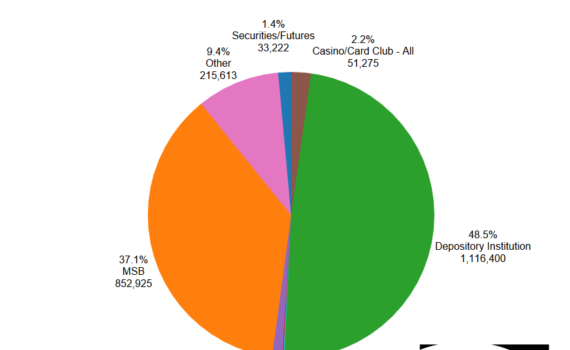

2,301,163 SARs were filed in 2019 which is an increase of 6% from 2018 levels. Depository Institutions filed 48% of all SARs, MSBs accounted for 37% and Securities/Futures filed 9%.

SAR-SF

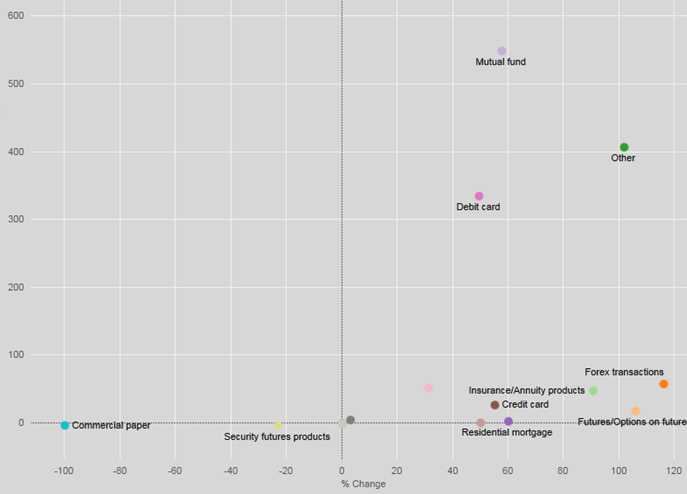

Dynamic Securities Analytics, Inc. analyzed 2017 SAR-SF filings from FinCEN’s SAR Stats to identify filing […]

Dynamic Securities Analytics, Inc. (“DSA”) reviewed the SEC’s and FINRA‘s 2017 exam priorities letters to […]

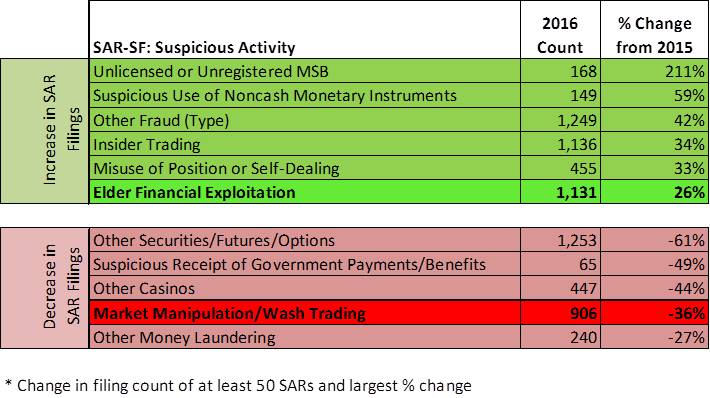

FINRA and the SEC recently released their respective 2016 exam & regulatory priorities. DSA reviewed […]

It’s Suspicious to Not be Suspicious SEC Enforcement Chief Andrew Ceresney made headlines when he […]

On April 22nd, 2015 FinCEN released In Focus: SAR Stats (April 2015). Dynamic Securities Analytics, […]

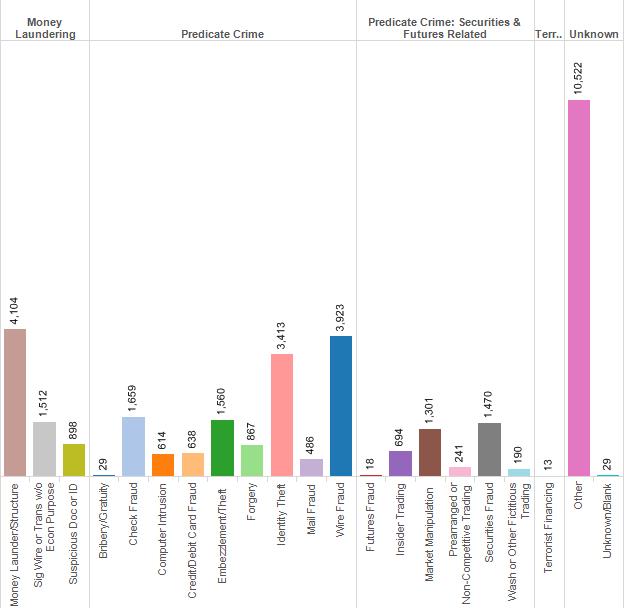

Dynamic Securities Analytics analyzed the latest FinCEN In Focus: SAR Stat report and found that […]

FinCEN released In Focus: SAR Stats (Jan 2015 Quarterly Update) which includes all 2014 Suspicious Activity Reports […]

Customers Represent the Minority of SAR Subjects for Most Institutions DSA analyzed FinCEN’s SAR Stats […]