This is the second article–Teen Sextortion Victim Payments– in a five-part series on the financial mechanisms of financially motivated sextortion of minors.

Read Part 1: Introduction to Financially Motivated Sextortion of Minors

Teen Access to Financial Products & Services

Teenagers have limited access to financial products and services. For example, teens can’t use financial products or services that require a contract binding signature by a legal adult. Generally, this is because a contract with a minor may not be legally enforceable.

However, teens are not completely shut out of the financial system. Instead, they rely on financial products that do not require a contract, like gift cards. Teens may also use accounts that are tied to adult’s “sponsor account” with the adult signing the contract. Finally, teens may use their parent’s account, with or without their parent’s permission.

What Do We Know About Teen Sextortion Victim Payments?

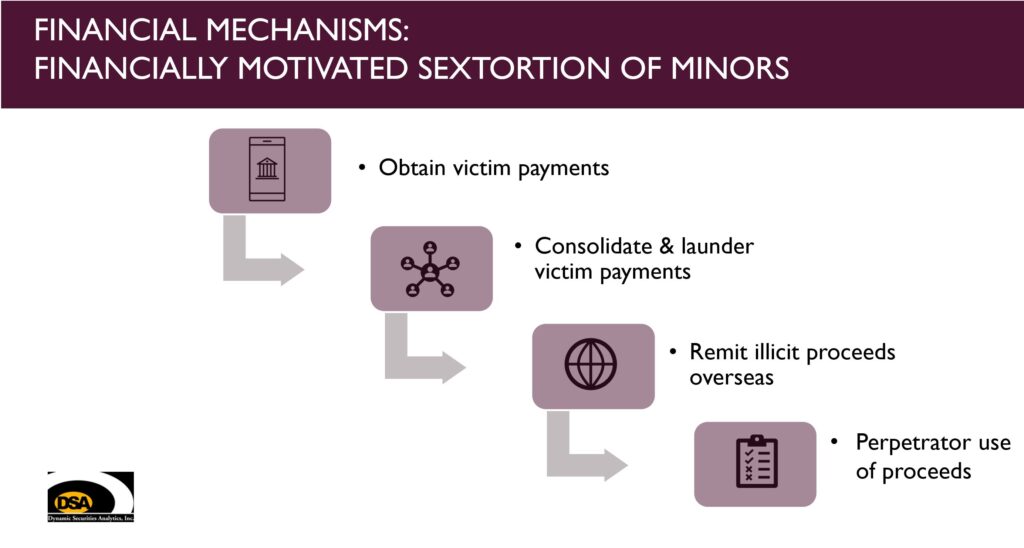

Teenage sextortion victims pay ransom to perpetrators to prevent the distribution of intimate images. This is the first step in the financial mechanisms of financially motivated sextortion of minors.

Teenage sextortion victims pay ransom to perpetrators to prevent the distribution of intimate images. This is the first step in the financial mechanisms of financially motivated sextortion of minors.

As discussed in Part 1: Introduction to Financially Motivated Sextortion of Minors, the young age of victims is key to understanding the financial mechanisms of this initial stage.

How Teen Victims of Sextortion Pay Ransom

Prior Work on Teen Sextortion Victim Payments

Thorn Study

Thorn in partnership with the National Center for Missing & Exploited Children (NCMEC) published a study in June 2024 titled Trends in Financial Sextortion. The Thorn study included a section on payment platforms mentioned in sextortion reports received by NCMEC.

