Alison Jimenez will be a featured speaker at the Digital Finance Institute’s #FinTech2017 conference in […]

Regulatory Analytics

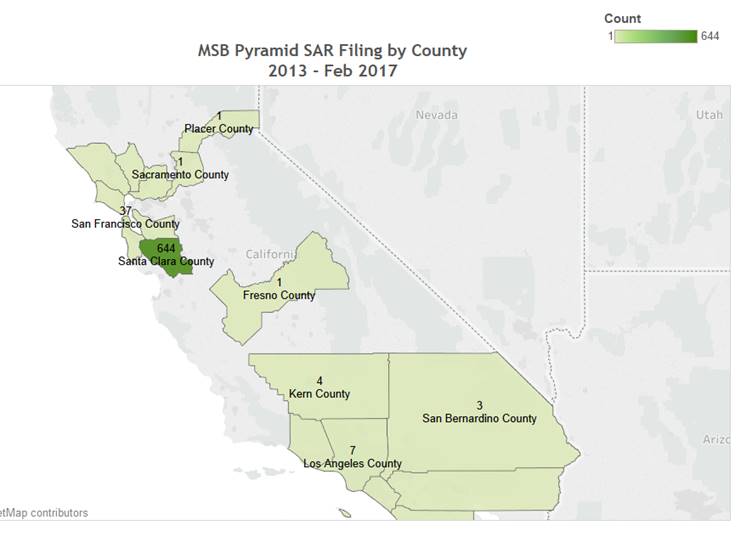

Pyramid Scheme SAR Filings Spike Dynamic Securities Analytics (“DSA’) has identified a trend in pyramid […]

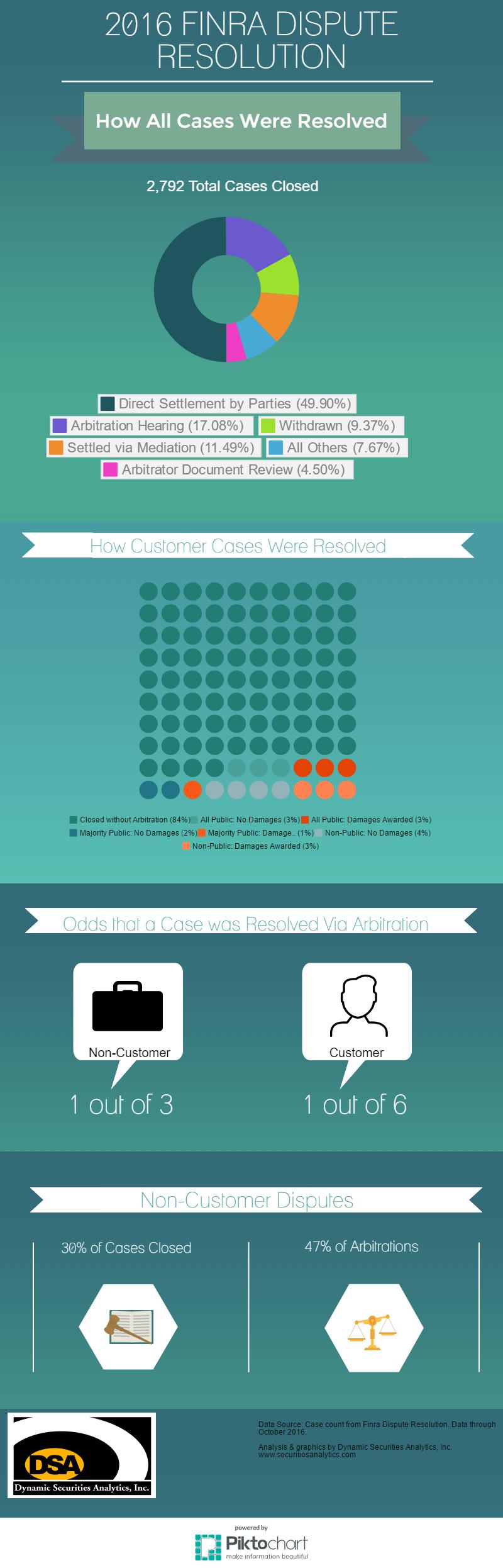

Dynamic Securities Analytics, Inc. (“DSA”) reviewed the SEC’s and FINRA‘s 2017 exam priorities letters to […]

