EB-5 projects expose financial institutions to risks ranging from Ponzi schemes, fraud, OFAC violations to challenging KYC/CIP issues.

DSA president, Alison Jimenez, was interviewed by ABC news for a story on the EB-5 Immigrant Investor program. The EB-5 program allows immigrant investors to apply for permanent residence if they make an investment of $500,000 in a commercial enterprise that creates or preserves 10 jobs for US workers. The EB-5 program is the US-equivalent of the EU’s “Golden Visa“.

Ms. Jimenez highlighted how EB-5 programs and related individuals have been the subject of numerous SEC enforcement actions.

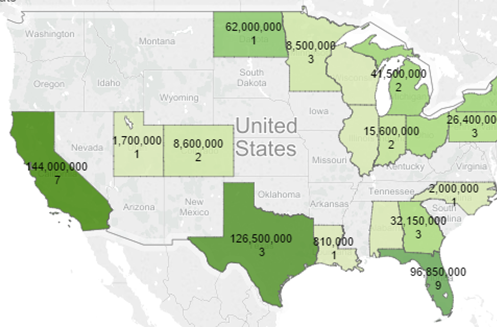

“The SEC has filed over 32 different enforcement actions since 2013. Specifically over EB-5 programs,” she said.

Jimenez said some EB-5 projects have even risen to the level of being a ponzi scheme.

Fraud, Ponzi, and Money Laundering Issues in EB-5

- Unknown or illicit source of funds for immigrant investors. In one instance, the DOJ alleged an investor earned the funds used for the EB-5 from a sanctioned Chinese coal company alleged to have laundered money for North Korea. In another, the DOJ alleged that the funds were stolen.

- CIP/KYC issues for banks. Immigrant Investor funds are often pooled at Regional Centers- organizations (public or private) that sponsor investment projects for EB-5 investors. Does the bank know that the customer is a Regional Center? Does the bank understand that the account will be pooling money from overseas investors (Know Your Customer’s Customer)? Did the bank collect Beneficial Ownership information for the Regional Center?

- Funnel accounts to pool funds or hawala used to move money to the US for immigrant investors subject to currency controls in their native country. Historically, Chinese investors received 85% of EB-5 green cards. Chinese investors have found ways to move $500,000 to the US despite a $50,000 yearly cap placed on removing funds from China.

- Theft/Ponzi Schemes. Businesses that received the immigrant investor funds have diverted funds for other purposes and in several cases individuals involved used the funds for their personal benefit. A number of financial institutions banking EB-5 projects have been sued when the EB-5 project turned out to be Ponzi schemes.

- Conflicts of Interest. Undisclosed relationships between immigration attorneys and the commercial enterprises.Undisclosed commissions paid to individuals finding investors or “investments” refunded to investors with no jobs ever being created

Disincentive to Report Fraud

Finally, Immigrant Investors have a strong disincentive to report suspected fraud to authorities. If the commercial enterprise does not create the 10 required jobs due to fraud or theft, not only is the investor out of $500,000 but they also lose their chance at a green card.