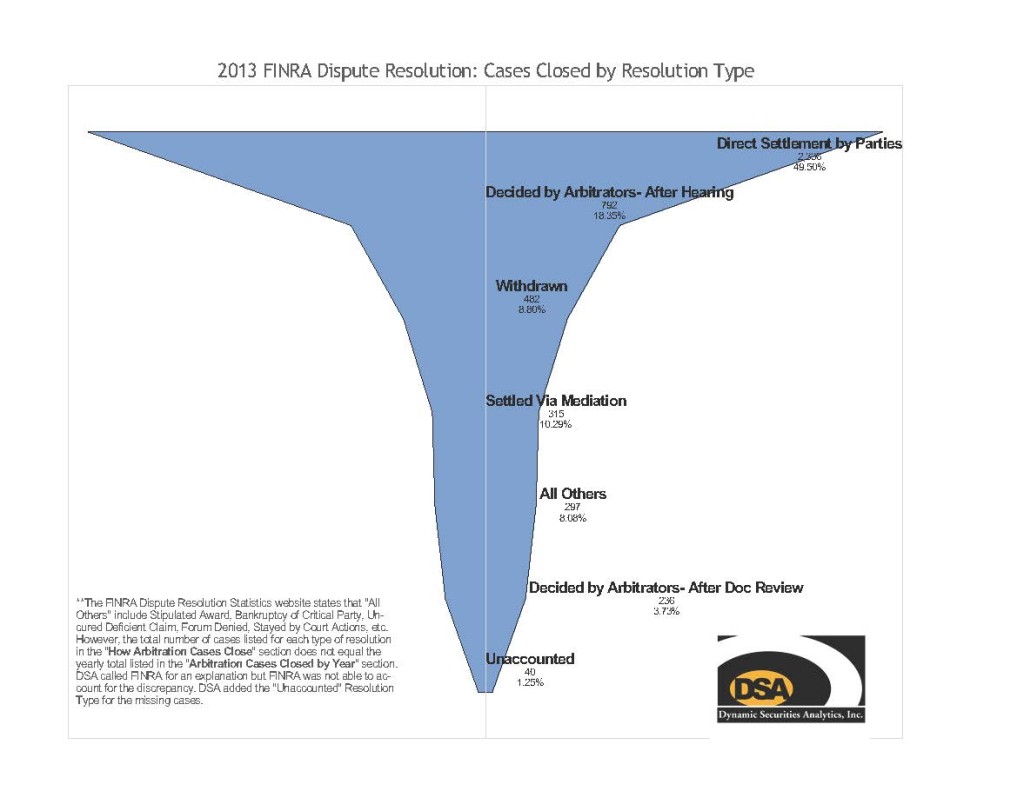

DSA analyzed how cases were closed through the FINRA dispute resolution process in 2013.

Customer Cases

FINRA reported that in 2013 there were 499 Customer Complaint cases decided by Arbitration (paper & hearing) and in 212 of these cases, the customer was awarded damages. Based on the statistics provided by FINRA, DSA determined:

- 2,772 Customer Complaint cases were closed in 2013 which accounted for 61% of all closed cases

- Customer Complaints closed by arbitration represented 11% of all cases closed in 2013

- Only 7% of all Customer Complaints were closed by an arbitration awarding the customer damages

Non-Customer Cases

Despite the attention Customer vs Member/Member Firm cases get, almost 40% of the closed 2013 FINRA cases did not involve customers. Other common case types involve Firm vs Employee (ex. recoup sign-on bonus), Employee vs. Firm (ex. wrongful termination) and Member Firm vs. Member Firm (ex. raiding). FINRA did not report stats on how these specific types of cases closed but by reverse engineering the Customer Complaint numbers, DSA determined that:

- 1,725 Non-Customer cases were closed in 2013

- 529 Non-Customer cases were closed by arbitration, representing 11.7% of all closed cases

- Non-Customer cases accounted for 51% of arbitrations (paper & hearing).

*FINRA was not able to account for 40 cases closed in 2013. See the footnote in the graphic below for more detail

DSA prepared the graphic below of how FINRA dispute resolution cases were closed in 2013.