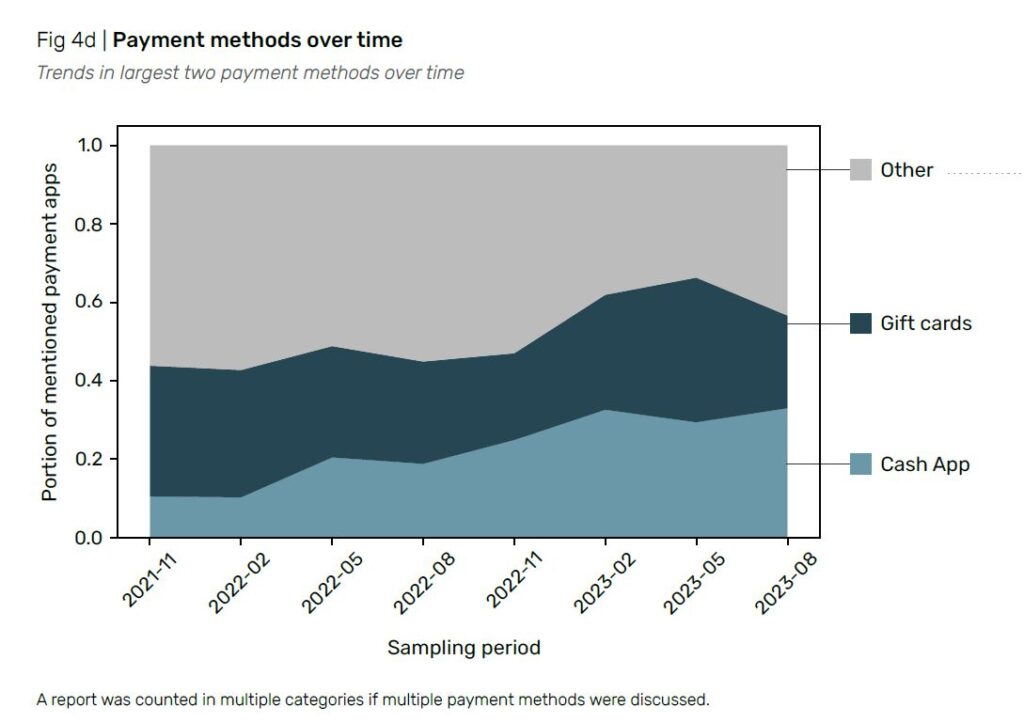

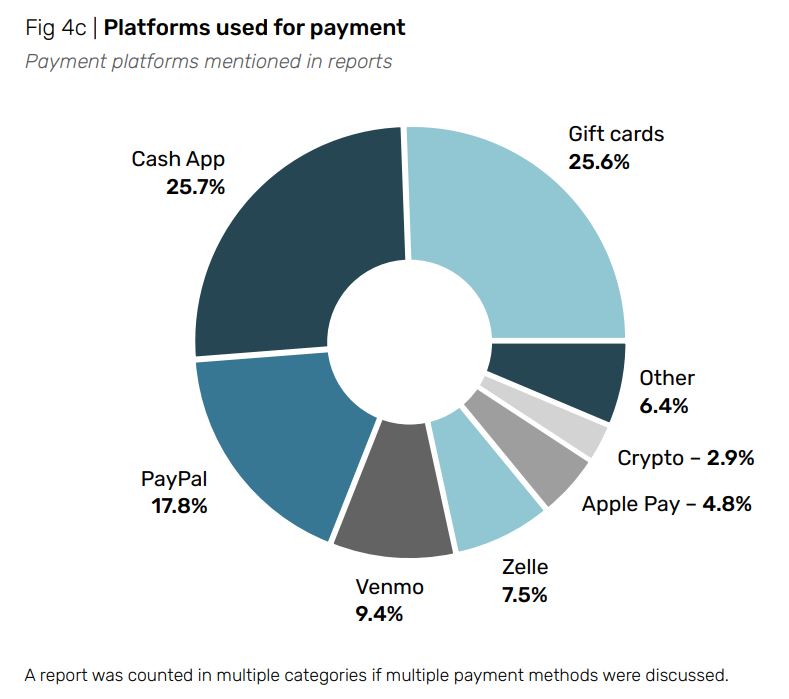

Thorn found that Cash App was the most frequently mentioned payment method from November 2021 through August 2023. In addition, Cash App grew as a percentage of total payment methods during that period.

Other leading sextortion payment methods included: gift cards 25.6%, PayPal 17.8%, Venmo 9.4%, Zelle 7.5%, Apple Pay 4.8%, and cryptocurrency at 2.9%. Notably, Venmo only began allowing teen accounts four months prior to the study end date.

