The Credit Union Journal published a slideshow version of Alison Jimenez’ Op-Ed on Marijuana Banking […]

Yearly Archives: 2015

American Banker published an Op-Ed by DSA president Alison Jimenez, co-authored with Steven Kemmerling of […]

Alison Jimenez, president of Dynamic Securities Analytics, Inc (“DSA”), was recently appointed to the […]

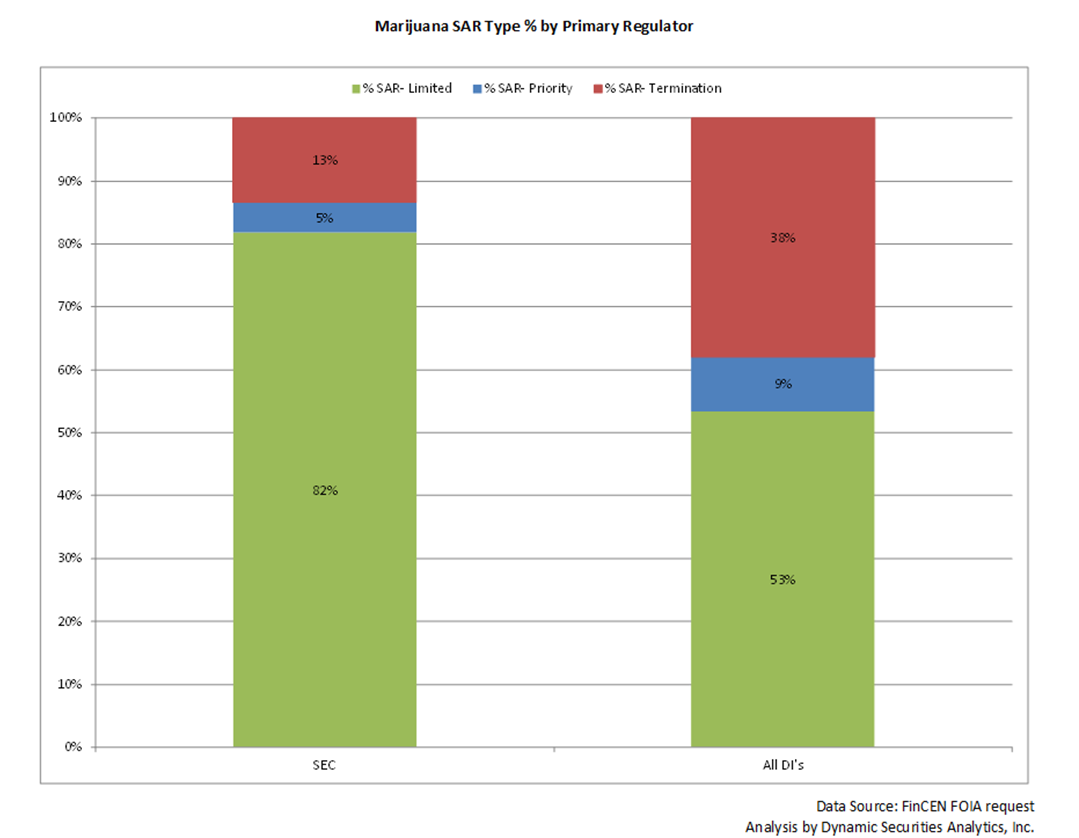

Dynamic Securities Analytics’ analysis of marijuana-related SARs was cited by the Wall Street Journal. The […]

Dynamics Securities Analytics, Inc. was cited in a recent American Banker article titled “Legal Clash […]

By Alison Jimenez, Dynamic Securities Analytics, Inc. and Steven Kemmerling, MRB Monitor The quickly-growing state-legalized […]

By Alison Jimenez, Dynamic Securities Analytics, Inc. and Steven Kemmerling, MRB Monitor Securities Brokers […]

Dynamic Securities Analytics president, Alison Jimenez, was quoted in today’s Bloomberg article by Neil […]