitted to FinCEN for review prior to the request being provided to financial institutions by FinCEN.”

The most recent FinCEN 314(a) Fact Sheet released on February 7, 2023 (apparently updated on 2/21/23) and the 2020 Fact Sheet do not include the statement that “all traditional means of investigation have been exhausted”.

Evolution of 314(a) Law Enforcement Use

Law Enforcement Requesters: Federal, State/Local and International

As originally implemented by FinCEN, 314(a) was limited to federal law enforcement agencies investigating criminal cases. In 2010, FinCEN updated its Final Rule on 314(a) to expand its use to state, local and select foreign law enforcement agencies.

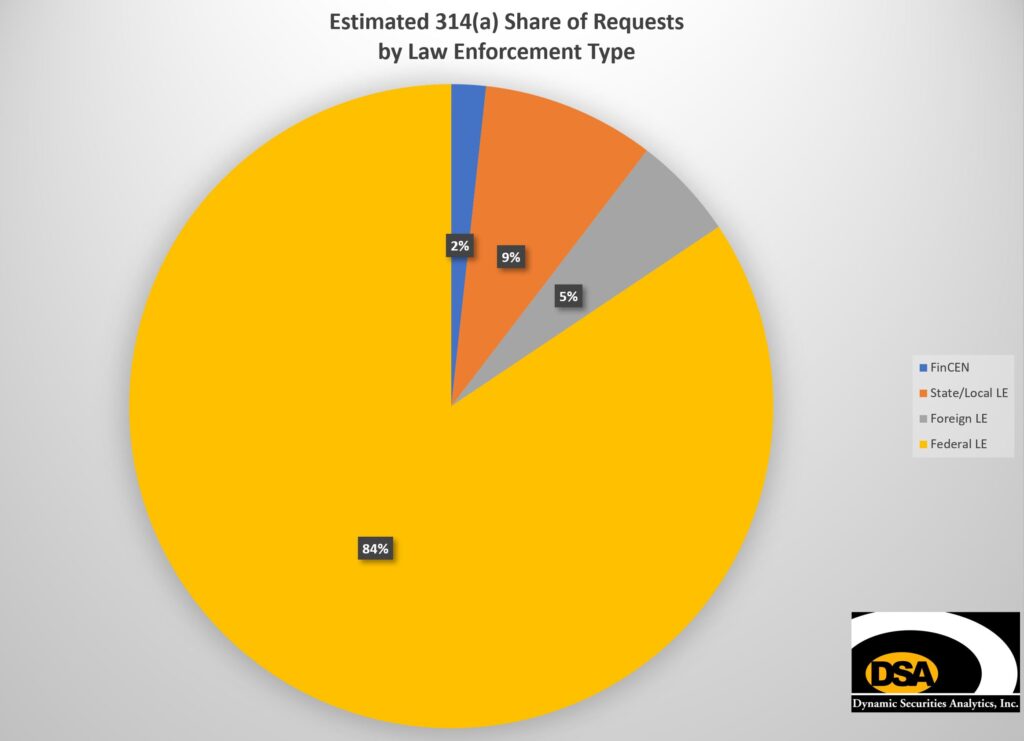

A 2019 FinCEN 314(a) renewal document estimated that 50 requests per year were from state/local law enforcement. I calculated that 577 requests were filed between 1/16/18 and 2/26/19. Using that as a baseline, I estimate the state/local law enforcement account for 8.7% of 314(a) requests, foreign law enforcement 5.2% and Federal law enforcement 84.4%.

Cases Types & Law Enforcement 314(a) Requests

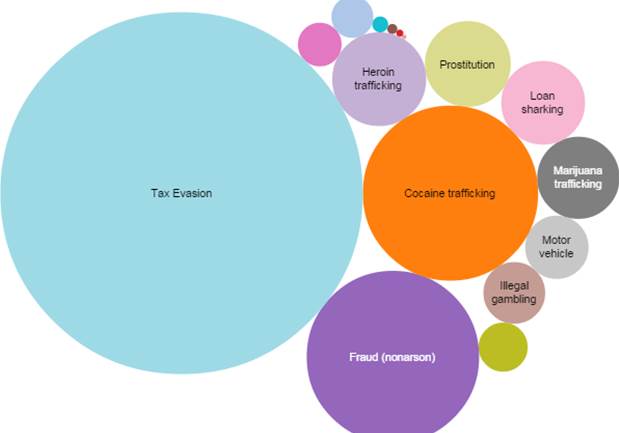

FinCEN broadly classifies Law Enforcement 314(a) information requests into Money Laundering or Terrorism/Terrorist Financing categories. While Terrorism is pretty straightforward, Money Laundering encompasses a wide range of underlying activities. FinCEN does not provide additional detail as to the predicate crimes comprising the Money Laundering category, such as Drug Trafficking, Ransomware or Healthcare Fraud.