C3P Study

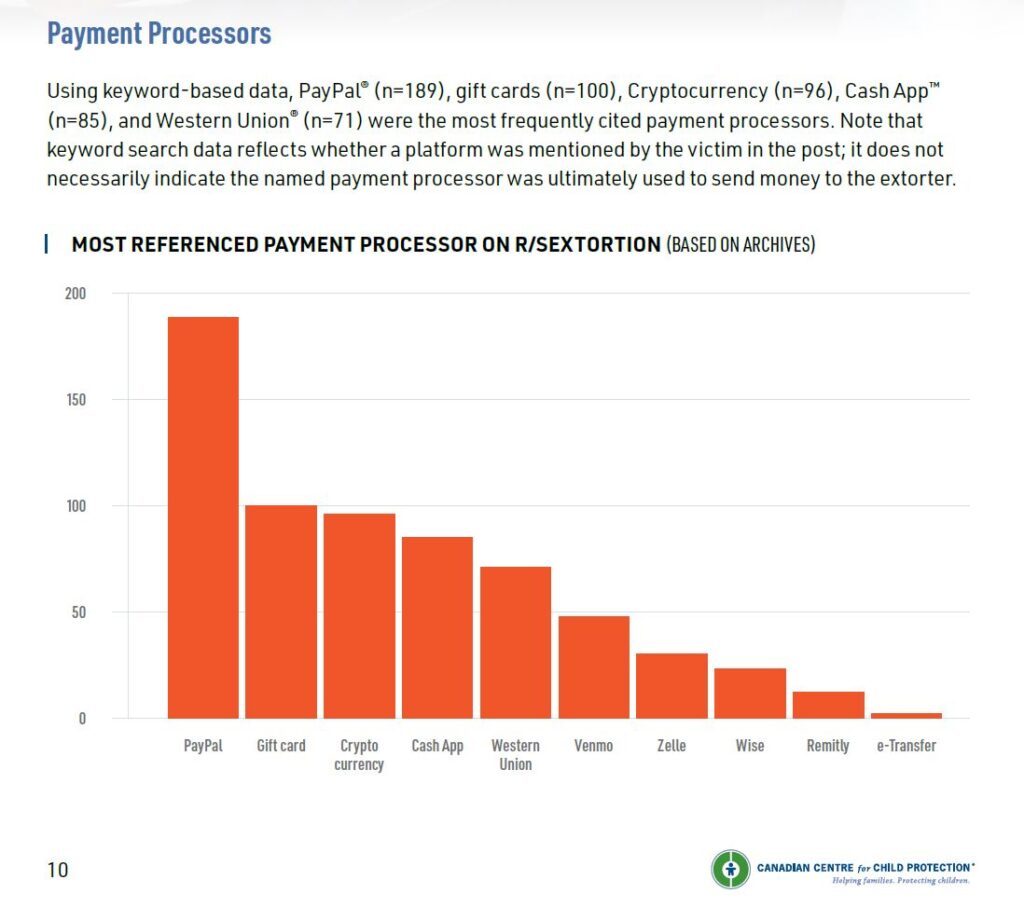

The Canadian Centre for Child Protection (‘C3P’) published “An Analysis of Financial Sextortion Victim Posts Published on R/Sextortion” in November 2022. The study analyzed reddit archives and victim narratives from July 2020 to September 2022 posted to r/sextortion.

The reddit sextortion forum is not limited solely to financially motivated sextortion of minors. Therefore, the payment methods mentioned include those made by victims over 18 years old who may have access to a wider variety of financial products and services. While in most cases victims did not provide their age, about 40% of those that did were under 18.

The C3P study found PayPal to be the most referenced payment processor on r/sextortion.

The differences between the Thorn and C3P findings may be due to:

- victim age and access to financial products,

- complaint timeframe with C3P covering an earlier period, before wide-spread adoption/disuse of certain financial products/services, and

- victim geographic location which impacts which financial products/services are available.

For example, money services business including Money Gram, Western Union and Remitly require U.S. users to be at least 18 years old and to be able to form legally binding contracts. The adult victims in the C3P study would have had easier access to these services as compared to teens.

