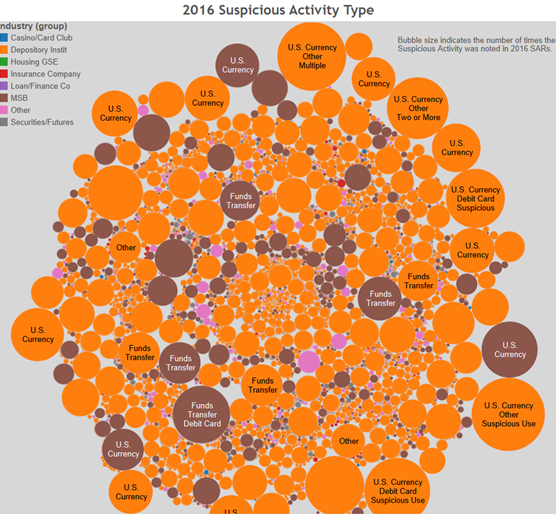

Dynamic Securities Analytics, Inc (“DSA”) analyzed 2016 SAR filings reported in FinCEN’s SAR Stats database. […]

FinCEN

Dynamic Securities Analytics, Inc (“DSA”) analyzed 2016 SAR filings reported in FinCEN’s SAR Stats database. […]

ACAMS Today published an article titled “Unmasking Bias in AML Algorithms” by DSA president, Alison […]

In my upcoming article titled “Unmasking Bias in AML Algorithms” in the September/October edition […]

Alison Jimenez, president of Dynamic Securities Analytics, will present on the topic “Mitigating Risks […]

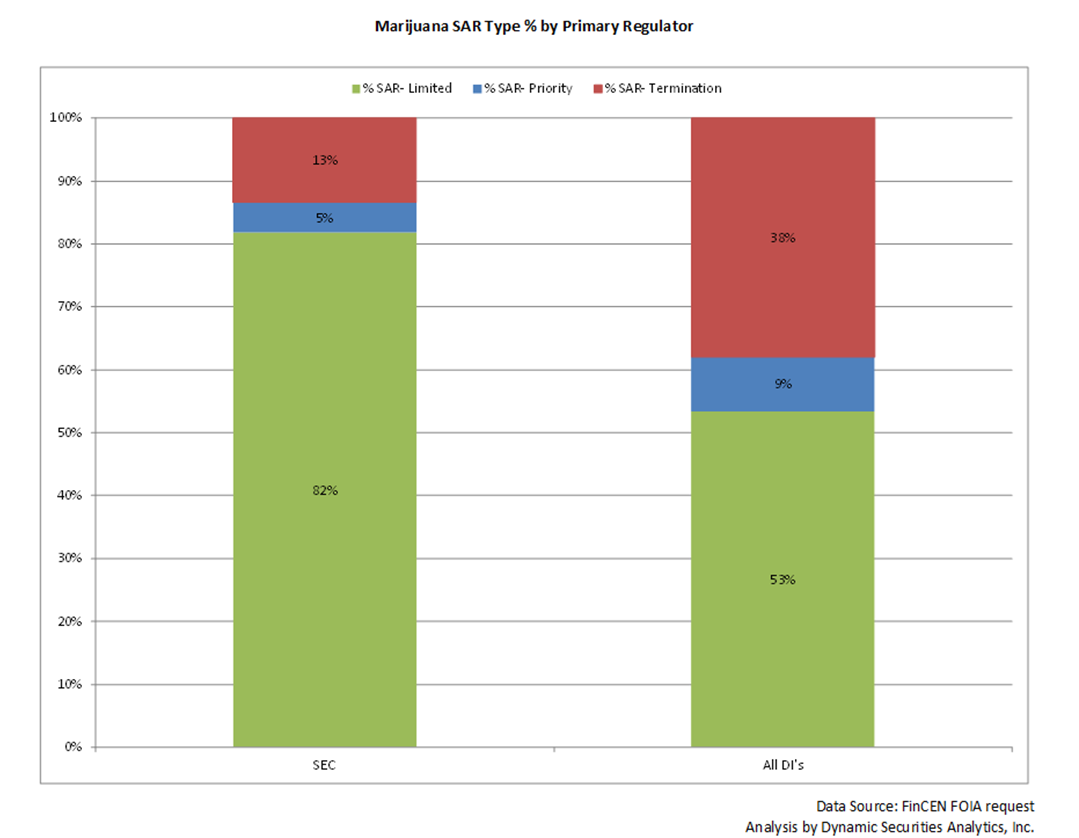

Dynamic Securities Analytics’ analysis of marijuana-related SARs was cited by the Wall Street Journal. The […]

By Alison Jimenez, Dynamic Securities Analytics, Inc. and Steven Kemmerling, MRB Monitor The quickly-growing state-legalized […]

By Alison Jimenez, Dynamic Securities Analytics, Inc. and Steven Kemmerling, MRB Monitor Securities Brokers […]

It’s Suspicious to Not be Suspicious SEC Enforcement Chief Andrew Ceresney made headlines when he […]