FINRA added three new securities types: Variable Annuities, Derivative Securities and Auction Rate Securities to the Security Type list in 2008. Derivative Securities and Auction Rate Securities to the Security Type list in 2008. Derivative Securities was the second most frequently cited type of security in its first year on the list. Mutual funds moved ahead of Common Stock in 2008 as the most frequently cited security type in arbitrations. In fact, the number of arbitration filings that included Common Stock actually decreased 2% from 2007. “Annuities” also decreased by 3% but that was likely due to the fact that “Variable Annuities” received its own category. Filings regarding Corporate Bonds increased 130% over 2007.

You may also like

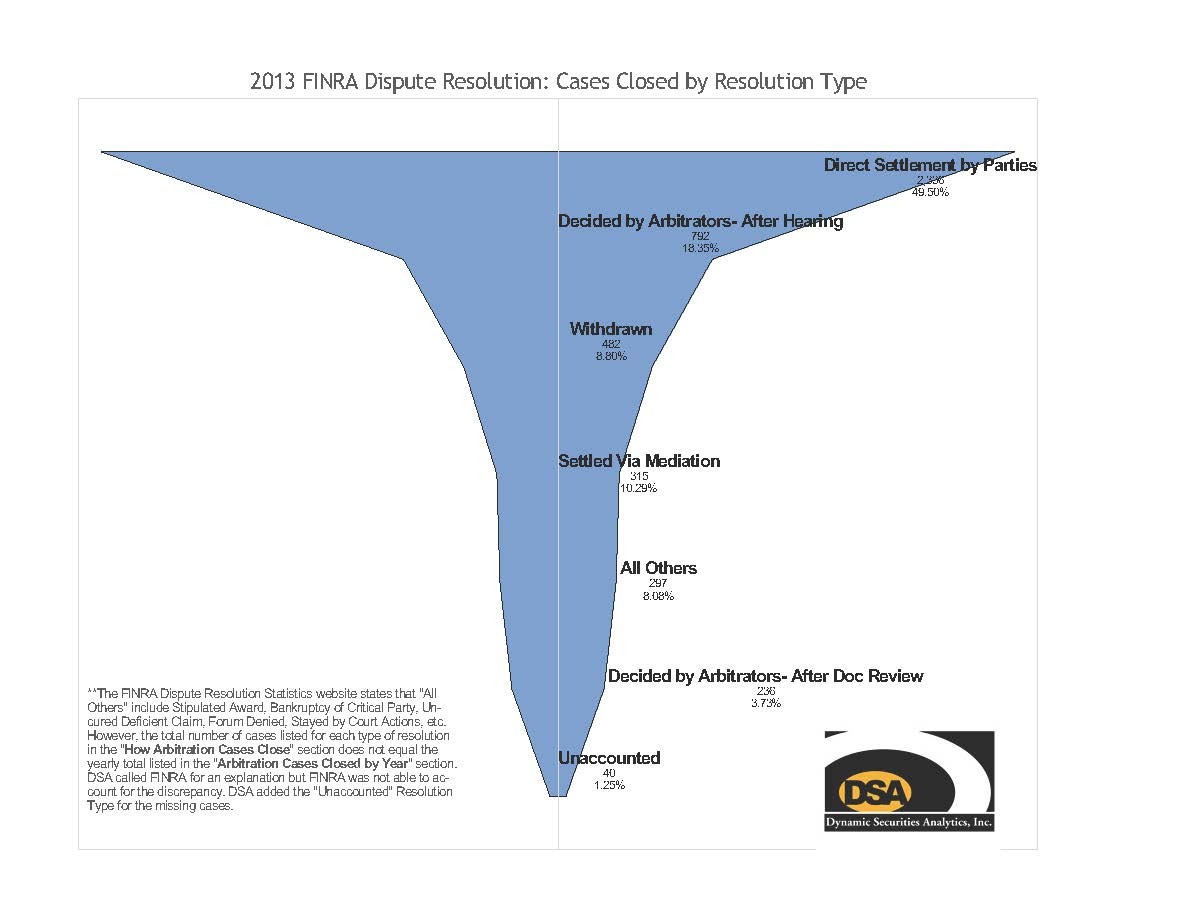

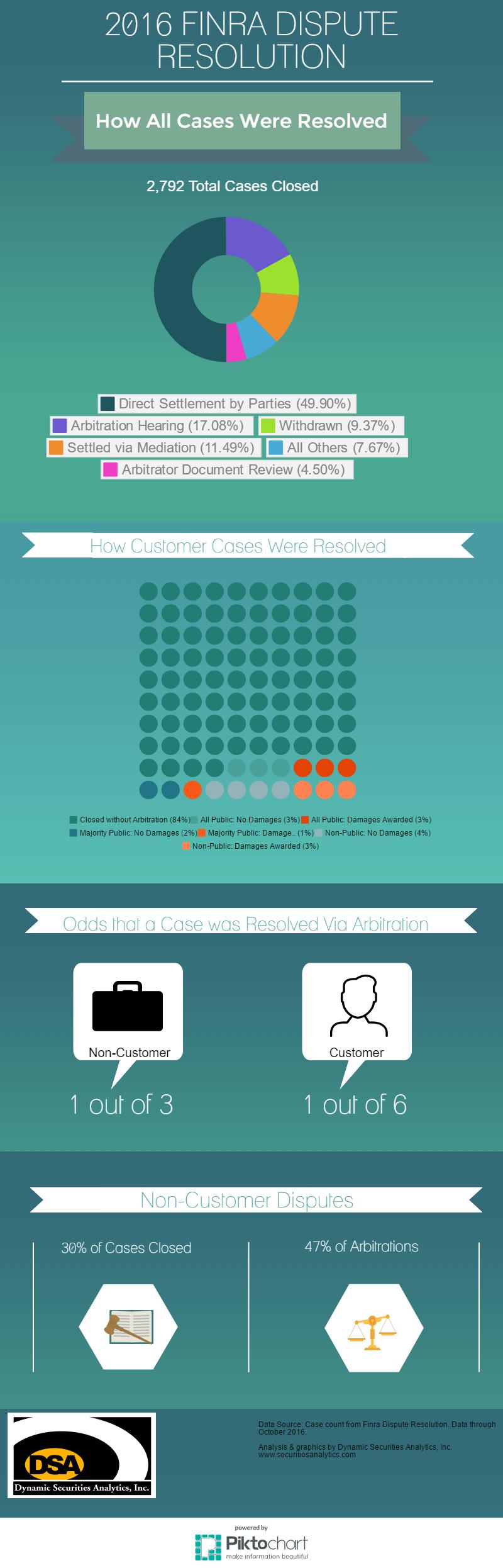

DSA analyzed how cases were closed through the FINRA dispute resolution process in 2013. Customer Cases FINRA reported that in 2013 there […]

FINRA arbitration isn’t just for customer disputes. As DSA found, over half of FINRA arbitrations are non-customer related. A large portion of […]

The media talks of the housing market collapse, the tightening credit market and the stock market collapse. At DSA, we’ve found investors that […]