Indictment Analysis

Scope of Indictments / Affidavits Analyzed

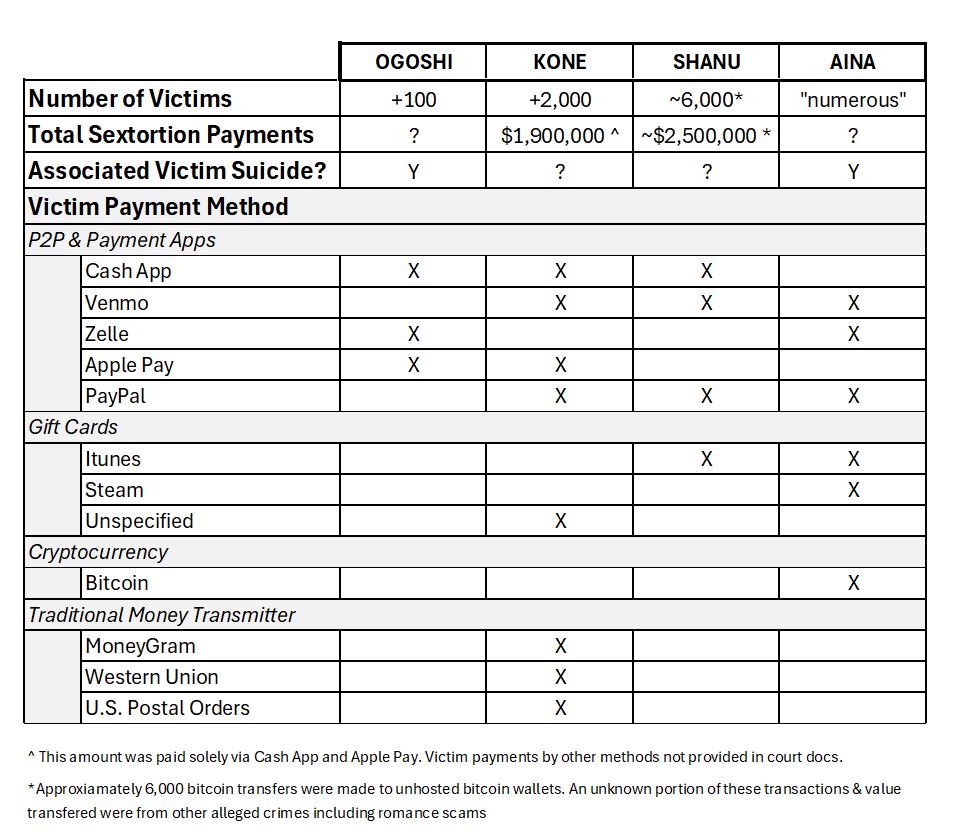

This analysis reviewed indictments and arrest warrant affidavits relating to four different alleged sextortion schemes referred to as: (1) OGOSHI, (2) KONE, (3) SHANU, and (4) AINA.[i]

These cases were selected because the alleged crimes fit the definition of Financially Motivated Sextortion of Minors as defined in Part 1 and court documents were available.

Each case has the following attributes:

- Victims who were minors, at least in part

- Multiple perpetrators involved in the scheme

- Leaders of the criminal organization were located overseas

- The use of the term “extortion” and/or “sextortion” in case documents

- The use of social media to initially contact victims

- Presence of actual victim payments and the identification of a payment method used.

The indictments/affidavits do not provide uniform data and present a clear need for agencies like the Department of Justice to release more comprehensive information to help minors and parents better appreciate the risks associated with financial products and services used by teens.

There are potentially other federal and state cases that were not identified due to a lack of transparency and/or a lack of classification as sextortion-related. Despite the small sample size, these four schemes were alleged to have had thousands of victims and earned the alleged perpetrators millions of dollars in illicit proceeds. Finally, as financially motivated sextortion of minors is a relatively new phenomenon and compounded by the difficulty in investigating these cases, the number of indictments may not be commensurate with the scope of the problem.

Variety of Teen Sextortion Victim Payment Methods Accepted

A striking variety of victim payment methods were detailed in the indictments and affidavits. This can be explained by understanding that the schemes are run by Transnational Criminal Organizations, employ professional money launders, crime-as-a-service providers, and/or advanced money laundering techniques.

The indictments and affidavits allege that perpetrators demanded / accepted ransom via P2P and payment apps, Zelle, gift cards, cryptocurrency, money transmitters (MSBs), and other means. While many types of payments were accepted, certain methods appear to be favored by sextortionists.

Teen Financial Access & Sextortion Victim Payments

While a wide variety of payment methods are accepted by perpetrators, certain methods are mentioned more frequently than others. The financial product’s features, teens’ access to the product, the regulatory environment, and international transferability are key to understanding why sextortionists prefer certain payment methods.

For example, adult victims of pig butchering are asked by the fraudster to send value primarily by cryptocurrency, or secondarily by wire. However, it is unlikely that a teenager would have access to a bank account capable of sending wires without the involvement of a parent.

Teens have access to P2P apps, payment apps, gift cards, bank accounts, and other financial products– and have made documented sextortion payments through these products and services.

P2P

Peer-To-Peer (‘P2P’) payment apps allows individuals to send value to another person who also uses the P2P app. P2P accounts are usually linked to a bank account or credit card to move funds on or off the P2P platform. P2P apps generally differ from a payment app in that funds are sent from an individual to another individual, as opposed from an individual to a business.

However, these distinctions are blurry.

Apps often incorporate both payment and P2P functions. For example, some businesses accept funds via P2P apps. In addition, certain transactions through an app may qualify an entity as a “money transmitter” while other transactions fall into exemptions for “third-party payment processors.”

A survey by Piper Sandler of teens found that Cash App ranked as the most preferred peer-to-peer money transfer app at 41%, followed closely by Venmo at 39%. The survey also found that Cash App only trailed Apple Pay in payment apps used in the last month.

CASH APP

Cash App was a first-mover offering P2P accounts for teenagers. Cash App announced P2P “sponsored” accounts for teens ages 13 to 17 in November 2021.

Cash App describes Sponsored Accounts as follows:

“If you are a parent or guardian with a verified Cash App account, you can invite someone between the ages of 13 and 17 to use Cash App and access features like P2P transactions (including recurring allowance payments), Cash App Card, Cash App Pay, direct deposit, Boost, bitcoin*, and stocks.

Once you sponsor their account, you become the legal owner of the sponsored account and the person you sponsor will be considered an authorized user of your sponsored account. Sponsors can track activity in the app, and turn specific features on/off. Sponsors may also cancel sponsorship at any time by contacting Cash App Support.”

Privacy

Cash App allows users to search for other users by phone number or email address. Cash App does not state that the search functionality for Teen Accounts is limited by default or appear to have parental controls related to search visibility.

