This is the third article in a five-part series analyzing the financial mechanisms of financially motivated sextortion of minors. Part 3 examines methods used for consolidating and laundering sextortion proceeds.

Catch up here:

Part 1: Introduction to Financially Motivated Sextortion of Minors

Part 2: Teen Sextortion Victim Payments

Financially motivated sextortion is the practice of obtaining a victim’s sexual photographs and/or videos (“nudes”), threatening to distribute the victim’s sexual material to others, and demanding that the victim pay money to avoid the threatened distributions. If the sexual images are of a minor, there are special considerations and legal implications.

This analysis reviewed indictments and arrest warrant affidavits relating to four different alleged sextortion schemes referred to as: (1) OGOSHI (related but separate indictment for alleged money mules GREEN), (2) KONE, (3) SHANU, and (4) AINA.

Many Small Sextortion Payments

Individual sextortion victim payments are often in the low hundreds of dollars. Teens use a wide variety of payment methods including gift cards, P2P, payment apps, and bitcoin to pay sextortion ransom.

Since Transnational Criminal Organizations victimize tens of thousands of kids through financially motivated sextortion, this results in large dollar amounts of illicit proceeds spread out among a variety of financial institutions and accounts.

TCOs consolidate and launder sextortion payments from the myriad accounts and institutions before remitting the illicit proceeds overseas.

Sextortion Money Mules and Professional Money Launderers

A common denominator among the court documents was the alleged use of U.S.-based money mules / professional money launderers (PML) in the consolidating and laundering of sextortion proceeds. The use of money mules / PMLs was present in schemes that were based out of Nigeria and Cote d’Ivoire.

Additionally, some sextortion victims were coerced into receiving payments from other victims.

The Shanu indictment states:

“The conspirators used money mules in the U.S. – who typically were also victims of the scheme – to transmit the payments to the conspirators through the purchase of gift cards and cryptocurrency.”

LAUNDERING SEXTORTION PROCEEDS – NIGERIA

Laundering from App > App

The AINA indictment succinctly describes the laundering of sextortion proceeds:

“The use of multiple online accounts and layering of payment services are common means to conceal perpetrators’ criminal activities.”

In the OGOSHI matter, court documents state that the money mules moved victim funds from Apple Pay and other payment apps into Cash App.

Laundering from App > Crypto

The OGOSHI-related GREEN indictment provides an example of sextortion money mules layering transactions at multiple P2P apps then purchasing cryptocurrency:

“Victim 1 sent $300 via Apple Pay to GREEN. GREEN transferred a portion of those Apple Pay funds into CashApp funds. Using those CashApp funds, GREEN purchased bitcoin.”

The SHANU indictment describes similar laundering but instead relied upon a victim to convert P2P funds to crypto:

“V2 had been victimized by the same sextortion scheme and had been coerced to receive payments from other victims. Pursuant to instructions provided to him by the conspirators, once he [V2] received the payments through his Venmo account, he would forward them to the conspirators – and in particular, a crypto currency wallet controlled by SHANU – at their instruction.”

Laundering from Crypto Wallet > Crypto Wallet

The AINA indictment describes “the use of intermediary cryptocurrency wallets” to launder a bitcoin sextortion payment. Similarly, the SHANU indictment lists an un-hosted wallet address that was used as an intermediary.

Control of U.S. Bank Account by Professional Money Launderer

The AINA indictment states that ADEWALE “calls himself a ‘Picker’ or a middleman for ‘Yahoo’ money transactions.”

ADEWALE allegedly controlled a U.S. bank account:

“ADEWALE stated that he was in communication with an actual person named Antonia Diaz from 2022 until May 2023. Over the course of the communications, Diaz sent ADEWALE a copy of her New York State Identification, U.S. Passport, and Social Security Card. ADEWALLE stated that Diaz gave him access to bank accounts.”

The indictment does not detail why Diaz allegedly provided ADEWALE access to her bank account.

