marijuana legalization

6 posts

Alison Jimenez will be a featured speaker at the Digital Finance Institute’s #FinTech2017 conference in […]

American Banker published an Op-Ed by DSA president Alison Jimenez, co-authored with Steven Kemmerling of […]

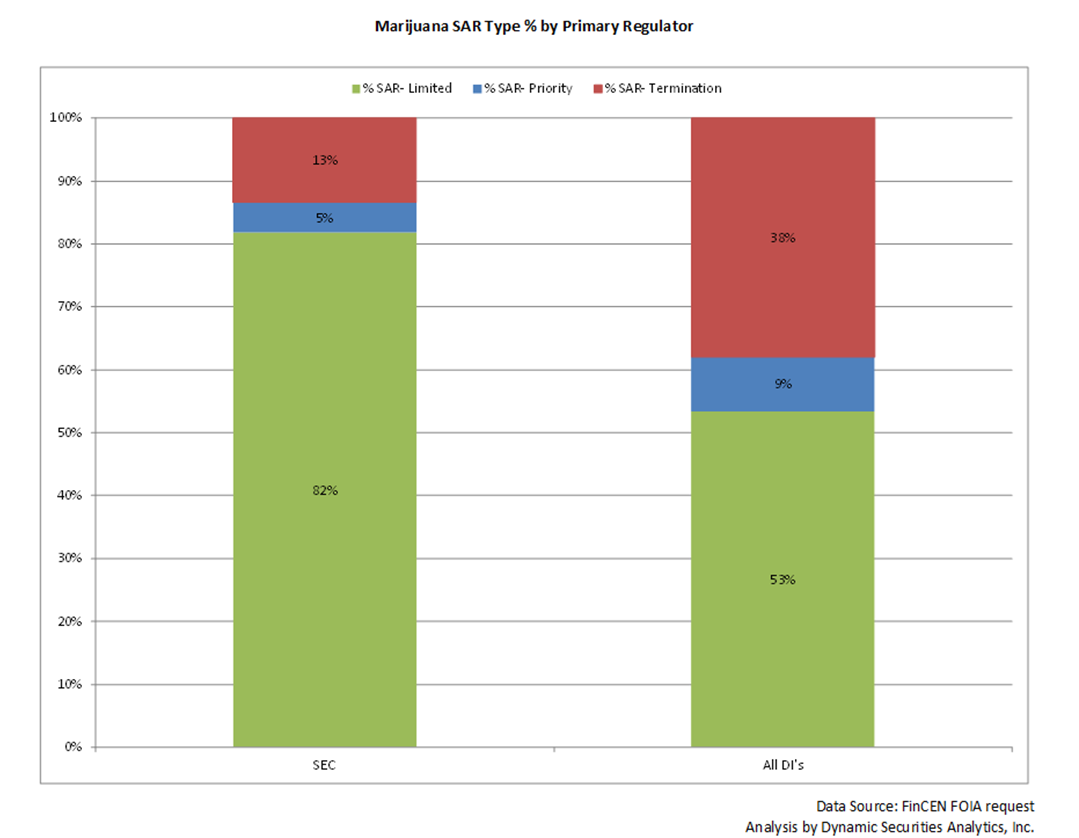

By Alison Jimenez, Dynamic Securities Analytics, Inc. and Steven Kemmerling, MRB Monitor Securities Brokers […]