Terrorism/Terrorist Financing 314(a) Requests

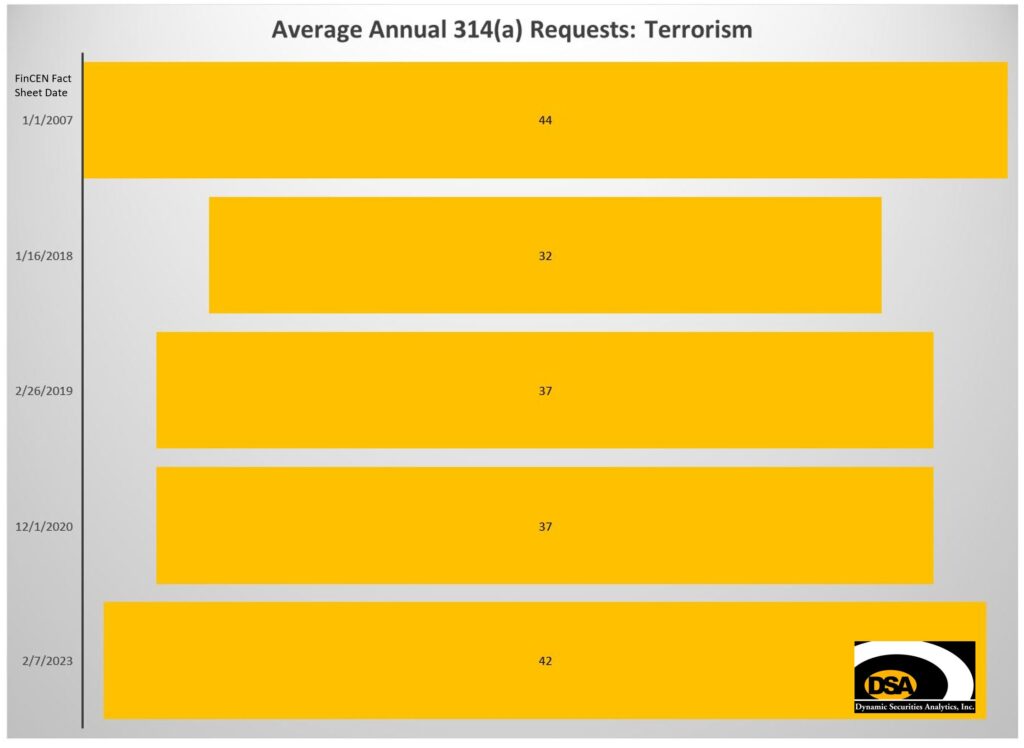

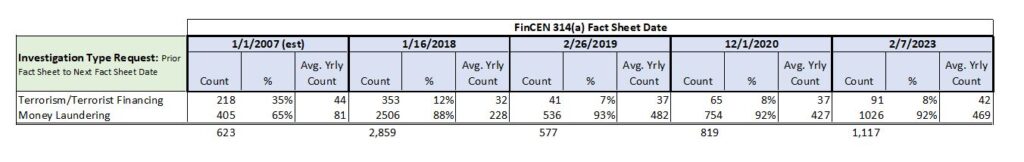

The share of Terrorism/Terrorist Financing 314(a) requests was at its highest level in 2007, accounting for 35% of requests. Between December 2020 and February 2023, only 8% of 314(a) requests were classified as Terrorism-related.

However, the number of Terrorism 314(a) requests filed each year has held remarkably steady. For example, I determined from the 2007 FinCEN data that there were on average 44 Terrorism 314(a) requests per year. While the most recent Fact Sheet suggests that between December 2020 – February 2023 there were 42 request per year.

Money Laundering 314(a) Requests

The expansion of law enforcement users beyond solely Federal law enforcement may partially explain the shift towards a larger share of requests involving Money Laundering. However, that is unlikely to explain all of the shift.

Using the most recent Fact Sheet data, Money Laundering accounted for 92% of 314(a) requests from 2020 through February 7, 2023. Money Laundering accounted for 65% of requests from 2002 through 2007.

The number of Money Laundering requests has also increased significantly from 2007 levels. I calculated that there were on average 469 Money Laundering requests each year using the latest data, versus 81 yearly requests per 2007 data.

Estimated 50,000 Subjects Have be Named in all 314(a) Requests

Each 314(a) request will likely list multiple subjects. For example, 314(a) Tracking Number 400363 transmitted on 2/7/23 had 60 subjects and Tracking Number 304221 transmitted on 8/24/2021 named 123 subjects.

I found that 8.3 subjects on average were named in requests from early 2021 through February 2023. If each of FinCEN’s 6,009 “processed requests” had 8.3 subjects, then just under 50,000 subjects will have been named in 314(a) requests since inception of the program.

Stale Law Enforcement 314(a) Feedback

The 2018, 2019, 2020 and 2023 Fact Sheets all included the exact same figures “derived from feedback FinCEN received from law enforcement requesters who have utilized the 314(a) Program”:

10 – New Account Identified per request

47 – New Transactions Identified per request

10 – Follow up initiatives taken by Law Enforcement with Financial Institutions per request

It is unlikely that over the course of five years (2018 – 2022) that the number of accounts, transactions, and follow-up initiatives held exactly steady.

So what’s going on?

The Treasury OIG reported that FinCEN has “implemented a minimum waiting period of 18 months before surveying law enforcement” with questions related to 314(a). It was less than 18 months between the 2018 and 2019 314(a) Fact Sheets, so the unchanged data is understandable. However, the same feedback numbers were reported in February 2023 as in January 2019. This leads me to conclude that the “minimum” of 18 months between surveys is long past and no new survey has been conducted.

Want more Insights into FinCEN Data?

FinCEN Reports Increased 314(b) Info Sharing. DSA Finds Room for Improvement.

Cryptocurrency SARs: What do we Know?

Dynamic Securities Analytics, Inc. provides litigation consulting to help clients successfully navigate disputes involving securities, cryptocurrency, and money laundering.