Parental Notification

Cash App allows sponsors of teen accounts to:

- Review transactions (monthly statements)

- Receive real-time notifications, but sponsor will need to enable the alerts within the settings

Who Can Teens Send Money To?

Parents can block someone from transacting with the sponsored account. Other than that, Cash App does not appear to have parental controls to limit who a child may send/receive funds, for example only allowing transactions with existing contacts or family members.

Other Embedded Financial Products/Services

Cash App allows sponsors to turn Investing (stocks) features on/off. However, Cash App does not clearly state whether a sponsor can “turn off” bitcoin permissions separately from stock investing permissions.

Indictment / Affidavit Example

Cash App was mentioned in three of the four sextortion schemes reviewed.

For example, the KONE superseding indictment states:

“On or about December 5, 2020, DIAKITE received three separate e-mail messages from CashApp, each containing a notification of an incoming payment from V-7. The subject lines read, respectively, “[V-7] sent you $50 for blackmailing,” “[V-7] sent you $50 for blackmailing,” and “You accepted $50 from [V-7] for blackmailing.” Each of the three emails had, as an attachment, a screenshot showing a CashApp payment for $50 with V-7’s name, $50, and the text: “blackmailing”.

In response to the White House’s May 2024 Call to Action to Combat Image-Based Sexual Abuse, Cash App committed to expanding participation in industry groups and initiatives that support signal sharing to detect sextortion and limit payment services.

VENMO

Venmo began offering Venmo Teen Accounts in May 2023.

Privacy

Venmo incorporates social media-type interaction when users select to have their transactions publicly displayed. However, Teen Account transactions are set to private by default. This setting can be changed by the parent or guardian to Public or Friends Only.

By default, Venmo sets Teen Accounts as not searchable by name or username. Parents/guardians may change the search visibility settings. However, if a Teen Account accepts a user as a friend in Venmo, then the Teen Account will “populate in search” regardless of the search setting selected by the parent/guardian.

Parental Notification

Venmo states “the parent or guardian will be notified when a Teen Account sends or receives money and when the Teen Account adds any additional payment methods.”

Parents are notified via email about any activity taking place on the Venmo Teen Account without the need to adjust control settings.

Who Can Teens Send Money To?

While Venmo’s Teen Account FAQs states that teens can “send and receive Person-to-Person payments with friends and family” it appears that there are no parental controls or default settings to, in fact, limit P2P payments to friends and family.

Similar to Cash App, Veno allows parents to block another specific user so that the user “won’t be able to send or request any payments from your Teen Account, and they will not show up in your Teen Account’s Venmo network.”

Other Embedded Financial Products/Services

Venmo Teen Accounts can use the Venmo Teen Debit Card, Direct Deposit, and send and receive P2P payments. Teen Accounts cannot use Venmo’s Crypto features, sign up for Venmo Credit Cards, receive payment for goods & services, or create a Business or Charity Profile.

Indictment / Affidavit Example

In SHANU, the mother of Victim 1 (‘V1’) attempted to contact the individual to whom V1 sent his extortion payments. The Venmo profile to which V1 sent his payments was public so V1’s mother was able to determine the name and phone number of the recipient of funds. Investigators contacted the recipient, Victim 2 (‘V2’) who confirmed that his Venmo account received payments from V1 and other victims of the sextortion scheme. V2 had been victimized by the same sextortion scheme and had been coerced to receive payments from other victims into his Venmo account.

ZELLE

Zelle is a peer-to-peer service that allows users to send and receive money from each other via connected bank accounts in the United States. Zelle is offered in two forms: (1) integrated service through banks’ mobile platforms, and (2) through the stand-alone Zelle App.

Children under 18 can use Zelle for P2P transfers through the bank integration route. In contrast, Zelle’s website states that “our App is not intended for children under the age of 18.”

Privacy

Users can send or request money by entering the other user’s email address or phone number. Zelle’s website states “Knowing your friend, family and those you trust are enrolled in Zelle is simple, we’ve tagged your contacts that are already using Zelle with a purple Z.’

Parental Notifications

As Zelle for teens is integrated by individual banks, the parental controls and notifications vary from bank to bank. Consumer Reports notes that some banks may not offer parents the ability to disable Zelle in their minor child’s online banking app.

Capital One’s disclosures about Teen Zelle usage states, “Once permission to use Zelle has been granted by the Adult, the Young Adult (once registered) can send money using Zelle without the Adult’s consent to each individual transaction.”

Zelle was mentioned in two of the four cases reviewed.

Indictment / Affidavit Example

The AINA related affidavits detail allegations that a victim made a $1,000 Zelle sextortion ransom payment from a joint bank account the young man held with this mother. Law enforcement linked the phone number associated with the receiving Zelle account to an individual in Nigeria who, per the affidavit, admitted to serving as a money mover for other participants.

