Data Analytics

31 posts

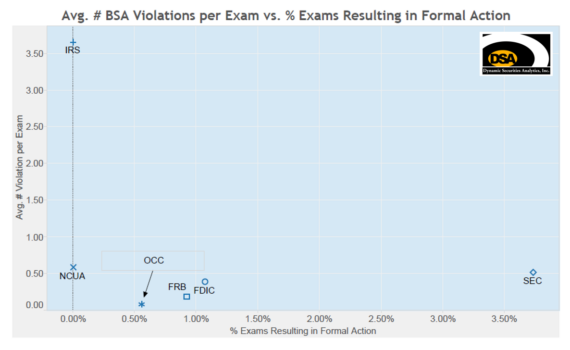

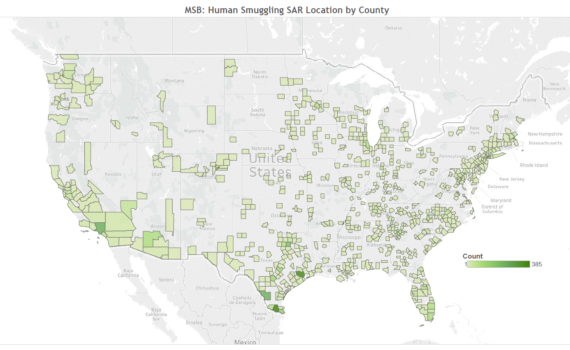

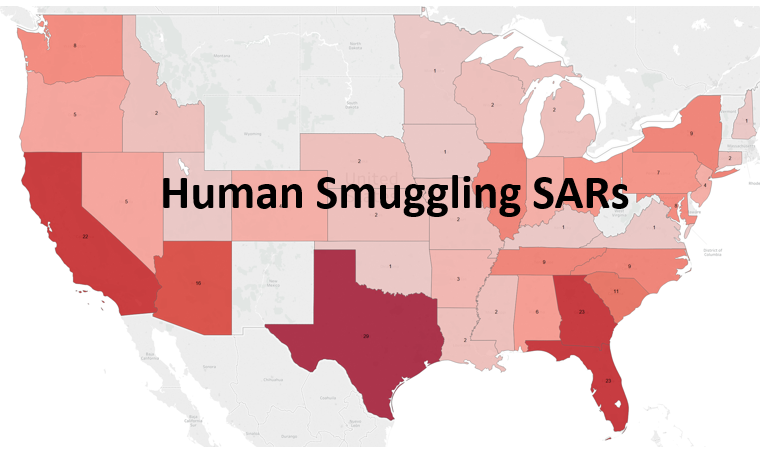

DSA analyzed SAR data and BSA regulator enforcement data to compare the level of regulator scrutiny.

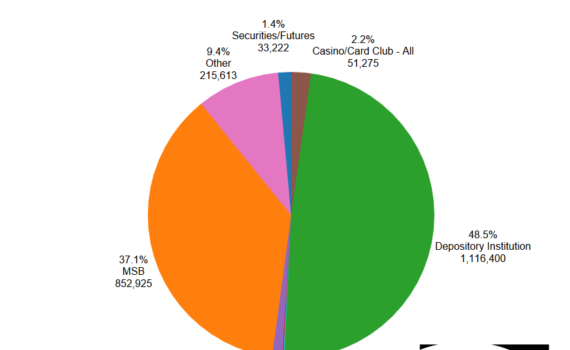

2,301,163 SARs were filed in 2019 which is an increase of 6% from 2018 levels. Depository Institutions filed 48% of all SARs, MSBs accounted for 37% and Securities/Futures filed 9%.

Migrant smuggling tragedies underscore the important role of financial institutions in identifying human smuggling

The Wall Street Journal’s Corruption Currents section referenced Dynamic Securities Analytics, Inc’s 2018 SAR Insights […]

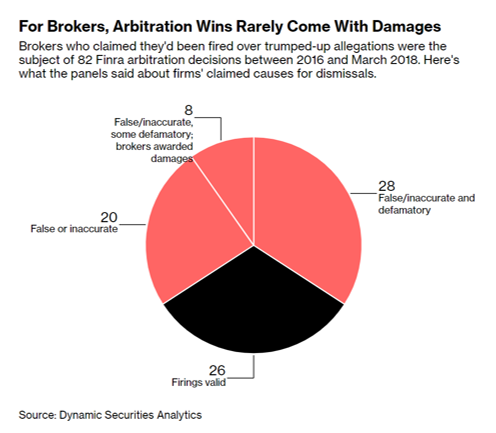

A story by Neil Weinberg in Bloomberg relied on Dynamic Securities Analytics (‘DSA’) analysis of […]

DSA president, Alison Jimenez, will serve as a panelist at the 36th Cambridge International Symposium […]