Alison Jimenez, president of Dynamic Securities Analytics, authored “Migrant Smuggling: What Financial Institutions Need to […]

Yearly Archives: 2019

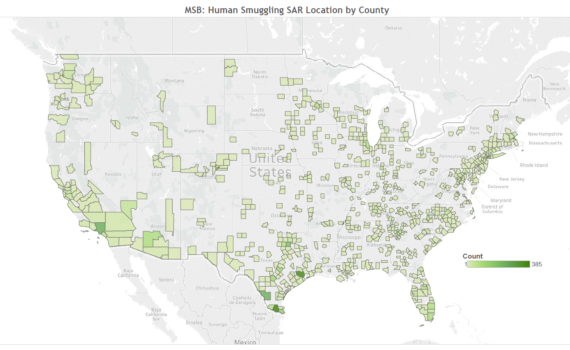

Migrant smuggling tragedies underscore the important role of financial institutions in identifying human smuggling

Alison Jimenez will present on regulatory algorithms at the World Bank- Law, Justice & Development Week.

Alison Jimenez explores the money laundering risks posed to financial institutions by EB-5 related-accounts in an ACAMSToday article.

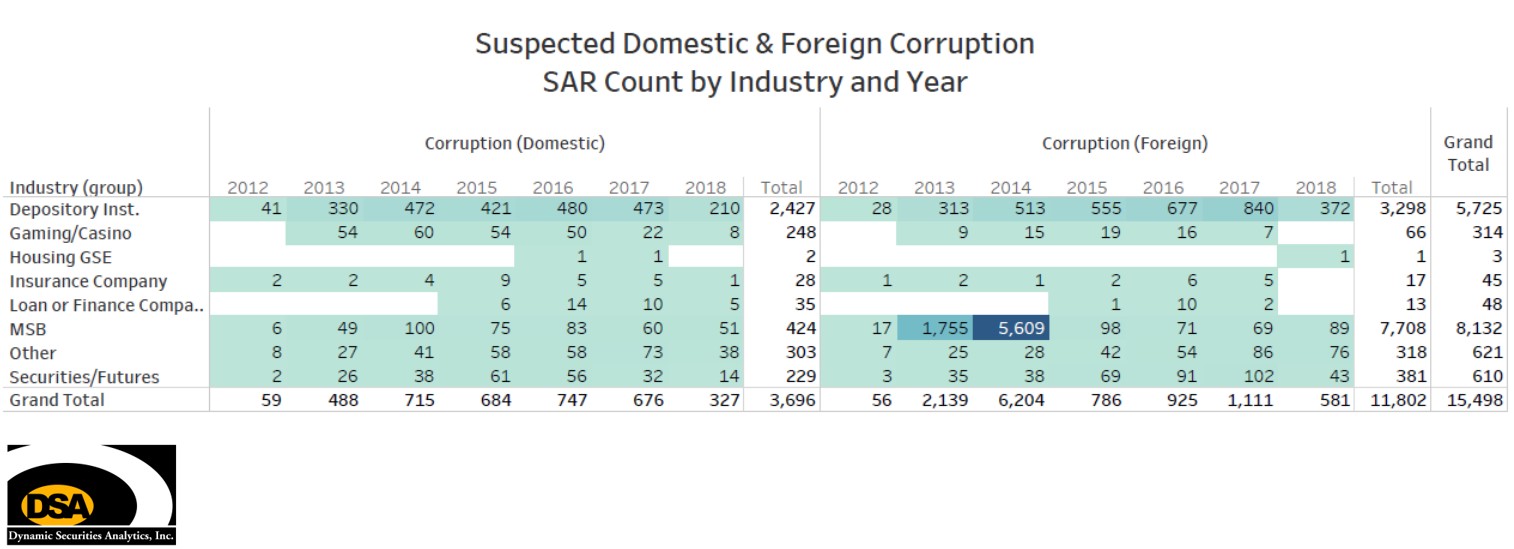

Alison Jimenez, president of Dynamic Securities Analytics, Inc. recently presented on an ACAMS webinar titled "Strengthening Your Anti-Bribery and Corruption Oversight."

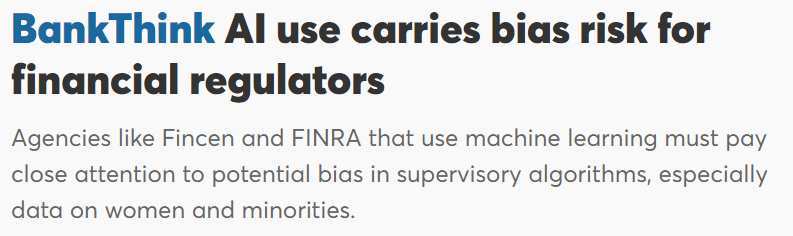

American Banker published an op-ed by DSA president, Alison Jimenez, titled “AI use carries bias […]

DSA president, Alison Jimenez, was selected to participate in the Countering Transnational Organized Crime (CTOC) […]

EB-5 projects expose financial institutions to risks ranging from Ponzi schemes, fraud, OFAC violations to […]