P2P Notes / Comments Relating to Sextortion Victim Payments

P2P apps often include a note or comment section for users to indicate the reason for the transaction.

Sextortion-related payment notes have included:

- “delete video”

- “release,” and

- “please I don’t want to die.”

In addition, perpetrators have directed victims to provide false or misleading memo lines.

Payment Apps

Payment apps allow teens to use their phones to make purchases for goods or services, in person and online. For example, Apple Pay and Google Pay allow teen accounts. Both platforms require a parent/adult sponsor for children.

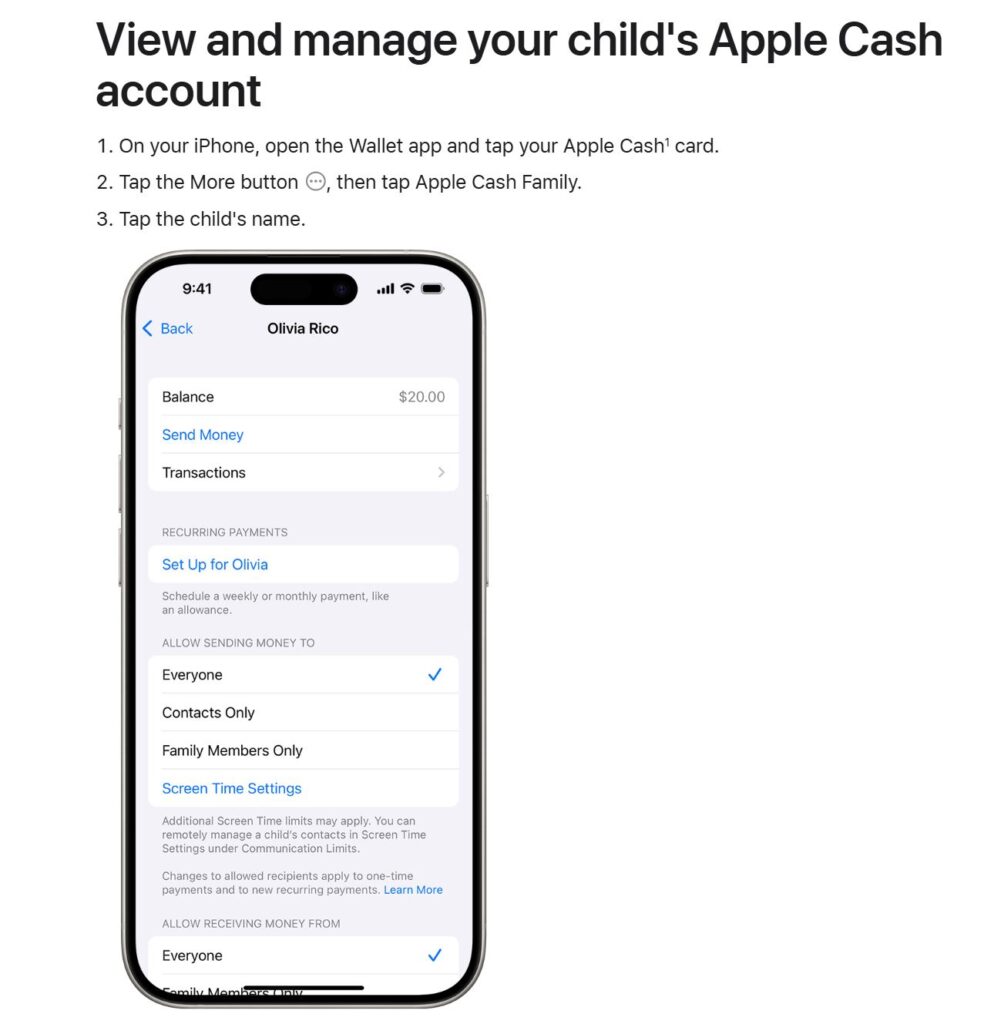

APPLE PAY

Apple Pay was mentioned two of the cases reviewed. However, there is a fuzzy line separating payment apps from P2P apps, and scammers may use familiar versus exact terms (ex. Apple Pay versus Apple Cash).

Apple Cash can be used to “send and receive money with people you know” if a family organizer sets it up for a child or teen’s use. Apple’s website states “To send and receive money with an Apple Cash account, you must be 18 and a U.S. resident. If you’re under 18, your family organizer can set up Apple Cash for you as part of their Apple Cash Family account, but you may not be able to access the features that require a supported payment card.”

Privacy

Apple Pay support does not mention privacy features for Teen Accounts. Nor does it mention an ability to block specific users from transacting with Teen Accounts. [See more below regarding Contacts].

The Apple Cash and Apple Payment Inc. privacy webpage states, “when you send or request money in Message or Wallet, your email address or phone number will be shown to the people you transact with.”

