Customers Represent the Minority of SAR Subjects for Most Institutions DSA analyzed FinCEN’s SAR Stats […]

SARs

77 posts

FinCEN’s record retention policy is detailed in the “Request For Records Disposition Authority” that FinCEN […]

When the Bank Secrecy Act passed in October 1970 with the $10,000 Currency Transaction Report (CTR) […]

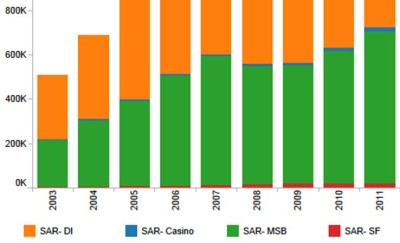

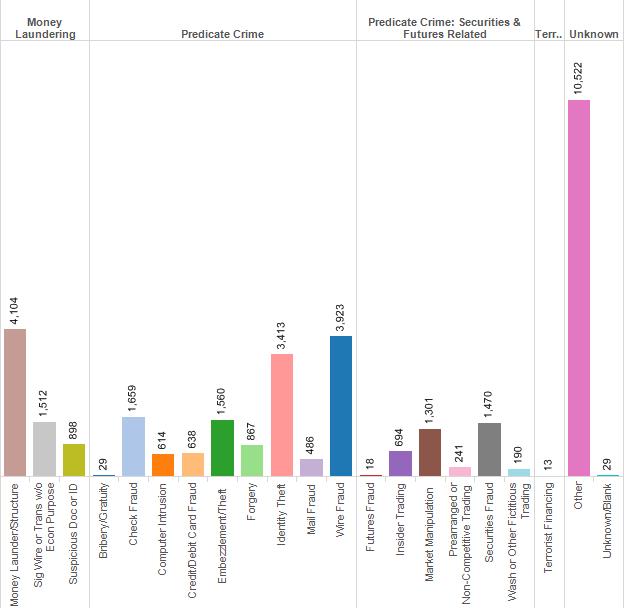

In 2012 there was 1 federal money laundering conviction per 2,047 Suspicious Activity Reports (SARs) filed. If […]

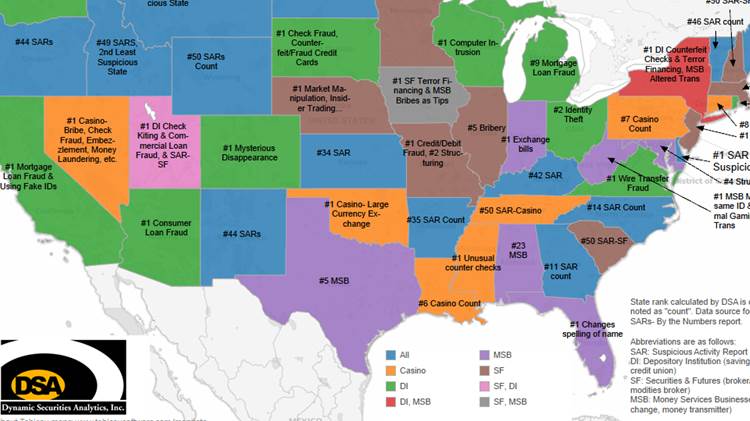

If you gauge suspicious activity by the Financial Crimes Enforcement Network’s (FinCEN) “By the Numbers” […]