Summary: Illicit finance occurs both within and by crypto exchanges as demonstrated by the recent criminal actions against SBF, Binance, and CZ.

_____________________

When the topic of illicit finance using cryptocurrency arises, the crypto industry often pivots to talking about “the blockchain.” However, cryptocurrency and “the blockchain” are not one in the same. The vast majority of cryptocurrency transactions never touch the blockchain.

If all cryptocurrency transactions were an iceberg, the crypto transactions visible on the blockchain are just the tip of the iceberg.

I noted the following in my written testimony to the House Financial Services Sub-Committee on Digital Assets:

Illicit Finance within Crypto Exchanges

Most cryptocurrency transactions occur within crypto exchanges. Crypto exchanges internally match buyers and sellers. Exchanges also act as market-makers, stepping in as a counterparty when a buyer/seller is unavailable. These off-chain transactions escape traceability and blockchain analytics.

Researchers estimated that bitcoin transactions within exchanges to be ten times the volume of transactions executed on the blockchain:

On-chain transactions, however, constitute only a small share of the universe of all Bitcoin trades, most of which are “off-chain” utilizing some form of exchange, some heavily regulated, some not so much.[1]

A crypto exchange’s internal transactions are not recorded on the blockchain. Instead, these off-chain transactions are recorded on the exchange’s internal ledger.

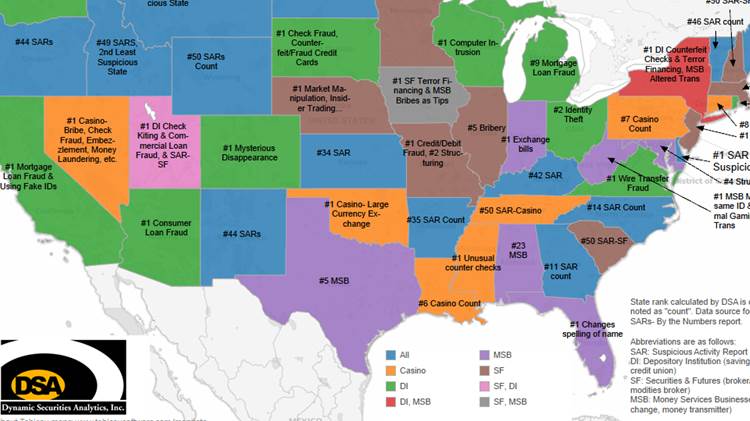

Bad actors can use cryptocurrency but evade creating a blockchain record of transactions by simply conducting transactions within an exchange. As demonstrated by SAR filings by Virtual Asset Service Providers (VASPs), IC3 and CFPB complaints, and criminal indictments, this is in fact occurring.

Illicit Customer Activity Within Crypto Exchanges

My analysis of nine enforcement actions against VASPs involving Suspicious Activity Reports found that darknet market activity was the most cited suspicious activity.[2] Other sources of illicit funds flowing through the VASPs included: funds from sanctioned entities/regions, Child Sexual Assault Material (CSAM), money laundering, drug trafficking, ransomware, unregistered MSBs and/or crypto mixers, terror finance, and other fraud.

Illicit Finance by Crypto Exchanges

Cryptocurrency exchanges and other types of VASPs, such as mixers and bitcoin ATMs, have also directly engaged in illicit financial activity using cryptocurrency.

Internal exchange ledgers of cryptocurrency transactions have been sloppy or outright fraudulent from the very beginning. Mt. Gox, one of the first cryptocurrency exchanges, allegedly failed to accurately record internal customers transactions, and stole crypto from customers.

Cryptocurrency exchanges have also engaged in market manipulation, wash trading, insider trading, and a host of other crimes.[3]

______________________

The guilty pleas by Binance and Changpeng Zhao (former Binance CEO), and Sam Bankman-Fried’s conviction demonstrate that illicit finance within and by crypto exchanges can have dire consequences.

Want more Cryptocurrency Insights?

The Limits of Blockchain Transparency: Fraud with Crypto Companies

Cryptocurrency Suspicious Activity Report Enforcement Actions

3 Misconceptions About Cryptocurrency Crime Estimates

Dynamic Securities Analytics, Inc. provides litigation consulting to help clients successfully navigate disputes involving securities, cryptocurrency, and money laundering.

[1] https://www.nber.org/papers/w29337

[2] https://securitiesanalytics.com/crypto-suspicious-activity-report-enforcement-actions/

[3] https://securitiesanalytics.com/fraud-within-crypto-companies/