Parental Notification

Apple Cash requires the family organizer to turn on notifications to receive alerts that a child has sent or received money.

Who Can Teens Send Money To?

The family organizer must select to whom a child is allowed to send money. The setting options include Family Members Only, Contacts Only, and Everyone. It appears that the default setting is the option Everyone. The “Contacts Only” are anyone added as a contact by the child.

Apple does offer parental controls to manage a child’s contacts. However, these controls are outside of the Apple Pay system and need to be manually adjusted.

Other Embedded Financial Products

On the receiving end, Apple states “When someone sends you money, it’s securely received and kept in Apple Cash. You can use the money right away to spend with Apple Pay, sent it to someone, or transfer it your bank account or eligible debit card.”

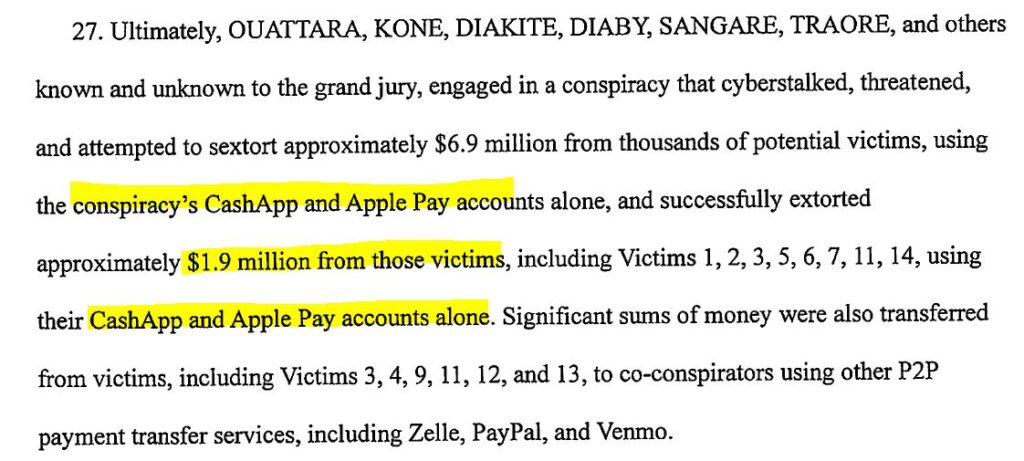

Indictment / Affidavit Example

The KONE superseding indictment alleges that $1.9 million in sextortion ransom payments were collected from thousands of victims via Apple Pay and Cash App accounts.

PAYPAL

Teens regularly have access to adults’ accounts, either with or without the adult’s permission. For example, the PayPal User Agreement states that users must be at least 18 years old. Yet three of the four cases mentioned PayPal. Thorn found that PayPal was mentioned in almost 18% of sextortion reports.

Gift Cards

Teens have easy access to gift cards and can purchase gift cards in person with cash. Sextortion victim payments can be made by providing the gift card code via a picture or message to the perpetrator.

Gift cards were mentioned in three of the four cases.

STEAM

Steam is one of the largest gaming platforms with a large offering of video games, game consoles, and accessories. Steam offers two types of gift card products: digital gift cards and Steam Wallet Codes.

Who Can Teens Send Money To?

Steam digital gift cards that can be purchased within Steam and gifted to another player, including in other countries. Steam states that the value of the gift card is automatically converted to the foreign currency.

A teen sextortion victim can purchase a digital gift card through their Steam account and “gift” it to their extorter located overseas.

Steam introduces friction by requiring that the gift giver and recipient be friends on Steam for at least three days before the digital gift card purchase. Steam offers parental controls. However, Steam’s Subscriber Agreement states, “You may not become a Subscriber if you are under the age of 13.”

Wallet Codes are described on Steam’s website as follows:

Steam Wallet codes work just like gift cards which can be redeemed on your account for Steam Wallet credit and used for the purchase of games, software and any other item you can purchase on Steam.

You can purchase a physical Steam Wallet code at a local retailer, printed directly on a receipt or delivered via SMS/text message or email through various kiosks, cyber cafes, and eCommerce websites.

Steam implemented changes placing country restrictions on Steam Wallet Codes but the details are unclear.