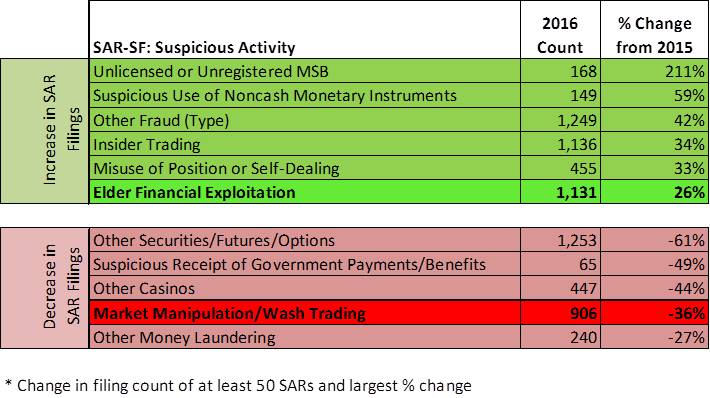

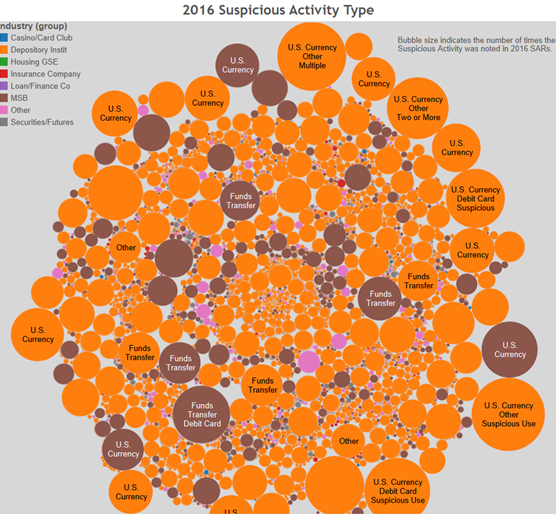

Dynamic Securities Analytics, Inc (“DSA”) analyzed 2016 SAR filings reported in FinCEN’s SAR Stats database. […]

Dynamic Securities Analytics, Inc (“DSA”) analyzed 2016 SAR filings reported in FinCEN’s SAR Stats database. […]

ACAMS Today published an article titled “Unmasking Bias in AML Algorithms” by DSA president, Alison […]

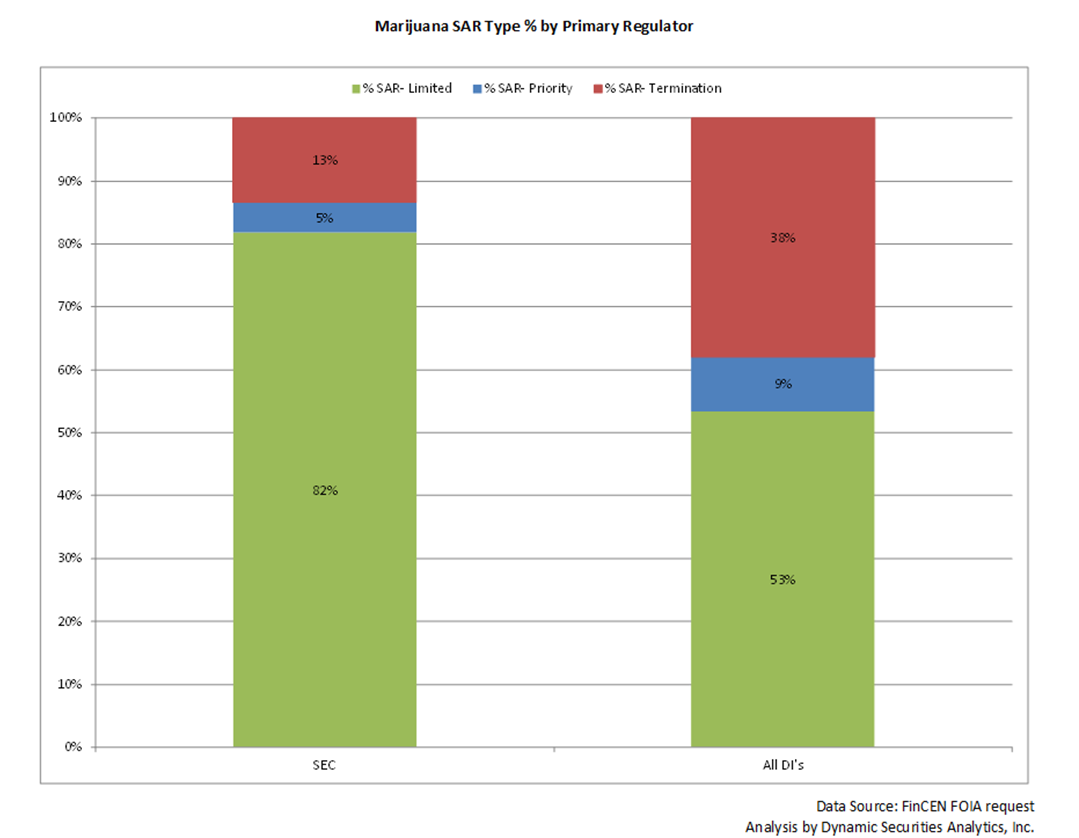

By Alison Jimenez, Dynamic Securities Analytics, Inc. and Steven Kemmerling, MRB Monitor The quickly-growing state-legalized […]

By Alison Jimenez, Dynamic Securities Analytics, Inc. and Steven Kemmerling, MRB Monitor Securities Brokers […]