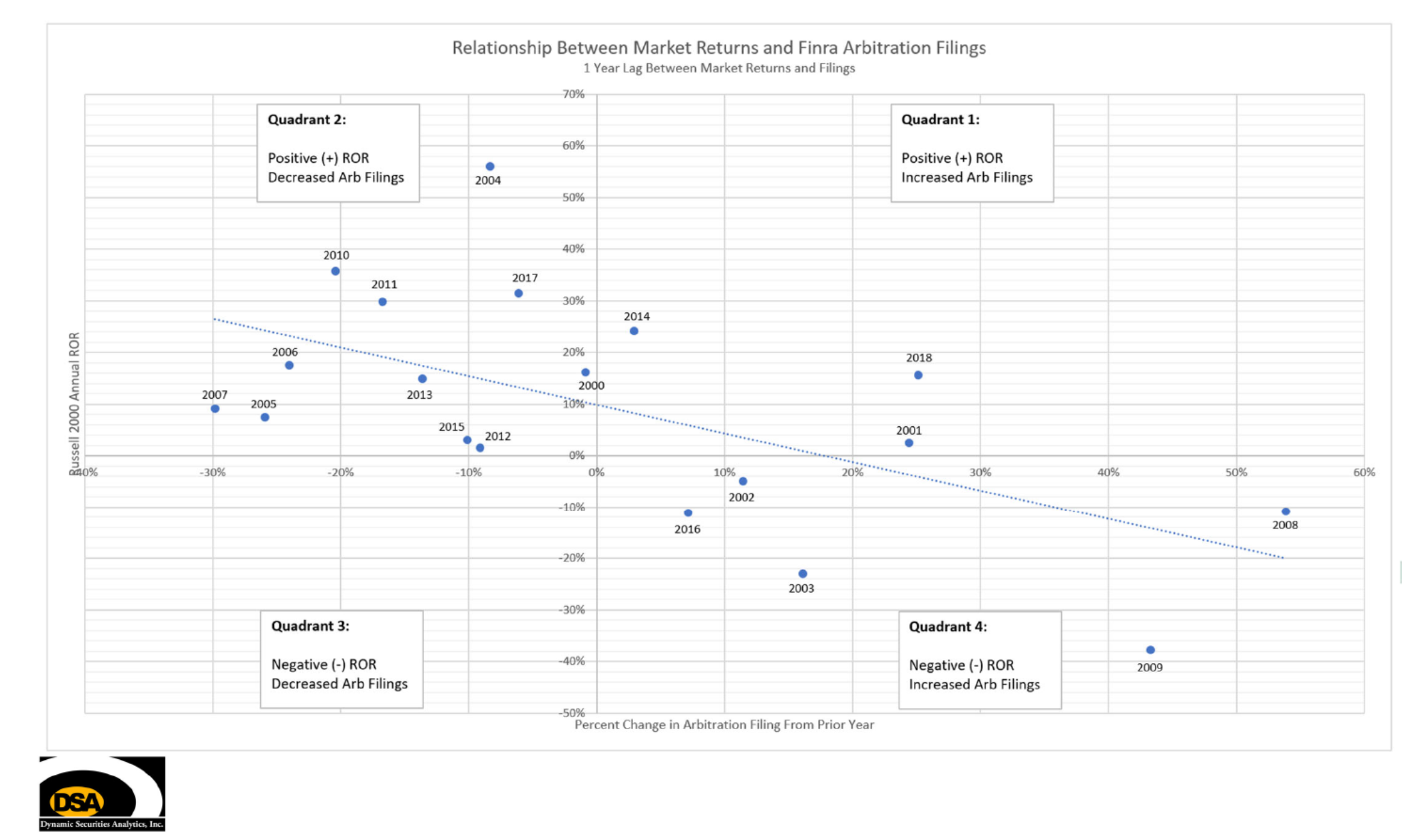

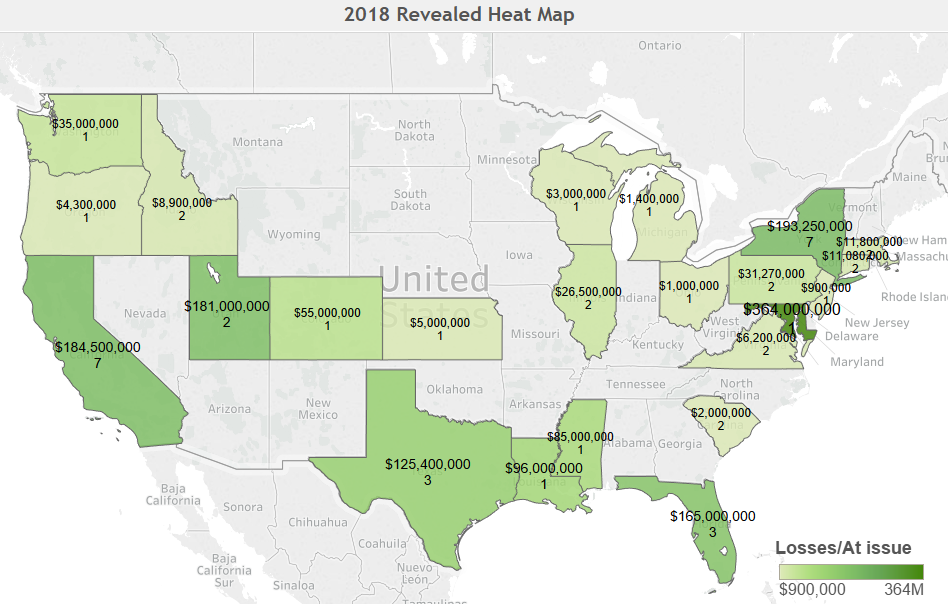

Dynamic Securities Analytics, Inc. in partnership with Jordan Maglich of www.ponzitracker.com prepared interactive analytics of […]