The Venezuela corruption/bribery/pilfering of national coffers scandal has a re-occurring theme: alleged conspirators buying or […]

Yearly Archives: 2018

11 posts

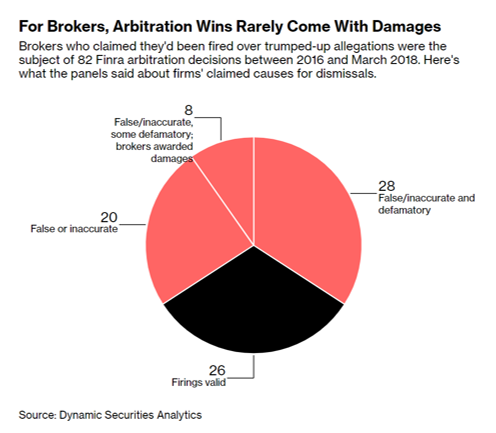

A story by Neil Weinberg in Bloomberg relied on Dynamic Securities Analytics (‘DSA’) analysis of […]

DSA president, Alison Jimenez, will serve as a panelist at the 36th Cambridge International Symposium […]

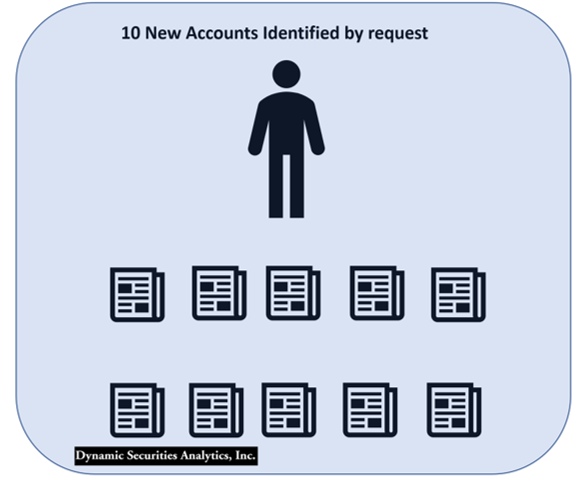

FinCEN recently released stats on the 314(a) information request program. FinCEN stated that over 16,000 […]

Finra released a video interview on 1/10/18 with Mike Rufino, Executive Vice President and Head of […]

Dynamic Securities Analytics, Inc (‘DSA’) analyzed a FinCEN report which provided data on Suspicious Activity Reports (‘SARs’) […]