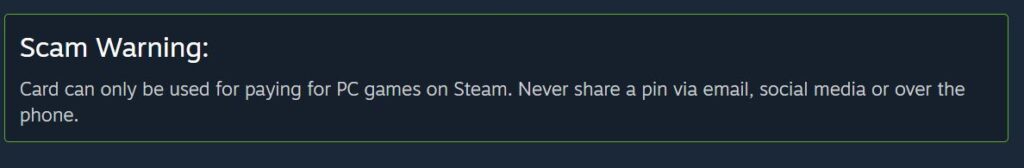

Steam provides the following poorly worded scam warning:

Indictment / Affidavit Example

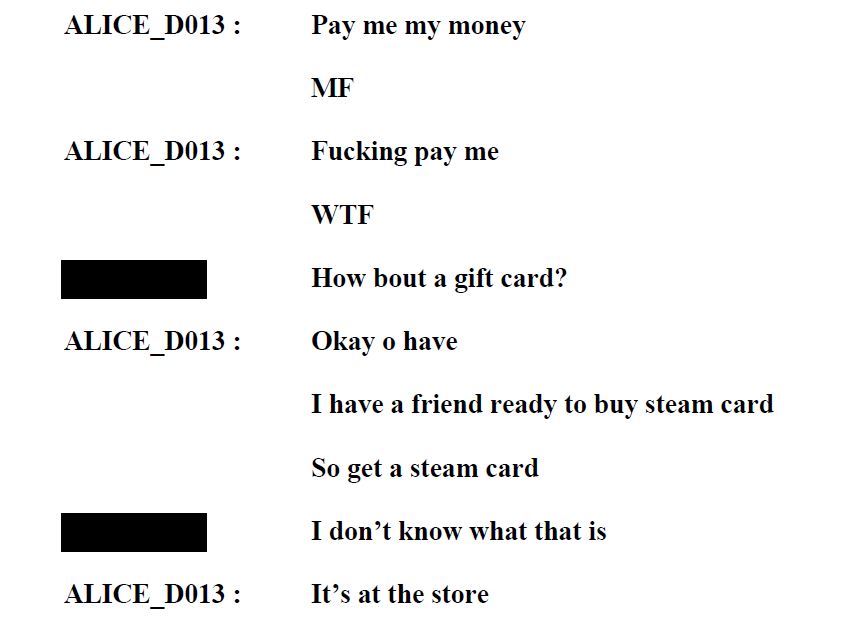

Per the AINA arrest affidavit, when a victim offered to pay via gift card the alleged sextorter responds with a request for a Steam card.

Cryptocurrency

Some U.S. cryptocurrency exchanges allow adult-sponsored teen accounts including Cash App. However, it is unclear if teens can transfer bitcoin out of U.S. exchanges. Additionally, some bitcoin kiosks/ATMs, crypto P2P platforms, and offshore cryptocurrency exchanges, do not have robust KYC which may allow a teenager to use the platform.

Indictment / Affidavit Examples

According to one indictment, an undercover FBI employee (‘UCE’) communicated with the extorter using the SIM card of a child victim who had committed suicide due to the sextortion. The UCE posed as a friend of the victim and offered to pay on the victim’s behalf (the extorter was unaware the victim had committed suicide). The extorters provided an unhosted bitcoin wallet address to receive a ransom payment from the victim. The FBI tracked the bitcoin from the unhosted wallet to Binance.com.

In another case, perpetrators directed a sextortion victim (over 18 years old) to deposit cash in a crypto ATM.

Consumer Protection Lacking for Teens

Financial products and services used by teens — such as P2P services, payment apps, and gift cards — claim exemption from liability and fraud protection.

Consumer Reports explains how P2P services leaves scam victims with little recourse:

“[S]cams are becoming increasingly common and sophisticated, yet most P2P payment services do not consider them ‘unauthorized’ transactions. Regulation E defines an unauthorized transaction as ‘an electronic fund transfer from a consumer’s account initiated by a person other than the consumer without actual authority to initiate the transfer and from which the consumer receives no benefit… Additionally, while credit card users enjoy robust protections under the Fair Credit Billing Act, including the ability to dispute fraudulent charges, P2P payment app users are left largely unprotected.”

A Consumer Report review of 11 companies policies had vague or no reference to how fraudulently-induced payments (scams) are not considered unauthorized and therefore not covered by liability protections.

Teens are not only suffering from the emotional toll of these scams, they also have little recourse to claw back the defrauded funds.

Stay tuned for Part 5: Disrupting Financial Mechanism, which will explore best practices the financial industry can adopt to help protect children and teens from financially motivated sextortion

Up next…

Part 3: Consolidating and Laundering Sextortion Victim Payments

A special thanks to Natalie Loebner for her insights and feedback on this article.

Suggested Additional Reading on Financially Motivated Sextortion:

“A Digital Pandemic: Uncovering the Role of ‘Yahoo Boys’ in the Surge of Social Media-Enabled Financial Sextortion Targeting Minors” by Paul Raffile.

Financially Motivated Sextortion of Minors: Introduction

How Cryptocurrency Revitalized Commercial CSAM

[i] An indictment is merely an allegation. Individuals are presumed innocent until proven guilty in a court of law. Two individuals named in the OGOSHI matter pleaded guilty and were sentenced to seventeen years in prison.