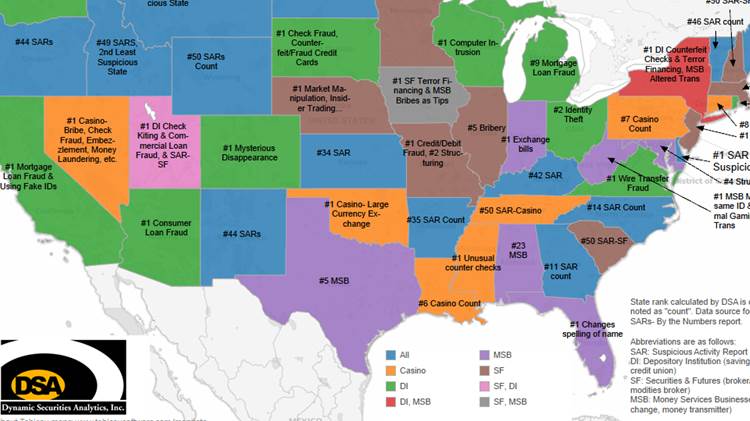

If you gauge suspicious activity by the Financial Crimes Enforcement Network’s (FinCEN) “By the Numbers” report on the Securities & Futures Industries, then yes. By FinCEN’s tally, Nebraska accounted for 7.31% of all SAR-SF filings from January 1, 2003 through June 30, 2008. Three states had higher counts (New York, Massachusetts & California) but Nebraska is the clear winner of SAR-SF filings on a per capita basis Download SAR-SF per capita .

Comparison with other States

- Nebraska filed 82% more SAR-SFs per capita compared to its next closest competitor, Massachusetts

- Nebraska filed 3.7 times as many SAR-SFs per capita as did New York

- Nebraska recorded 185 SAR-SFs for every 100,000 residents whiled Florida filed just 6.4 per 100,000 in residents

How can this be so?

According to a FinCEN spokesman, Steve Hudak, the “By the Numbers” filings are recorded by the location of the branch where the suspicious activity occurred. Hudak continued that if the branch information is left blank, the reporting institution’s headquarter location is used instead. Reporting by institution headquarter location biases the state results especially in the cases of an on-line brokers, a mutual fund companies or a clearing firms.

In the case of Nebraska, Omaha is home to Legent, a top clearing firm and to TD Ameritrade, one of the nation’s largest on-line brokerages. The headquarters of a large clearing firm and large on-line broker/dealer in a low population state result in Nebraska documenting the highest per capita SAR-SF filing rate.

The inverse also holds true.

Florida is not home to a major mutual fund company, on-line brokerage or clearing firm. Florida ranks 11th in the nation in the number of SAR-SFs filed and 15th on a per capita basis. Floridians are no angels as witnessed by the state’s #1 spot in mortgage fraud yet the Sunshine state trails in securities related SAR filings. This is because a large share of the suspicious activity undertaken by Floridians is being recorded in another state’s column.

Some securities transactions involve as many as three locations:

1) the location of the suspicious person initiating the activity (let’s say Illinois)

2) the branch location of his broker/dealer (ex. an online brokerage based out of Ft. Lauderdale, Florida)

3) the location of the clearing firm or home office (for instance, Nebraska).

Why is the branch location the state chosen for the “By the Numbers” report? Why not the clearing firm/home office location or the location of the suspicious person? All three locations are important and FinCEN should produce the “By the Numbers” report reflecting all three.

Why is this important?

The current methodology is not useful or even worse, provides misleading information. The chief securities regulator for Florida could not use FinCEN’s report to justify a request for more examiners and a state legislator in Nebraska might think the state was awash with securities scammers. When FinCEN prepares and disseminates the report, it should be useful and reflect reality. The public, regulators, government officials, law enforcement, and compliance professionals rely on this data to make important decisions and they should have confidence in its accuracy.