Monthly Archives: March 2014

6 posts

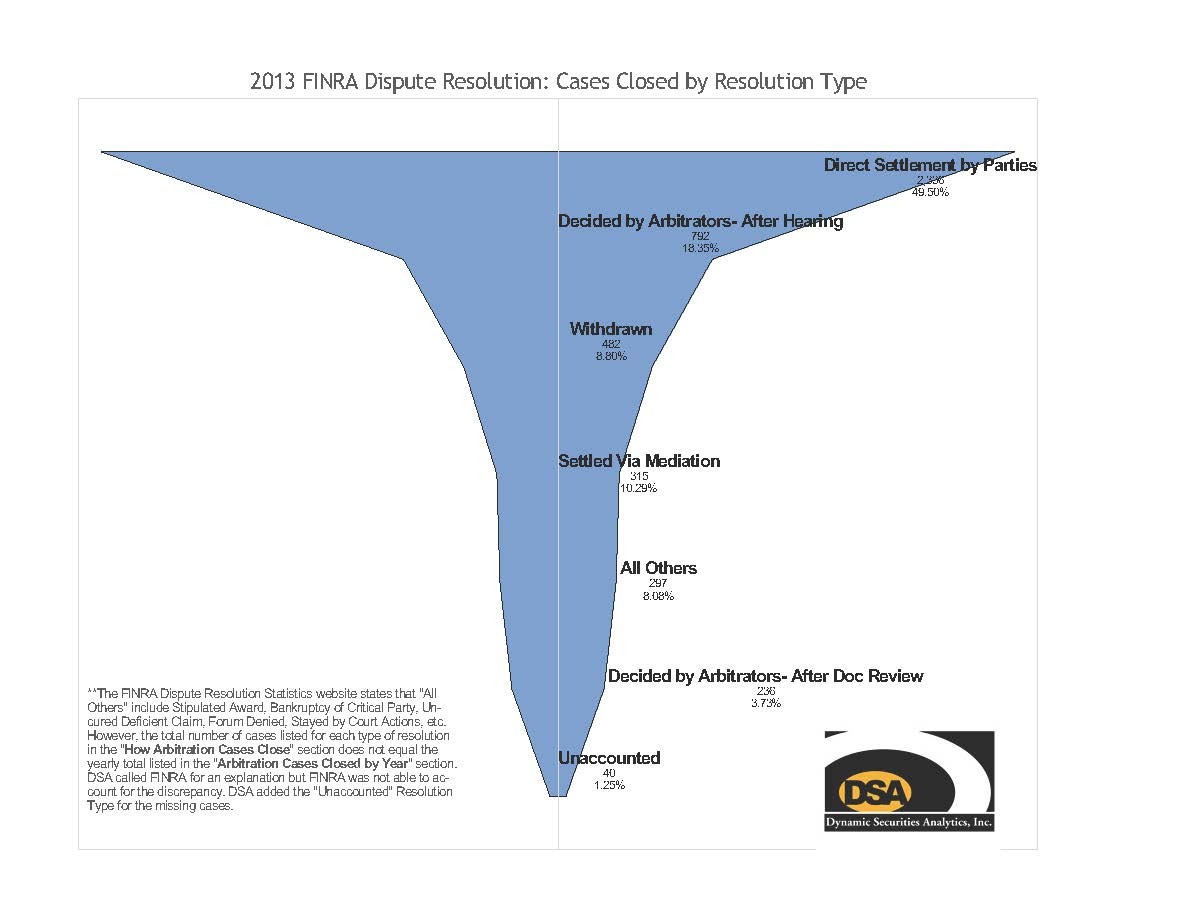

DSA analyzed how cases were closed through the FINRA dispute resolution process in 2013. Customer […]

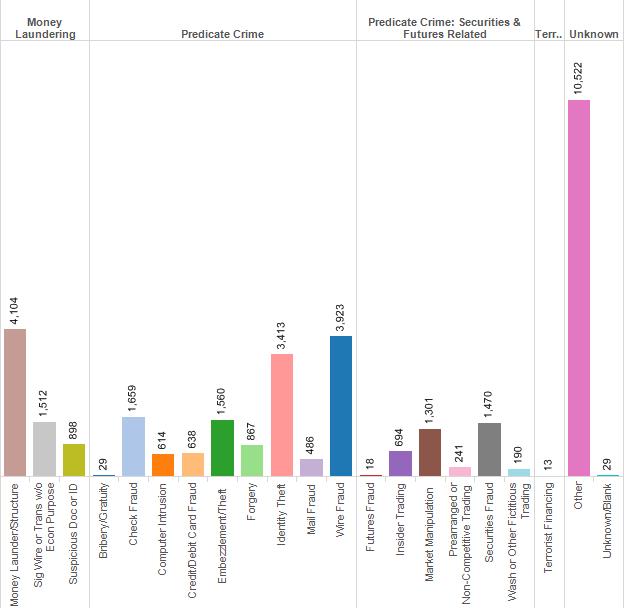

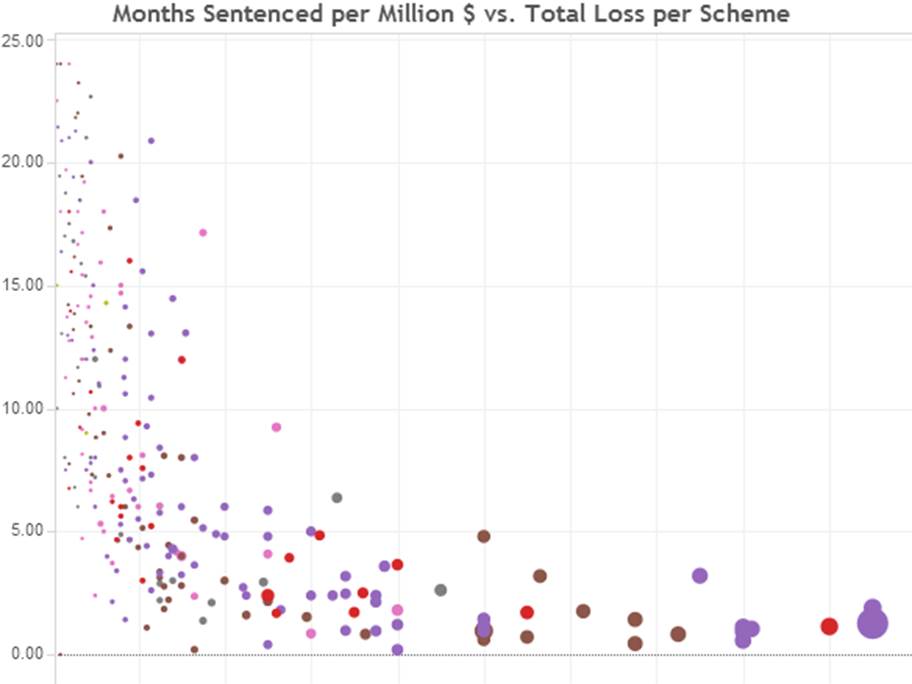

DSA prepared interactive analytics of over 500 Ponzi schemes in the post-Madoff era. The schemes […]

The Tampa Bay and Jacksonville Business Journals featured DSA’s analytics of Florida Ponzi Schemes. Jane […]