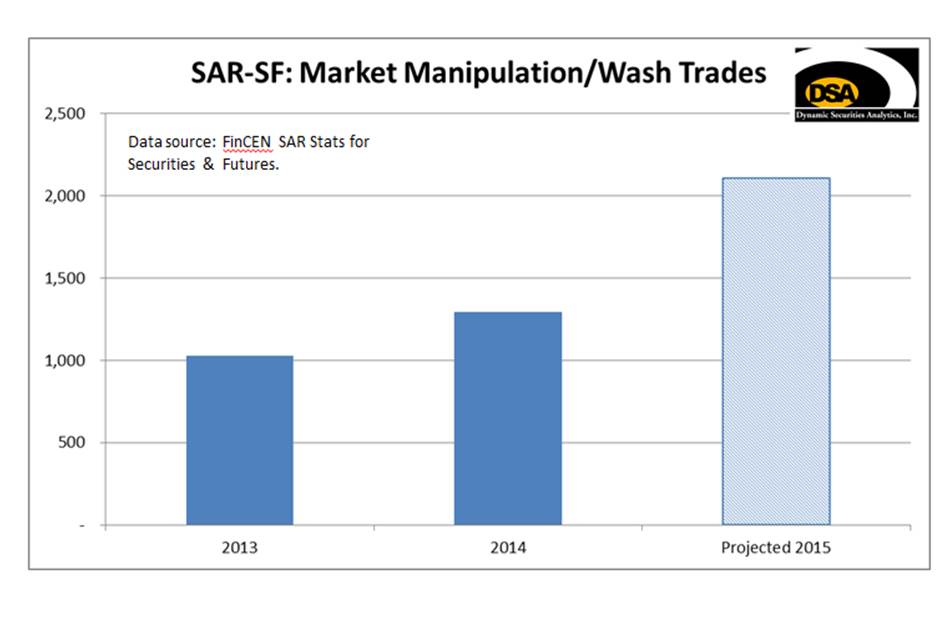

On April 22nd, 2015 FinCEN released In Focus: SAR Stats (April 2015). Dynamic Securities Analytics, Inc. (“DSA“) analyzed the new Suspicious Activity Report-Securities/Futures (“SAR-SF”) data and found that Market Manipulation/Wash Trades SARs have increased 63% from 2014 and 105% from 2013 levels (on a quarterly basis)*.

Penny stocks/microcap securities also saw a spike in SAR-SF product type, up 87% from 2014 levels. The SAR filing increases for market manipulation and penny stocks may be related in that penny stocks are often the target of market manipulation schemes.

Other Key Findings:

- Financial services companies may be making some ground in the battle against cyber-crime. Account takeover is down 21%, identity theft is down 16% and unauthorized electronic intrusion is down 30%.

- Firms are taking Insider Threats seriously as demonstrated by the 39% increase in SAR filings against employees. DSA president, Alison Jimenez, will be presenting “Spotting and Removing Problem Employees” for an upcoming Association of Certified Anti-Money Laundering Specialists webinar. Read more about employee due diligence here.

- It appears that the worst of the mortgage fraud days are in the past. All types of mortgage related suspicious activity saw large decreases.

- Reporting of casino related SAR-SF saw the largest increase of any category over 2014 levels with an increase of 1,425% for Casino-Other SARs.

- Total 1Q15 SAR-SF filings are on pace with the 2014 number of filings. Keep in mind that 2014 saw a 45% increase in SAR-SFs over 2013.

* FinCEN instituted a new SAR form in 2012 which makes comparing earlier periods difficult.