LAUNDERING SEXTORTION PROCEEDS – COTE D’IVOIRE

KONE — the sole Cote d’Ivoire case with available court documents — also used money mules. However, the methods of consolidating and laundering sextortion proceeds differed from the Nigeria-based schemes.

Consolidation / Laundering from App > Bank Account > Cash

The KONE indictments state that complicit money mules received victim payments into P2P accounts that the mules controlled and transferred the funds to the linked U.S. bank accounts. Additionally, a victim made a sextortion payment via Zelle to a bank account controlled by a conspirator.

The conspirators then withdrew cash from the bank accounts.

Laundering from Bank Account > MSB

Press reports detail a second Cote d’Ivoire sextortion scheme. Jonathan KASSI faced two felony extortion charges for “collecting blackmail money from teen boys and sending it to a co-conspirator on the Ivory Coast of Africa.”

A teen victim sent $150 through Zelle to KASSI. The teen committed suicide 15 minutes after sending the funds. The San Francisco Times reports that “detectives reviewed Varo bank transactions, found deposits via Zelle, and identified withdrawals of thousands of dollars from Varo to a Western Union bank on the Ivory Coast.” KASSI was convicted in September 2023 and sentenced to 18 months.

Laundering Traditional MSB > Cash

KONE victims allegedly made sextortion payments via “money transfer services like Western Union and MoneyGram, payable to the money mules” and by “U.S. Postal money orders, payable to the money mules and mailed to their residential addresses.”

The money mules alleged cashed out the traditional MSB payments by “retrieving cash in-person at locations of money transfer services like Western Union” and “receiving U.S. Postal money orders that victims mailed to them and cashing the money orders at designated locations.”

Laundering Gift Cards > Luxury Goods

KONE conspirators allegedly cashed out victim funds by “obtaining the identifiers of stored value cards (gift cards) and purchasing and receiving shipment of goods, including luxury clothing, computers, and cell phones.”

The Thorn study discussed in Part 2: Victim Payments found that gift cards were mentioned in over 25% of sextortion reports to the National Center for Missing and Exploited Children (NCMEC).

Laundering Sextortion Proceeds for Profit

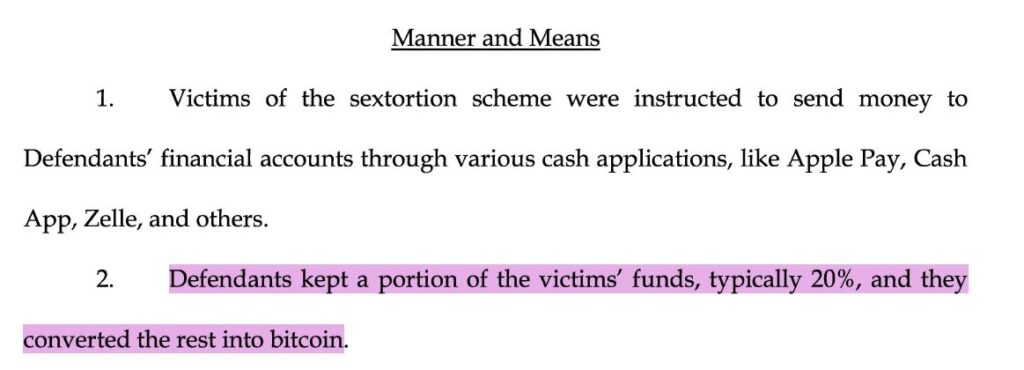

The OGOSHI and KONE indictments both state that the alleged complicit money mules / professional money launderers kept 20% of the funds laundered.

An indictment is merely an allegation. Individuals are presumed innocent until proven guilty in a court of law. Two individuals named in the OGOSHI matter pleaded guilty and were sentenced to seventeen years in prison.

Stay tuned for Part 4: Remitting Proceeds Overseas

Suggested Additional Reading on Financially Motivated Sextortion:

“A Digital Pandemic: Uncovering the Role of ‘Yahoo Boys’ in the Surge of Social Media-Enabled Financial Sextortion Targeting Minors” by Paul Raffile.

How Cryptocurrency Revitalized Commercial CSAM